The hard part about looking for new positions this week is that memories are still fresh of barely a week ago when we got a glimpse of where prices could be.

The hard part about looking for new positions this week is that memories are still fresh of barely a week ago when we got a glimpse of where prices could be.

When it comes to short term memory the part that specializes in stock prices is still functioning and it doesn’t allow me to forget that the concept of lower does still exist.

The salivating that I recall doing a week ago was not related to the maladies that accompany my short term memory deficits. Instead it was due to the significantly lower share prices.

For the briefest of moments the market was down about 6% from its May 2013 high, but just as quickly those bargains disappeared.

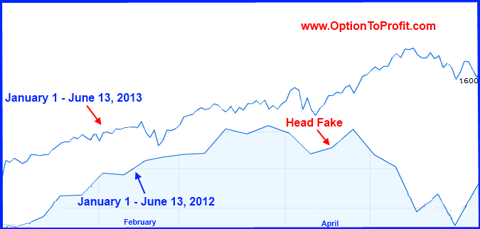

I continue to beat a dead horse, that is that the behavior of our current market is eerily reminiscent of 2012. Certainly we saw the same kind of quick recovery from a quick, but relatively small drop last year.

What would be much more eerie is if following the recovery the market replicated the one meaningful correction for that year which came fresh off the hooves of the recovery.

I promise to make no more horse references.

Although, there is always that possibility that we are seeing a market reminiscent of 1982, except that a similar stimulus as seen in 1982 is either lacking or has neigh been identified yet. In that case the market just keeps going higher.

I listened to a trader today or was foaming at the mouth stating how our markets can only go higher from here. He based his opinion on “multiples” saying that our current market multiple is well below the 25 times we saw back when Soviet missiles were being pointed at us.

I’ll bet you that he misses “The Gipper,” but I’ll also bet that he didn’t consider the possibility that perhaps the 25 multiple was the irrational one and that perhaps our current market multiple is appropriate, maybe even over-valued.

But even if I continue to harbor thoughts of a lower moving market, there’s always got to be some life to be found. Maybe it’s just an involuntary twitch, but it doesn’t take much to raise hope.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend or Momentum categories. With earnings season set to begin July 8, 0213, there are only a handful of laggards reporting this coming week, none of which appear risk worthy (see details).

I wrote an article last week, Wintel for the Win, focusing on Intel (INTC) and Microsoft (MSFT). This week I’m again in a position to add more shares of Intel, as my most recent lots were assigned last week. Despite its price having gone up during the past week, I think that there is still more upside potential and even in a declining market it will continue to out-perform. While I rarely like to repurchase at higher prices, this is one position that warrants a little bit of chasing.

While Intel is finally positioning itself to make a move into mobile and tablets and ready to vanquish an entire new list of competitors, Texas Instruments (TXN) is a consistent performer. My only hesitancy would be related to earnings, which are scheduled to be announced on the first day of the August 2013 cycle. Texas Instruments has a habit of making large downward moves on earnings, as the market always seems to be disappointed. With the return of the availability of weekly options I may be more inclined to consider that route, although I may also consider the August options in order to capitalize somewhat on premiums enhanced by earnings anticipation.

Already owning shares of Pfizer (PFE) and Merck (MRK), I don’t often own more than one pharmaceutical company at a time. However, this week both Eli Lilly (LLY) and Abbott Labs (ABT) may join the portfolio. Their recent charts are similar, having shown some weakness, particularly in the case of Lilly. While Abbott carries some additional risk during the July 2013 option cycle because it will report earnings, it also will go ex-dividend during the cycle. However, Lilly’s larger share drop makes it more appealing to me if only considering a single purchase, although I might also consider selling an August 2013 option even though weekly contracts are available.

I always seem to find myself somewhat apologetic when considering a purchase of shares like Phillip Morris (PM). I learned to segregate business from personal considerations a long time ago, but I still have occasional qualms. But it is the continued ability of people to disregard that which is harmful that allows companies like Phillip Morris and Lorillard (LO), which I also currently own, to be the cockroaches of the market. They will survive any k

ind of calamity. It’s recent under-performance makes it an attractive addition to a portfolio, particularly if the market loses some ground, thereby encouraging all of those nervous smokers to sadly rekindle their habits.

The last time I purchased Walgreens (WAG) was one of the very few times in the past year or two that I didn’t immediately sell a call to cover the shares. Then, as now, shares took, what I believed to be an unwarranted large drop following the release of earnings, which I believed offered an opportunity to capture both capital gains and option premiums during a short course of share ownership. It looks as if that kind of opportunity has replicated itself after the most recent earnings release.

Among the sectors that took a little bit of a beating last week were the financials. The opportunity that I had been looking for to re-purchase shares of JP Morgan Chase (JPM) disappeared quickly and did so before I was ready to commit additional cash reserves stored up just for the occasion. While shares have recovered they are still below their recent highs. If JP Morgan was not going ex-dividend this trade shortened week, I don’t believe that I would be considering purchasing shares. However, it may offer an excellent opportunity to take advantage of some option pricing discrepancies.

I rarely use anecdotal experience as a reason to consider purchasing shares, but an upcoming ex-dividend date on Darden Restaurants (DRI) has me taking another look. I was recently in a “Seasons 52” restaurant, which was packed on a Saturday evening. I was surprised when I learned that it was owned by Darden. It was no Red Lobster. It was subsequently packed again on a Sunday evening. WHile clearly a small portion of Darden’s chains the volume of cars in their parking lots near my home is always impressive. While my channel check isn’t terribly scientific it’s recent share drop following earnings gives me reason to believe that much of the excess has already been removed from shares and that the downside risk is minimized enough for an entry at this level.

While I did consider purchasing shares of Conoco Phillips (COP) last week, I didn’t make that purchase. Instead, this week I’ve turned my attention back to its more volatile namesake, Phillips 66 (PSX) which it had spun off just a bit more than a year ago. It has been a stellar performer in that time, despite having fallen nearly 15% since its March high and 10% since the market’s own high. It fulfills my need to find those companies that have fared more poorly than the overall market but that have a demonstrated ability to withstand some short term adverse price movements.

Finally, I haven’t recommended the highly volatile silver ETN products for quite a while, even though I continue to trade them for my personal accounts. However, with the sustained movement of silver downward, I think it is time for the cycle to reverse, much as it had done earlier this year. The divergence between the performance of the two leveraged funds, ProShares UltraShort Silver ETN (ZSL) and the ProShares Ultra Silver ETN (AGQ) are as great as I have seen in recent years. I don’t think that divergence is sustainable an would consider either the sale of puts on AGQ or outright purchase of the shares and the sale of calls, but only for the very adventurous.

Traditional Stocks: Abbott Labs, Eli Lilly, Intel, Mosaic, Phillip Morris, Texas Instruments, Walgreens

Momentum Stocks: Phillips 66, ProShares UltraSilver ETN

Double Dip Dividend: Darden Restaurants (ex-div 7/8), JP Morgan (ex-div 7/2)

Premiums Enhanced by Earnings: none

Remember, these are just guidelines for the coming week. Some of the above selections may be sent to Option to Profit subscribers as actionable Trading Alerts, most often coupling a share purchase with call option sales or the sale of covered put contracts. Alerts are sent in adjustment to and consideration of market movements, in an attempt to create a healthy income stream for the week with reduction of trading risk.