For some, “The Big Man” may refer to a personal deity. For others, the late saxophonist for The E Street Band.

While I have abiding faith in each of those, there’s no doubt in my mind that Ben Bernanke is “The Big Man.”

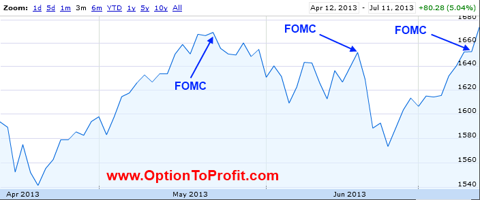

While the stock market soared to a new high just two months after its most recent high, it shouldn’t be lost on too many people that the Chairman of the Federal Reserve was at the center of the move down from the highs as well as the move beyond the high.

Just take a quick look at the journey of the S&P 500 from its high on May 21, 2013 to its new high on July 11, 2013.

Guess who got the blame for those drops? That’s right. Ben Bernanke in what was obviously a slam dunk example of cause and effect, at least based on the fervor with which fingers were pointed.

Guess who got the blame for those drops? That’s right. Ben Bernanke in what was obviously a slam dunk example of cause and effect, at least based on the fervor with which fingers were pointed.

But on the heels of Thursday’s march to record heights very few of those fingers were pointed in Bernanke’s general direction or heaping praise upon him.

After Thursday’s close, one well known individual only begrudgingly gave Bernanke credit for the gains, suggesting that it was unexpectedly good earnings that drove the rally. In her questioning of interview guests, her phrasing of the question to get their opinions on the root cause of the day’s rally trailed off as mentioning Bernanke as a possible catalyst.

You can argue cause or correlation, but to me it’s clear. Especially when you consider that the most extreme moves, on June 20 and July 11, 2013 came after some words from the Chairman in complement of the committee minutes.

What isn’t clear is what exactly Bernanke said that made this month any different and resulted in a market making new highs. Did he speak more slowly? Did he enunciate more clearly?

When the most recent minutes were released it came as somewhat of a surprise that so much attention within the FOMC was spent on how the markets react to words. The concern that FOMC members had for the words used by its members, especially its Chairman, was evident in the text of the minutes.

Words. Words that are interpreted at will. Words that are interpreted in context, out of context, on the basis of breathing patterns and cadence.

But to show how long we have come, at least no one is interpreting policy on the basis of the thickness of Bernanke’s attaché case.

What’s also not clear to me is how “credible” individuals can make comments, such as “by offering so much information in such a muddled fashion, they have made policy less transparent,” in reference to the FOMC by a Bank of America (BAC) official. Compare that to the complaints levied against predecessor Alan Greenspan, whose leadership and obtuse pronouncements were criticized for their lack of transparency.

But that is the general theme. There is no “winning,” despite how simple Charlie Sheen made it sound during manic periods. As Federal Reserve Chairman, Ben Bernanke is criticized roundly regardless of what he says or does, as if he is pushing the “enter” key to get those algorithms running a muck when the outcome is bad and criticized when the results are pleasing.

Perhaps I listen and read with a very different set of filters, but the metrics and criteria for a tapering of Quantitative Easing seems to be clearly defined. It is the policy that everyone loves to hate, but most of all, really love, at least when it comes to personal fortunes. The conflict within must be terrible, when on the one hand you have disdain for the interference but really love the results. It’s probably similar to how noted politicians may feel when engaging in illegal acts between consenting adults when they have sworn to uphold those laws.

While my personal fortune has improved this week, I too am conflicted. I’m certainly happy about the gains, but would like to see somewhat of a resting period. With these sudden gains I stand to see too many positions assigned next week with the expiration of the July 2013 option cycle. Of course, I felt the same way last month, until I got what I wished for well in excess of my wishes, following the June 2012 FOMC minutes and Bernanke’s press conference, just 2 days prior to monthly expiration. Suddenly, the number of assignments was far fewer than anticipated.

Beyond that, I still have memories of a similar rapid recovery from a 5% drop in 2012 that saw me also wishing for a breather, only to see the bottom fall out from under and drag the market down 9%.

Surely there is something than can make us all happy. It just appears to not be Ben Bernanke unless he calls it a public service career, although I certainly wouldn’t be among those looking forward to that outcomeCertainly not like a ubiquitous and noted gold enthusiast who commented “the good news is at least that Ben Bernanke is leaving,” when asked who he thought might be replacing him.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or “PEE” categories. (see details).

As has been the case several times over the past few months it sometimes gets more chall

enging to discover potential bargains at mountain tops when you can still see the valley below. This week the general trend is looking for low beta and high yield stocks.

The contrarian in me always looks at stocks that have received analysts downgrades. On Friday, both Bristol Myers Squibb (BMY) and Target (TGT) had that honor. Fortunately, Target’s first CEO and a member of the original Dayton family of owners who passed away this week didn’t have to suffer the indignity of a downgrade. Although both Bristol Myers and Target are both up from recent dips and approaching 52 weeks highs, of late they have also fared well during market declines. While I prefer either of these low beta stocks on the immediate period before an ex-dividend date, I actually would have much preferred that they reacted more negatively to the downgrades, but in a strong market they may simply be a case of “high and going higher,” while perhaps also having some downside resistance.

