Maybe coincidentally, but over the past two days I’ve had a number of subscribers mention that they had a large amount of cash to invest.

Maybe coincidentally, but over the past two days I’ve had a number of subscribers mention that they had a large amount of cash to invest.

That isn’t unusual. Whether as a result of a 401k rollover, an inheritance or just having sat on the sidelines for a while or saving up for just the right moment, it happens.

Additionally, looking at a market that seems to be able to fight off any attempts to make it back down makes people want to be a part of the fun and that means putting to money into play and to work at the same time.

And you know what? It is fun, at least until you lose some money.

I have always believed that we all come pre-packaged with bad luck and that we have to take actions to minimize the bad luck. Admittedly, it’s not really about luck but rather bad judgment, emotions or other factors that somehow seem to conspire to get in the way of forward progress.

For those with a big pile of cash and the inclination to put the money into the stock market I don’t really think there is anything like a good time or a bad time. I think it’s always a good time, as long as you follow some rules.

- What are your objectives?

Everyone should have identifiable objectives. Are you seeking to create income streams in addition to capital appreciation? Are you looking to generate capital appreciation and are less concerned about income?

If you’re going to be selling covered options understanding what it is that you hope to achieve will determine, to a degree, what kind of strike prices you may utilize and what portion of your shares held will be hedged with option sales.

- What are your goals?

Once you know what you are seeking in broad terms, quantifying those objectives is a good idea.. Whether it’s on the basis of comparing performance to an index or whether your income stream meets your needs, goals are the report card necessary to know whether you’re on the right path.

- Don’t put all of your money in at once

Part of that feeling that bad luck is pervasive is the belief that If I had a big lump sum of money to invest I would probably do so at the very peak of the market and the following day my big lump sum would be that much less.

Most everyone empathized with the George Costanza character on Seinfeld when he finally came to the realization that he was far better off doing exactly the opposite of what his instincts led him to do.

I suppose that it is possible that the very next day the market could sky rocket, but ask yourself, given your luck, which direction do you think that it would go if you made the commitment?

That’s what I thought.

- Keep some money back in reserve

When looking to put a large amount of money to work the first thing I think about is how much I want to keep in reserve in the event of a sudden decline in stock prices that may represent an opportunity. Even though you’re thinking about putting your money to work, simply think of reserve cash as a sector that is part of an overall strategy to be diversified.

To make this simple, lets talk about a hypothetical $100,000 that’s begging for a home.

- Don’t invest your rainy day fund

Let’s also assume that this is purely discretionary money. That is, there is virtually no chance that you would have to turn to it to meet an expected or even an unexpected expense. I’ve made that mistake and I never want to make it again. In fact, when I made the mistake the market was at unheard of levels in October 1987. No one in his right mind thought that we would ever look backward again. It was a time of incredible optimism and freely flowing margin.

- Don’t use the financial world’s answer to “Hamburger Helper”

Don’t use margin. Leverage is for other people, like those who buy options. I hate to harp on the concept of luck, but you just know that as soon as you start to leverage up will be the very moment that the market heads lower. The use of margin just serves to magnify your losses and you get to pay interest for that privilege.

Normally, I have been 100% invested over the past years, aiming to end each week with a 20-40% turnover of portfolio from assignments and then quickly re-investing that money. But the past few months I’ve tried to bring my cash up to a 40% level at the end of each option cycle and have then proceeded to try and get the level down to about 25-30% cash. That’s because I want at least 25% cash in the event of unexpected opportunities. You may have a different amount to keep in reserve, but whatever it is, keep something. In hindsight, there’s probably very little reason to ever be fully invested.

So let’s use that amount in this example, such that of the original $100,000, I would seek to keep $25,000 available for unforeseen bargains.

- Have a timeframe for your investment strategy

That means I have $75,000 to invest, but next I need to know over what period of time I want to funnel the money into the market. Doing so is the same as the well known “dollar cost averaging” technique. But you really need to have the discipline not to chase the market if it keeps going higher and you have to resist throwing all of your money in because you’re afraid of missing out. That’s called “FOMO,” the fear of missing out. It’s like envy and is definitely one of the seven deadly sins.

To make the math easy, let’s just assume that I want to have my $75,000 fully invested over a period of 5 weeks.

That means that I can commit $15,000 each week to new positions (or to add to existing positions).

- Be diversified by sector

The first thing that you may see is that $15,000 isn’t that much to begin a diversified investment plan.

The next issue that becomes part of the equation is just how do you achieve diversification when you’re just starting out. That’s especially true if you’re also selling options, because there is a minimum number of shares that need to be purchased, yet your funds may be limited.

For those selling options, there’s also a good chance that your brokerage rewards you with lower total commissions per contract based on the number of contracts transacted.

