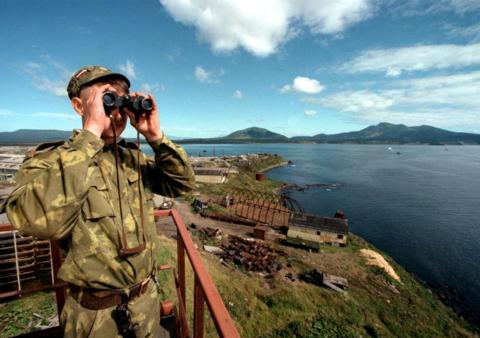

I’m was beginning to feel like one of those Pacific Island soldiers that never found out World War II had ended and remained ever-presently vigilant for an impending attack that never came.

I’m was beginning to feel like one of those Pacific Island soldiers that never found out World War II had ended and remained ever-presently vigilant for an impending attack that never came.

Amazingly, some held up their vow to defend for decades while I’m having difficulty after a bit more than a month waiting for a correction. Nothing big, just in line with this same time period in 2012, as I see lots of similarities to that time, not only in the parallel nature of the charts, but also in my own less than stellar performances, having been selling covered options as religiously as a sentinel keeps an eye on the horizon.

Having weathered the acute shock value of Cyprus, decreasing economic growth in China, currency manipulation in Japan and digested the initial uncertainty of the Korean Peninsula, it looked as if any sentinel for a sell-off would be a lonely soldier.

Now faced with a disappointing employment situation there’s opportunity to wonder over the weekend whether the pole has been sufficiently greased or whether this is simply the very quick mini sell-off of April 2012 that occurred just as Apple (AAPL) hit its high, then quickly recovered, just in time to lead to a 9% sell-off.

Apple had came off its April high by 5% at that point that the greater market downturn began, which is that same point that Google (GOOG) was down from its recent high point, at the close of Thursday’s trading (April 4, 2013). Coincidentally, that was the day before today’s sell-off. For those that have believed that Google has rotated into market leadership, having wrestled the position away from Apple, that may be a cause for concern. as does the fact that Google has traded below that dreaded 50 Day Moving Average.

I don’t know much about those kind of technical factors, but I do recognize that sometimes there is a basis for deja vu being more than just a feeling. What actually exists over the horizon is still anyone’s guess, but unlike those lonely soldiers you can feel relatively assured that at some point an unwelcome visitor will appear and wreak some havoc on the market. From my perspective that comes along every 52 months, so I’m not quite ready to accept that the time has come to drop defenses, but there may be room to let the guard down a bit.

I don’t know much about those kind of technical factors, but I do recognize that sometimes there is a basis for deja vu being more than just a feeling. What actually exists over the horizon is still anyone’s guess, but unlike those lonely soldiers you can feel relatively assured that at some point an unwelcome visitor will appear and wreak some havoc on the market. From my perspective that comes along every 52 months, so I’m not quite ready to accept that the time has come to drop defenses, but there may be room to let the guard down a bit.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum and “PEE” categories, as earnings season begins anew on April 8, 2013 (see details). Additionally, for the first time in a few weeks there is a somewhat greater emphasis on Momentum stocks, as a coming downslide might reasonably be expected to unduly impact upon issues that have thrived recently, particularly the more defensive stocks. However, I am still inclined to consider monthly contracts over weekly ones, simply for a little extra breathing room while continuing to await a market heading in a southerly direction.

One Momentum stock that has also thrived up until very recently is YUM Brands (YUM). It also happens to go ex-dividend this week and has already given back much of its gains in the absence of any news. In the past it has demonstrated itself very capable of bouncing back from both real news and speculation regarding its forward prospects. Simultaneously being held hostage to the Chinese economy and also proving to be independent of swirling winds, YUM Brands serves as a model of what can be achieved in a marketplace where the playing field is anything but level.

