Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

December 28, 2016

.

TheAcsMan Returns on January 2, 2017 (More or Less)

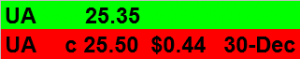

Just as a teaser, on Tuesday, at 9:58 AM, I purchased Under Armour (UA) at $25.35 and sold the weekly $25.50 option for a $0.44 premium

It’s Back

TheAcsMan.com will be coming back in 2017.

After a nearly 5 year hiatus operating the “Option to Profit” stock trading service and publishing all original daily content there and on Seeking Alpha, it’s time to come home.

Original content will now appear daily and will be advertizer supported. No more subscriptions and no more paid articles.

Sample reprints of previously published “Daily Market Updates” available to subscribers of OptionToProfit.com appear for informational purposes only and links are de-activated.

Daily Market Update (August 21, 2013 Reprint)

|

(see all trades this option cycle)

Daily Market Update – August 21, 2013 (Close) Yesterday was the 45th anniversary of the Warsaw pact nations invasion of Czechoslovakia. That’s not ordinarily something that I use an an introduction to a Daily Market Update, but bear with me. After all, it’s Wednesday and that’s usually a slow trading day for us. The early market action didn’t give any reason to think that this Wednesday would be different from any other. Except that today we sit and await the release of the FOMC minutes in an era when the Federal Reserve has taken on new transparency and current members are suggesting that even more transparency may be warranted. 45 years ago on that date, my family and I were supposed to leave Hungary, where we had been vacationing, having returned to the country we left across a land-mined border in the middle of the night twelve years earlier. Hungary, a member of the Warsaw Pact, a member Soviet Union satellite nation had only recently allowed those who escaped during the 1956 Revolution to return as tourists, once they realized that tourist dollars weren’t in conflict with dogma. Our visas, which were absolutely necessary for travel, as was reporting your itinerary to local authorities, were due to expire on that date. Funny thing, though. The airport was closed. There were fighter jet planes flying overhead and we were turned back by soldiers who wouldn’t allow entry onto the road leading to the airport. My parents were smart enough to know not to ask questions. Questions required answers and that was considered to be information. If Seinfeld had existed in Hungary the certainly would have been a character intoning “No information for you.” Returning to the hotel, the clerk asked for our visas and before we knew it the police were at the hotel threatening to have us arrested for over staying our visas, suggesting that perhaps we were spies. The American Embassy could provide no information. Why were the airports closed? When could we leave? They knew, but in a land where information was so tightly controlled they couldn’t be seen as the source of a leak that would have preceded any official local government spin. They did tell us that all borders were sealed and informed us that we could stay at the embassy if our request for visa extensions wasn’t granted. An embassy worker suggested a “gratuity” could get us an extension and it did. My father later told others who had been denied that the equivalent of about two dollars would buy a visa extension. Back in the hotel lobby, television pre-empted its usual airing of the endless loop of “The Flintstones” episodes to play patriotic kind of music. Forget about trying to get a newspaper that gave out any kind of information. Not only were the borders sealed, but so was all flow of information and so were people’s mouths. Three days later we were allowed to leave and arrived in Paris. It was there that we saw images of Soviet and Warsaw Pact tanks on overhead televisions in the airport, but we still had no clue as to what was happening. It looked as if it was World War II kind of archival footage. But the International Herald Tribune told the story. The “Prague Spring” as it had become known under the liberalization of Alexander Dubcek was crushed, just as Poland and Hungary had their brief attempts to rid themselves of Soviet yoke crushed. It is absolutely amazing at how a government can entirely control our access to information. I don’t know how long it took for normal Hungarian citizens to learn what had been going on next door to them, but they certainly didn’t talk about it on the streets while it was all unfolding. So why am I recalling old news of 45 years ago? Mostly because Eddy Elfenbein of “Crossing Wall Street” fame made note of the anniversary and suggested I write a post. I had let the day just slip by, never giving it a thought. Now we’re awash in information. The one-time opaque Federal Reserve is now like your best friend telling you more than you need to know or more than you can understand. But you have to be right there when that friend spills all, because you need to know before any of your other friends. Government reports, ADP, Tweets, blogs, Instagram and an endless supply of other sources of information with the only gatekeeper being the one who is supposed to ensure that all get equal access to its release, give or take a few nano-seconds, for give or take a few million. If Hampton Pearson, the usual purveyor of information on CNBC had it in him to give away the minutes in exchange for blow and hookers, society might be better off having a chance to chew over the information rather than reflexively responding to it. The problem has become one of interpretation of news. Keeping the population ignorant of the news is one thing, but an over-flow of news is far better because it creates a new kind of ignorance, one that has its genesis in too many competing and often contradictory bits of data that cause us to proceed irrationally or haphazardly and sometimes bounce from one action to the next without a coherent plan. In a society where information is strictly controlled or parceled, there isn’t much in the way of interpretation necessary. You simply knew that the truth was diametrically opposite of the official version. This afternoon will come word by word parsing of the FOMC minutes. Although this month is likely to be a non-event, much like last month, the interpretations can differ wildly and the markets can go into spasms from too much attention being paid to the details. In the meantime we continue to get conflicting earnings reports and alternating positive and negative market reactions to the news. Just think about the names mentioned yesterday. Anadarko, Intel, Chesapeake Energy and add to those Home Depot, JC Penney and others and see how quickly their fates are altered with the flow of information and the parsing of that information. It can make the difference between putting a $250 price tag on Apple or placing a $700 target. Same information, yet two disparate interpretations. So often the net result of that flow of information is minimal change, but a wide range of reaction. Just look at the immediate reaction to the release of the FOMC minutes this afternoon. Someone or their algorithm interpreted the minutes in a negative manner, sending the market down an additional 70 points in 5 minutes, only to see it then add 130 points in the next 40 minutes. Increasingly, I’m beginning to believe that being in an information vacuum has its merits. At the very least ignoring the party line, taking note of the jets flying above and having a goal that is immutable.

