Much has been made of the recent increase in volatility.

Much has been made of the recent increase in volatility.

As someone who sells options I like volatility because it typically results in higher option premiums. Since selling an option provides a time defined period I don’t get particularly excited when seeing large movements in a share’s price. With volatility comes greater probability that “this too shall pass” and selling that option allows you to sit back a bit and watch to see the story unwind.

It also gives you an opportunity to watch “the smart money” at play and wonder “just how smart is that “smart money”?

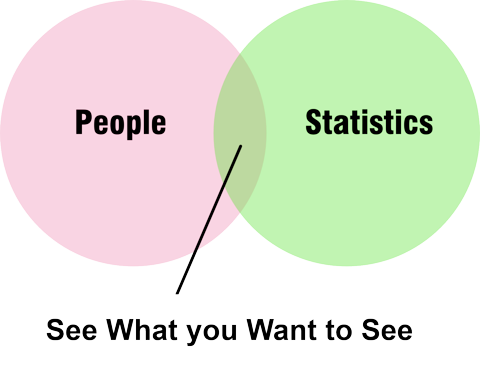

But being a observer doesn’t stop me from wondering sometimes what is behind a sudden and large movement in a stock’s price, particularly since so often they seem to occur in the absence of news. They can’t all be “fat finger ” related. I also sit and marvel about entire market reversals and wildly alternating interpretations of data.

I’m certain that for a sub-set there is some sort of technical barrier that’s been breached and the computer algorithms go into high gear. but for others the cause may be less clear, but no doubt, it is “The Smart Money,” that’s behind the gyrations so often seen.

Certainly for a large cap stock and one trading with considerable volume, you can’t credit or blame the individual investor for price swings, especially in the absence of news. Since for those shares the majority are owned by institutions, which hopefully are managed by those that comprise the “smart money” community, the large movements certainly most result in detriment to at least some in that community.

But what especially intrigues me is how the smart money so often over-reacts to news, yet still can retain their moniker.

This week’s announcement that there would be a one year delay in implementing a specific component of the Affordable Care Act , the Employer mandate, resulted in a swift drop among health care stocks, including pharmaceutical companies.

Presumably, since the markets are said to discount events 6 months into the future, the timing may have been just right, as a July 3, 2013 announcement falls within that 6 month time frame, as the changes were due to begin January 1, 2014.

By some kind of logic the news of the delay, which reflects a piece of legislation that has regularly alternated between being considered good and bad for health care stocks, was now again considered bad.

But only for a short time.

As so often is seen, such as when major economic data is released, there is an immediate reaction that is frequently reversed. Why in the world would smart people have knee jerk reactions? That doesn’t seem so smart. This morning’s reaction to the Employment Situation report is yet another example of an outsized initial reaction in the futures market that saw its follow through in the stock market severely eroded. Of course, the reaction to the over-reaction was itself then eroded as the market was entering into its final hour, as if involved in a game of volleyball piting two team of smart money against one another.

Some smart money must have lost some money during that brief period of time as they mis-read the market’s assessment of the meaning of a nearly 200,000 monthly increase in employment.

After having gone to my high school’s 25th Reunion a number of years ago, it seemed that the ones who thought they were the most cool turned out to be the least. Maybe smart money isn’t much different. Definitely be wary of anyone that refers to themselves as being part of the smart money crowd.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or “PEE” categories. (see details).

As a caveat, with Earnings Season beginning this week some of the selections may also be reporting their own earnings shortly, perhaps even during the July 2013 option cycle. That knowledge should be factored into any decision process, particularly since if you select a shorter term option sale that doesn’t get assigned, since yo may be left with a position that is subject to earnings related risk. By the same token, some of those positions will have their premiums enhanced by the uncertainty associated with earnings.

Both Eli Lilly (LLY) and Abbott Labs (ABT) were on my list of prospective purchases last week. Besides being a trading shortened week in celebration of the FOurth of July, it was also a trade shortened week, as I initiated the fewest new weekly positions in a few years. Both shares were among those that took swift hits from fears that a delay in the ACA would adversely impact companies in the sector. In hindsight, that was a good opportunity to buy shares, particularly as they recovered significantly later in the day. Lilly is well off of its recent highs and Abbott Labs goes ex-dividend this week. However, it does report earnings during the final week of the July 2013 option cycle. I think that healthcare stocks have further to run.