A real signal that something is evolving, at least from my perspective, is that I no longer classify AIG (AIG) as a Momentum stock. Over the past year, had I followed by frequent suggestions that AIG might be an appropriate covered call position, I think I could have limited my portfolio to a single stock. Robert Ben Mosche, it’s CEO is the poster child for leadership and focus. With some recent share weakness, I think it may be time to add it back to a portfolio in need of income and reasonable price stability.

A couple of months ago I made an earnings related trade in F5 Networks (FFIV) that worked out nicely. Having sold puts just prior to earnings, F5 surpassed expectations and the trade was closed in 4 days. Thursday evening after the closing bell, F5 release disappointing guidance that saw its shares fall more than 15%.

I hate guidance that comes out weeks before earnings and catches me off-guard. In the past I’ve seen Cummins Engine (CMI) and Abercrombie and Fitch (ANF) seem t

o regularly upset happy shareholders with that kind of timed guidance. Despite the fact that analysts seem to be in agreement that this is solely an F5 issue, it indiscriminately drags down the sector, perhaps offering opportunities.

In this case, I think the opportunities are now in both Cisco (CSCO) and Riverbed Technology (RVBD), both unduly hit in the aftermath of F5 and just a couple of weeks ago by Oracle’s (ORCL) disappointing earnings, which were also agreed to be an Oracle specific shortcoming. I currently own shares of Riverbed and would even consider adding to the position ahead of earnings later in the month.

Western Refining (WNR) returns to the list from last week, as an unrequited purchase. It is, possibly another example of how the market acts indiscriminately and emotionally. Following Valero’s (VLO) moaning about the costs of upcoming EPA initiatives for cleaner gas the market punished the entire sector, despite the fact that the EPA suggested that the costs of compliance were minimal for most refiners. The market made no distinction and assumed that all refiners would be subject to additional costs similar to the $300-400 million suggested by Valero. Unfortunately, I didn’t have the fortitude to pick up shares of Western Refining as it briefly dipped below $30 or Phillips 66 (PSX) as it fell about 10%. It didn’t stay there very long and certainly never confirmed the worst case scenario that Valero so openly shouted.

MetLife (MET) also returns from last week, which was another week of hesitancy to commit cash in favor of building reserves. There were, however, a number of times that I was ready to part with some of the cash, but ultimately resisted. As opposed to Western Refining, MetLife’s shares went down even further, so those decisions to embrace inaction may have balanced one another out. I continue to believe that shares will benefit from an increasingly healthy housing market, although that is far from MetLife’s core and highest profile business.

The financial sector was hit quite hard this past week. Since I owned shares of both Morgan Stanley (MS) and JP Morgan (JPM), I was acutely aware of their duress. However, in addition to JP Morgan and Wells Fargo (WFC) releasing earnings this Friday and perhaps representing some opportunity, Bank of America (BAC), whose shares I had assigned just a week ago has given up much of its recent run-up higher and is becoming attractive again.

Finally, Bed Bath and Beyond (BBBY) s one of my favorite stores, but not one of my favorite stocks. It has had a bit of a price rise on some buy-out speculation and it has demonstrated past ability to disappoint on earnings. Already down about 4% from its very recent high, I would be comfortable owning shares at $60 and would consider a 1.5% ROI for a 2 week holding period to be a decent reward while anticipating less than a 5% decline in share price in the after-math of earnings.

Traditional Stocks: AIG, Cisco, MetLife

Momentum Stocks: Bank of America, Riverbed Technology, Western Refining,

Double Dip Dividend: YUM Brands (ex-div 4/10)

Premiums Enhanced by Earnings: JP Morgan (4/12 AM), Pier 1 (4/11 AM), Wells Fargo (4/12 AM)

Remember, these are just guidelines for the coming week. Some of the above selections may be sent to Option to Profit subscribers as actionable Trading Alerts, most often coupling a share purchase with call option sales or the sale of covered put contracts. Alerts are sent in adjustment to and consideration of market movements, in an attempt to create a healthy income stream for the week with reduction of trading risk.

Some of the stocks mentioned in this article may be viewed for their past performance utilizing the Option to Profit strategy.