OTP Sector Distribution* as of August 21, 2013 * Assumes equal number of shares in positions Intraday versions of the Daily Market Update are not archived. You may access prior day’s Daily Market Updates by clicking here The posting of these trades is not a recommendation to initiate positions nor to execute any trading positions, as they may represent time sensitive actions. |

|||||||||||||||||||

|

Monday through Thursday? See “Daily Market Update” with first edition published by 12 Noon and Closing Update published by 4:30 PM Friday? See Week in Review for summary statistics and performance Sunday? See Weekend Update for potential stock choices for coming week Any day? See Performance for open and closed positions Subscribers may see ROI statistics on all new, existing and closed positions on a daily updated basis |

|

||||||||||||||||||

|

WEEKLY TRADING SUMMARY

|

|||||||||||||||||||

|

|

|||||||||||||||||||

Week in Review (August 5 – 9, 2013 Reprint)

| Option to Profit Week in ReviewAugust 5 – 9, 2013 |

| NEW POSITIONS/STO | NEW STO | ROLLOVERS | CALLS ASSIGNED/PUTS EXPIRED | CALLS EXPIRED/PUTS ASSIGNED | CLOSED |

| 7 / 8 | 1 | 3 | 4 / 1 | 0 / 0 | 0 |

Weekly Up to Date Performance

August 5 – 9, 2013

For the week, new purchases returned to its usual ways and well exceeded the time adjusted S&P 500 in a week that the market had a negative tone, but still showed great resilience.

For the week, new purchases returned to its usual ways and well exceeded the time adjusted S&P 500 in a week that the market had a negative tone, but still showed great resilience.

New positions beat the adjusted index by 2.7%, and also bested the unadjusted index by an even larger 3.1%. But just as I used JC Penney as an excuse last week for trailing the overall market, this week’s results are skewed by having used a number of September 17, 2013 option contracts. That actually added almost 1% to the results.

Adjusting for time, to a standard weekly observation period the week’s new positions beat the adjusted S&P 500 by 1.7% and the unadjusted index by 2.1%.

The market showed an adjusted loss of 0.6% for the week, while the unadjusted S&P 500 lost 1.1%. New purchases gained 2.1% for the week, well above the threshold, even when adjusting for extended options.

For positions opened in 2013 and subsequently closed, performance exceeded that of the S&P 500 by 0.5%. They are up 2.7% out-performing the market by 20.6%.

Well, this week was more like it, although I’m still upset about JC Penney, particularly the silence this past week regarding its vendor’s lending facility remains unanswered. Besides that, the soap opera was amusing and at least offered a brief window to sell some call options as Bill Ackman helped to temporarily raise share price by being Bill Ackman. Of course that only lasted about a day as shares went down because Bill Ackman acted like Bill Ackman.

Additionally, it was a week where we may have gotten a message that things aren’t as dour in China as we have believed. For me, that would be wonderful, because much of my 2013 thesis was based on better than expected outcomes from China. So far, that hasn’t been a good call, but I remain patient (and stubborn).

But otherwise, this was a week that demonstrates why a weak or declining market may have value and benefit that if alternating with an advancing market can create returns well in excess of the apparent net.

For much of 2013 that hasn’t been the case as alternating markets just haven’t been the norm as they usually are.

Every now and then when I need confirmation that sometimes the sum of the parts is far greater than the whole I look at historical returns and remind myself that a stock doesn’t have to move anywhere in order to be a profit generating machine.

Lately I’ve been looking for confirmation with great regularity.

As much as it’s convenient to try and read into this week’s weak performance, it’s probably not a good idea to do so.

With the August 2013 option cycle expiring next Friday, I’m simply hopeful that the market will maintain enough integrity to see many positions assigned.

That was also my hope at the end of June, but the Federal Reserve got in the way and prices dropped just in time to help reduce the number of assignments, so I’m not counting on anything.

Since I’m not reading much into the lack of strength this week, I still plan to follow the same pattern as with the past two months, looking to reduce cash from about 40% to 25% over the course of the week.

