After last week’s deluge of 150 of the S&P 500 companies reporting their earnings this week is a relatively calm one.

For all of its gyrations last week, including the sell-off on Friday, if you simply looked at the market’s net change you would have thought that it was a quiet week as well.

The initial week of earnings season did see seem promise coming from the financial sector. Last week was a mixed one, as names such as Facebook (FB) and Amazon (AMZN) went in very different directions and the initial responses to earnings didn’t necessarily match the final result, such as in the case of NetFlix (NFLX).

While some of the sell-off on Friday may be attributed to the announcement of additional European Council sanctions against Russia and perhaps even the late in the session downgrade of stocks and bonds by Goldman Sachs (GS), earnings had gotten most of the week’s attention.

The coming week offers another opportunity to consider potential trades that can profit regardless of the direction of share price movements, as long as they stay reasonably close to the option market’s predictions of their trading range in response to those reports.

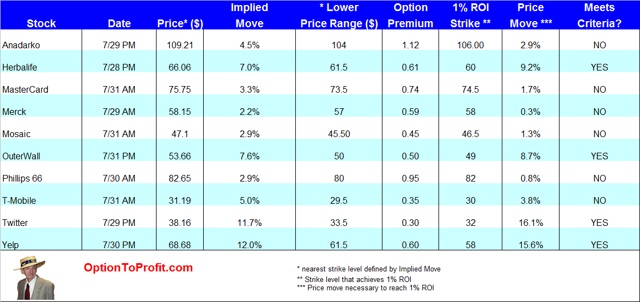

In line with my own tolerance for risk and my own definition of what constitutes a suitable reward for the risk, I prefer the consideration of trades that can return at least 1% for the sale of a weekly put option at a strike level that is below the lower boundary defined by the option market’s assessment. Obviously, everyone’s risk-reward profile differs, but I believe that consistent application or standardizing criteria by individual investors is part of a discipline that can make such trades less anxiety provoking and less tied to emotional factors.

Occasionally, I will consider the outright purchase of shares and the sale of calls, rather than the sale of puts for such trades, but that is usually the case if there is also the consideration of an upcoming ex-dividend date, such as will be the case with Phillips 66 (PSX). Additionally, doing so would most likely be done if I had no hesitancy regarding the ownership of shares. In contrast, often when I sell puts I have no real interest in owning the shares and would much prefer expiration or the ability to roll over those contracts if assignment appeared likely.

This coming week there again appear to be a number of stocks deserving attention as the reward may be well suited to the level of risk, thanks to the option premiums that are enhanced before earnings are released.

As often is the case the stocks that are most likely to be able to deliver a 1% or greater premium at a strike level outside of the implied move range are already volatile stocks, whose volatility is even greater in response to earnings. While at first glance an implied move of 12%, as is the case for Yelp (YELP) may seem unusually large, past history shows that concerns for moves of that magnitude are warranted.

Among the companies that I am considering this coming week are Anadarko (APC), Herbalife (HLF), MasterCard (MA), Mosaic (MOS), Merck (MRK), Outerwall (OUTR), Phillips 66, T-Mobile (TMUS), Twitter (TWTR) and Yelp.

These potential trades are entirely based upon what may be a discrepancies between the implied price movement and option premiums that will return the desired premium. Generally, I don’t think very much about those issues that may have relevance prior to considering a purchase of shares. The focus is entirely on numbers and whether the risk-reward proposition is appealing. Issues such as whether people are tweeting enough or whether a company is based upon a pyramid strategy can wait until the following week. Hopefully, by that time I would be freed from the position and would be less interested in those issues.

Deciding to pull the trigger is often a function of the prevailing price dynamic. My preference when selling put contracts is to do so if shares are falling in price in advance of earnings. For example, last week I did not sell puts on Facebook (FB), as its shares rose sharply prior to earnings. In that case, that represented a missed opportunity, however.

Compared to the previous week’s close of trading when the market had a sizable gain, this past Friday there were widespread losses, perhaps resulting in a different dynamic as the coming week begins its trading.

While I would rather not take ownership of shares, there must be a realization that doing so may be inevitable or may require additional actions in order to prevent that unwanted outcome, such as rolling the put option forward, if possible.

If there is a large decline in share price well beyond that lower boundary, the investor should be prepared for an extended period of needing to juggle that position in order to avoid assignment while awaiting some price recovery. I have some positions, that I’ve done so for months. The end result may be satisfactory, but the process can be draining.

The table may be used as a guide for determining which of this week’s stocks meet risk-reward parameters. Re-assessments should be made as share prices option premiums and strike levels may change.

The table may be used as a guide for determining which of this week’s stocks meet risk-reward parameters. Re-assessments should be made as share prices option premiums and strike levels may change.

While the list can be used in executing trades before the release of earnings, there may also be opportunity to consider trades following earnings. I typically like to consider those trades if a stock moved higher before earnings and then plunged afterward, if in the belief that the response was an over-reaction to the news. In such cases there may be an opportunity to sell put options whose premiums will still see some enhancement as a reflection of the strong negative sentiment taking shares lower.

Ultimately, if large price movements are either anticipated or have already occurred there is usually some additional opportunity that arises with the perceived risk at hand. If the risk isn’t realized, or if the risk is managed appropriately, the reward can be very addictive.