Another pharmaceutical company that has my attention this week is GlaxoSmithKline. Its chart looks just like that of Bristol Myers, but has the added benefit of an expected dividend payment during the August 2013 option cycle, although like Bristol Myers will also add some earnings related risk during that cycle. It tends to match the S&P 500 during downward moves, so Bristol Myers may have an edge in that regard if you have room for only one more pharmaceutical in your portfolio. However, the dividend, i believe may outweigh that consideration, especially if you believe that the overall market is headed higher.

I don’t very often own shares of any of the major oil and gas companies other than British Petroleum (BP) and it has been many years since I’ve owned Royal Dutch Shell (RDS.A), although there is rarely a week that I haven’t checked its chart and performance. Keeping with the theme, its low beta and very generous dividend, which is likely during the August 2013 cycle make it an appealing consideration.

Caterpillar (CAT) has been cited almost on a daily basis as being one of the worst performers of the S&P 500, at lest prior to last week’s strong performance. Caterpillar, which only has a very small portion of its overall business dependent on the Chinese economy hasn’t been able to escape the perception that it is intimately tied to that market and has been held hostage by that weakness and uncertainty. I almost always own shares and currently have two lots. Despite last week’s strong move and the relatively high beta, I may add additional shares as they are ex-dividend during the week offering an increased payout.

Cheniere Energy Partners (CQR), which operates liquefied natural gas terminals, is a good example of a low beta/high dividend company. It has been reliably paying a consistently sized dividend since going public in 2007, currently a 5.6% yield. Although it does report earnings on August 2, 2013 and has in the past exhibited some greater volatility with earnings, it is also expected to go ex-dividend during the August 2013 option cycle. It also tends to do well in down markets, which has appeal for me since I’m still somewhat nervous about what tomorrow may bring, even if Bernanke stays silent.

Darden Restaurants (DRI) is a company that I usually only consider purchasing in order to capture its dividend. I did consider it recently for that purpose, but didn’t buy the shares. Now, instead, I’ve come to appreciate it on its own merits. Those include a low beta, a nice call premium for the remaining week of the monthly option cycle and freedom from earnings reports until sometime in September, as Darden was among the last to report earnings in the immediately prior earnings season.

I love trading shares or buying puts in Abercrombie and Fitch (ANF). Of course, doing so runs counter to the pursuit of low beta positions, but it does offer a small dividend. Its volatility is what makes it a frequently good trade when selling either covered calls or puts. The risk tends to come with earnings and occasionally they do pre-release information, especially regarding European operations and currency risk, typically two weeks before earnings, which are currently scheduled for August 14, 2013.

For those with strong constitutions, there is VMWare (VMW) which will report earnings on July 23, 2013, the first week of the August 2013 cycle. Its shares still haven’t recovered from the loss related to February 2013 earnings, as there is increasing concern that its proprietary product no longer can sustain growth against competition for the cloud by Microsoft (MSFT), Oracle (ORCL) and Amazon (AMZN).

For the final week of the July 2013 option cycle, prior to earnings, for those believing that VMWare will delay any substantive move until after earnings, there is an opportunity for the short term trade which includes the sale of calls. However, if purchased shares are not assigned, earnings related risk is of concern.

Finally, there are many high profile companies reporting earnings this coming week, many of whom trade with high beta and have had recent large gains. However, the option premium pricing of out of the money puts, which I typically like to sell to exploit earnings, are very inexpensive, indicating continuing bullish sentiment.

Two exceptions are SanDisk (SNDK) and Align Technology (ALGN).

As perhaps expected, they are neither low beta, nor offer high dividend yields, or any yield for that matter. Both SanDisk and Align Technology are significantly higher over the past two months, both hovering at 20% gains since early May 2013 and easily outperforming the S&P 500 during that period. The worries of years past that SanDisk was doomed as flash memory was going to become a commodity hasn’t quite worked out as predicted.

As a lapsed Pediatric Dentist, I’m very familiar with Align Technologies “even a monkey can perform Orthodontics” technology and it has recently expanded its product portfolio and is increasingly enticing non-specialists to adopt the product in the hopes of creating new profit centers within office practices.

If either is a case of “high and going higher,” then selling out of the money puts expiring this coming Friday is certainly a consideration and a relatively simple way to generate premium income. If either is poised to give back recent gains Align Technology offers a better risk to reward experience as you can generate approximately 0.9% ROI for the week if shares drop less than 15%. However, the additional caveats for both of these is that they do tend to underperform in a dropping market.

Traditional Stocks: Bristol Myers, Cheneire Energy Partners, Darden Restaurants, GlaxoSmithKline, Royal Dutch Shell, Target

Momentum Stocks: Abercrombie and Fitch, VMWare

Double Dip Dividend: Caterpillar (7/18 $0.60)

Premiums Enhanced by Earnings: Align Technology (7/18 PM), SanDisk (7/17 PM)

Remember, these are just guidelines for the coming week. Some of the above selections may be sent to Option to Profit subscribers as actionable Trading Alerts, most often coupling a share purchase with call option sales or the sale of covered put contracts. Alerts are sent in adjustment to and consideration of market movements, in an attempt to create a healthy income stream for the week with reduction of trading risk.