The question and where I’ve been varying the approach recently is deciding between weekly or monthly contracts when both are available.

I do want to have weekly contracts in the mix because they form the basis for cash flow necessary to both replenish cash reserves and fund new investments, if they’re assigned.

Now, the really big news is that next week’s first new position will be the 500th since expanding the service from being shared among only a small group of insiders to opening it up to outside subscribers 15 months ago.

Thank you for making it possible and providing reason to continue an implausible venture

Initially intended to provide a basis for subscribers to “graduate” after a few months, and the Informational web site continues to list that as the objective, a large core of subscribers have been here for all 499 trades.

That level of trust and confidence, together with the comments I receive are incredibly gratifying (as are the subscription fees).

Thank you. Looking forward to the next 500.

This week’s details may be seen in the Weekly Performance spreadsheet * or in the PDF file, as well as as in the summary.below

(Note: Duplicate mention of positions reflects different priced lots):

New Positions Opened: ANF, GMCR (puts), FL, LO, MOS, MRO, PSX, WNR

Puts Closed in order to take profits: none

Calls Rolled over, taking profits, into the next weekly cycle: CAT

Calls Rolled over, taking profits, into extended weekly cycle: none

Calls Rolled over, taking profits, into the monthly cycle: WNR, X

Calls Rolled Over, taking profits, into a future monthly cycle: none

Calls Rolled Up, taking net profits into same cycle: none

Put contracts sold and still open: none

Put contracts expired: GMCR

Long term call contracts sold: none

Calls Assigned: ANF, EBAY, MOS, STX

Calls Expired: none

Puts Assigned: none

Stock positions Closed to take profits: none

Stock positions Closed to take losses: none

Calls Closed to Take Profits: none

Ex-dividend Positions: AAPL (ex-div 8/8 $3.05), BP (ex-div 8/7 $0.54), INTC (ex-div 8/5 $0.22), STX (ex-div 8/25 $0.38)

Some did report early assignment of AAPL (which was expected), in addition to early assignment of INTC (which was not expected). The early assignment of INTC was a small minority, while the number reporting early assignment of AAPL was more sizable, but less than a majority of respondents.

For the coming week the existing positions have lots that still require the sale of contracts: CLF, DE, FCX, INTC, JCP, MCP, MOS, PBR, SHLD, WLT, WY, X (See “Weekly Performance” spreadsheet or PDF file)

* If you don’t have a program to read or modify spreadsheets, you can download the OpenOffice Suite at no cost.

LRJ

Who’s Wagging Who?

Anytime a major market goes down 7% it has to get your attention, but what seemed to set Japan off? Maybe it was just coincidental that earlier in the day across an ocean, the United States markets had just finished a trading session that was marked by a “Key Reversal,” ostensibly in response to some nuanced wording or interpretation of Federal Reserve Chairman Ben Bernanke’s words in testimony to a congressional committee.

Anytime a major market goes down 7% it has to get your attention, but what seemed to set Japan off? Maybe it was just coincidental that earlier in the day across an ocean, the United States markets had just finished a trading session that was marked by a “Key Reversal,” ostensibly in response to some nuanced wording or interpretation of Federal Reserve Chairman Ben Bernanke’s words in testimony to a congressional committee.

The very next day we showed recovery, but since then it’s been an alternating current of ups and downs, with triple digit moves back in fashion. Intra-day reversals, as in their May 22, 2013 “Key Reversal” extreme have been commonplace in the past week after a long absence

Finish reading this article on Seeking Alpha

Picking a Winner in the Pfizer-Zoetis Divorce

Strictly speaking, Pfizer’s (PFE) decision to separate from Zoetis (ZTS) is called a spin-off.

Strictly speaking, Pfizer’s (PFE) decision to separate from Zoetis (ZTS) is called a spin-off.

It did so initially on February 1, 2013 and there was much excitement about the prospects of being able to invest in the pets and livestock healthcare business, which was being touted as that portion of Pfizer that had the greater growth potential and by inference the greatest likelihood of out-performing the market and certainly out-performing stodgy old Pfizer, itself.

Certainly, if you are able to remember back to the heady days of Pfizer when Viagra was brought to an eager consumer demographic, there isn’t much reason to believe that sort of growth is in Pfizer’s future. From every logical point of view the best way to unlock shareholder value was to unleash hidden gems that were buried inside of a behemoth.

Additionally, if you look at the recent experience of the spin off by Conoco Phillips (COP) of its refiner arm, Phillips 66 (PSX) you might be of the belief that such spin-offs are akin to a license to print money.

By now Pfizer shareholders may have received the offer to exchange shares of Pfizer for Zoetis. With consummation of this offer, the separation of the two entities will be complete.

Pfizer refers to it as an “exchange offer to separate the Zoetis animal health business from Pfizer’s bio-pharmaceutical businesses in a tax-efficient manner, thereby enhancing stockholder value and better positioning Pfizer to focus on its core bio-pharmaceutical business.”I call that a divorce.

Finish reading this Article on Seeking Alpha