AIG (AIG) is probably the stock that I’ve most often thought of buying over the past two years but have too infrequently gone that path. While at one time I thought of it only as a speculative position it is about as mainstream as they come, these days. Under the leadership of Robert Ben Mosche it has accomplished what no one believe was possible with regard to paying back the Treasury. While its option premiums aren’t as exciting as they once were it still offers a good risk-reward proposition.

Despite having given up on “buy and hold,” I’ve almost always had shares of Dow Chemical (DOW) over the past 5 years. They just haven’t been the same shares f

or very long. It’s CEO, Andrew Liveris was once the darling of cable finance news and then fell out of favor, while being roundly criticized as Dow shares plummeted in 2008. His star is pretty shiny once again and he has been a consistent force in leading the company to maintain shares trading in a fairly defined channel. That is an ideal kind of stock for a covered call strategy.

The recent rise in oil prices and the worries regarding oil transport through the Suez Canal, hasn’t pushed British Petroleum (BP) shares higher, perhaps due to some soon to be completed North Sea pipeline maintenance. British Petroleum is also a company that I almost always own, currently owning two higher priced lots. Generally, three lots is my maximum for any single stock, but at this level I think that shares are a worthy purchase. With a dividend yield currently in excess of 5% it does make it easier to make the purchase or to add shares to existing lots.

General Electric (GE) is one of those stocks that I only like to purchase right after a large price drop or right before its ex-dividend date. Even if either of those are present, I also like to see it trading right near its strike price. Its big price drop actually came 3 weeks ago, as did its ex-dividend date. Although it is currently trading near a strike price, that may be sufficient for me to consider making the purchase, hopeful of very quick assignment, as earnings are reported July 19, 2013.

Oracle (ORCL) has had its share of disappointments since the past two earnings releases. Its problems appear to have been company specific as competitors didn’t share in sales woes. The recent announcement of collaborations with Microsoft (MSFT and Salesforce.com (CRM) says that a fiercely competitive Larry Ellison puts performance and profits ahead of personal feelings. That’s probably a good thing if you believe that emotion can sometimes not be very helpful. It too was a recent selection that went unrequited. Going ex-dividend this week helps to make a purchase decision easier.

This coming week and next have lots of earnings coming from the financial sector. Having recently owned JP Morgan Chase (JPM) and Morgan Stanley (MS) I think I will stay away from those this week. While I’ve been looking for new entry points for Citigroup (C) and Bank of America (BAC), I think that they’re may be a bit too volatile at the moment. One that has gotten my attention is Bank of New York Mellon (BK). While it does report earnings on July 17, 2013 it isn’t quite as volatile as the latter two banks and hasn’t risen as much as Wells Fargo (WFC), another position that I would like to re-establish.

YUM Brands (YUM) reports earnings this week and as an added enticement also goes ex-dividend on the same day. People have been talking about the risk in its shares for the past year, as it’s said to be closely tied to the Chinese economy and then also subject to health scare rumors and realities. Shares do often move significantly, especially when they are stoked by fears, but YUM has shown incredible resilience, as perhaps some of the 80% institutional ownership second guess their initial urge to head for the exits, while the “not so smart money” just keeps the faith.

Finally, one place that the “smart money” has me intrigued is JC Penney (JCP). With a large vote of confidence from George Soros, a fellow Hungarian, it’s hard to not wonder what it is that he sees in the company, after all, he was smart enough to have fled Hungary. The fact that I already own shares, but at a higher price, is conveniently irrelevant in thinking that Soros is smart to like JC Penney. In hindsight it may turn out that ex-CEO Ron Johnson’s strategy was well conceived and under the guidance of a CEO with operational experience will blossom. I think that by the time earnings are reported just prior to the end of the August 2013 option cycle, there will be some upward surprises.

Traditional Stocks: Bank of New York, British Petroleum, Dow Chemical, Eli Lilly, General Electric,

Momentum Stocks: AIG, JC Penney

Double Dip Dividend: Abbott Labs (ex-div 7/11), Oracle (ex-div)7/10)

Premiums Enhanced by Earnings: YUM Brands (7/10 PM)

Remember, these are just guidelines for the coming week. Some of the above selections may be sent to Option to Profit subscribers as act

ionable Trading Alerts, most often coupling a share purchase with call option sales or the sale of covered put contracts. Alerts are sent in adjustment to and consideration of market movements, in an attempt to create a healthy income stream for the week with reduction of trading risk.