Pricing power is always nice but sometimes purchasing more than 100 shares of a specific stock may put you over that $15,000 weekly limit.

More importantly, putting all of your weekly eggs into a single stock puts you hostage to that stock and leaves you entirely undiversified.

In such situations, I think you’re better off giving up some pricing power on commissions, accepting a lower ROI in return for being able to buy more than a single stock with your weekly allocation.

Again, think about your luck. The stock or the sector that you would have happily thrown all of your money toward may have picked just the wrong time to fall out of investor favor. Unless there’s a generalized market downturn, the chances of picking two out of favor sectors just before they go out of favor is less likely, even with your luck.

And when I say “your luck,” I mean my luck, too.

- Be diversified by risk

Part of having a diversified portfolio is not only doing so by sector, but also by risk.

For example, you know that I classify selections as either being “TRADITIONAL” or “MOMENTUM.” The TRADITIONAL category encompasses shares that are less likely to have minute to minute gyrations, or at least are more likely to revert to their mean more quickly than a MOMENTUM kind of stock.

Think of Dow Chemical as a TRADITIONAL stock and Abercrombie and Fitch as a representative MOMENTUM stock. Although Dow Chemical is currently trading with a “beta” of 1.58, as opposed to Abercrombie and Fitch’s 1.30, that measure of volatility is somewhat misleading, as anyone owning both knows that Dow Chemical will typically let you sleep more soundly at night.

Certainly their respective option premiums tell the story. Dow Chemical is simply less risky. Do you want a portfolio full of Dow Chemicals or do you want a portfolio full of Abercrombie and Fitchs?

When you set up your portfolio give strong consideration to having the risk profile of your holdings reflect your own temperament for risk.

- Don’t stress over predictable gyrations

Stock prices go up and stock prices go down. It’s a very predictable process.

The Biblical story goes that whenever King Solomon felt extremely happy or extremely sad, he would look at his ring, which was engraved with the expression “This too shall pass.”

If the gyrations bother you, consider using longer term duration option contracts. For example, a large adverse move in share price may create less anxiety when there is a monthly contract with weeks to go as opposed to a weekly contract with only a day left until expiration. Plenty can happen over the course of weeks, while it’s much less likely that significant movement will happen in a single day.

- Have an exit plan

For those exercising a buy and hold strategy the conventional wisdom has always been that the individual investor rarely knows when to exit a position, whether to take profits or limit losses.

There is relatively little conventional wisdom that I agree with, but this is one of the ones that I can’t find fault with. Among the things that I love about covered options is that you define an exit strategy as soon as you open the position. It’s called the strike price.You define your ROI and your time frame, although it doesn’t always work out

as planned.

But in the world of “Buy and Hold,” it’s not just that the individual investor doesn’t know when to exit, neither does their investment advisor. That’s especially true when it comes to locking in profits and less so when it comes to exiting losing positions.

Professional advisors typically use a variation of the old Bernard Baruch axiom that you should liquidate positions when they hit 10% losses.

That’s great, but of course, you know that with our luck that is the precise time that the stock begins its recovery.

Again, look at enough stocks and you’ll notice that most don’t stay depressed forever. In hindsight, how many times have you sold shares at a loss and then watched them recover?

While you’re doing that little mental exercise, how many times have you watched your paper gains evaporate and then come back and maybe evaporate again? It’s as if taking profits is a bad thing.

Now add another piece of pessimism to the mix. What makes you believe that the same person that selected a loser of a stock that is now down 10% suddenly has the skill and intelligence to exchange that stock for a winner? With my luck I tend to think that I would simply exchange it for something that was about to begin its price descent.

I don’t abide by the Bernard Baruch rule, but that has potential consequences. Some stocks simply don’t recover or take a very long time to do so and may also become non-performing assets.

I generally sell big losers in order to take advantage of tax codes that allow a portion of the losses to receive favorable tax credits, but that may not be appropriate for everyone or for every kind of account.

So set your own limits. Is it 10%, 15% 25%? But whatever it is, apply it consistently. Don’t fall prey to using a rational thought process to decide which to sell and which to keep.

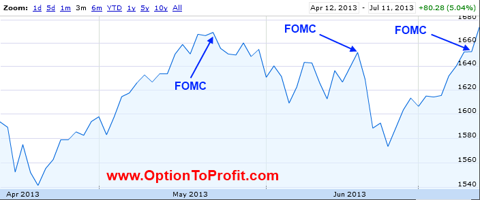

This week may have marked the last time Ben Bernanke sits in front of far less accomplished inquisitors in fulfilling his part of the obligation to provide congressional testimony in accordance with law.

This week may have marked the last time Ben Bernanke sits in front of far less accomplished inquisitors in fulfilling his part of the obligation to provide congressional testimony in accordance with law.