This past Monday, prior to the market’s opening, I posted the following for Option to Profit subscribers:

“In all likelihood, at this point there are only two things that would make the market take any news badly.

The first is if no interest rate increase is announced.

Markets seem to have finally matured enough to understand that a rate hike is only a reflection of all of the good and future good things that are developing in our economy and are ready to move on instead of being paralyzed with fear that a rate hike would choke off anemic growth.

The second thing, though, is the very unlikely event of a rate hike larger than has been widely expected. That means a 0.5% hike, or even worse, a full 1% hike.

That would likely be met with crazed selling.”

Based on the way the market was trading this week as we were awaiting the FOMC Statement which was very widely expected to announce an interest rate increase, you would have been proud.

The proudness would have arisen as it seemed that the market was finally at peace with the idea that a small interest rate increase, the first in 9 years, wouldn’t be bad news, at all.

Finally, it seemed as if the market was developing some kind of a more mature outlook on things, coming to the realization that an interest rate hike was a reflection of a growing and healthy economy and was something that should be celebrated.

It always seemed somewhat ironic to me that the investing class, perhaps those most likely to endorse the concept of teaching a man how to fish rather than simply giving a handout, would be so aghast at the possibility of a cessation of a zero interest rate policy (“ZIRP”), which may have been tantamount to a handout.

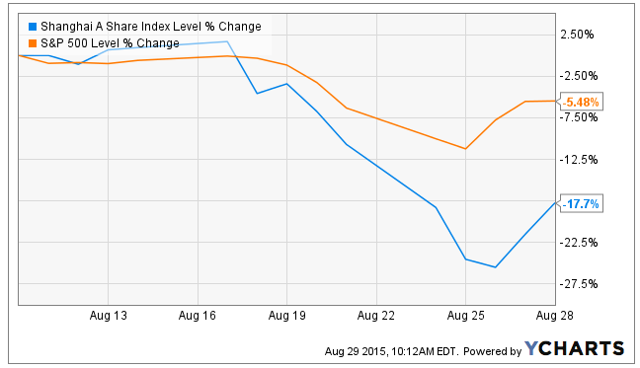

The realization that ours was likely the best and most fundamentally sound economy in the world may have also been at the root of our recent disassociation from adverse market events in China.

So while the week opened with more significant weakness in China, our own markets began to trade as if they were now ready to welcome an interest rate increase and seeing it for what it really reflected.

All was well and in celebration mode as we awaited the news on Thursday.

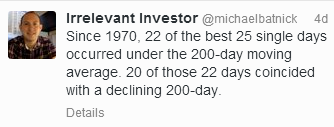

As the news was being awaited, I saw the following Tweet.

I don’t follow many people on Twitter, but Todd Harrison, the founder of Minyanville is one of those rare combinations of humility, great personal and professional successes, who should be followed.

I have an autographed copy of his book “The Other Side of Wall Street,” whose full title really says it all and is a very worthwhile read.

Like the beer pitchman, Todd Harrison doesn’t Tweet much, but when he does, it’s worth reading, considering and placing somewhere in your memory banks.

Many people in their Twitter profiles have a disclaimer that when they re-Tweet something it isn’t necessarily an endorsement.

When I re-Tweet something, it is always a reflection of agreement. There’s no passive – aggressiveness involved in the re-Tweet by saying “I endorse the re-Tweeting of this, but I don’t necessarily endorse its content.”

I believed, as Todd Harrison did, some 4 minutes before the FOMC statement release, that the knee jerk reaction to the FOMC decision wasn’t the one to follow.

But a funny thing happened, but not in a funny sort of way.

For a short while that knee jerk reaction would have been the right response to what should have been correctly viewed as disappointment.

What was wrong was a reversion back to a market wanting and believing that it was given another extension of the ZIRP handout. That took a market that had given up all of its substantial gains and made another reversal, this time going beyond the day’s previous gains.

With past history as a guide, going back to Janet Yellen’s predecessor, who introduced the phenomenon of the Federal Reserve Chairman’s Press Conference, the market kept going higher during the prepared statement portion of the conference and continued even higher as some clarification was sought on what was meant by “global concerns.”

Of course, everyone knew that meant China, although one has to wonder whether those global concerns also included the opinions held and expressed by Christine Legarde of the International Monetary Fund and others, who believe that it would be wrong for the FOMC to introduce an interest rate increase in 2015.

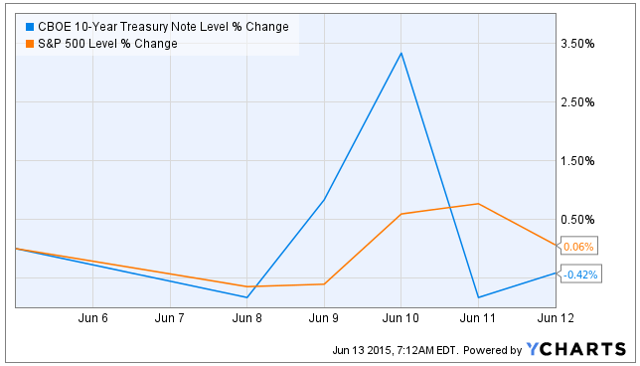

While some then began to wonder whether “global concerns” meant that the Federal Reserve was taking on a third mandate, it all turned suddenly downward.

With the exception of a very early Yellen press conference when she mischaracterized the FOMC’s time frame on rate increases and the market took a subsequent tumble, normally, Yellen’s dovish and dulcet tones are like a tonic for whatever may have been ailing the market/ This week, however, the juxtaposition of dovish and hawkish sentiments from the FOMC Statement, the subsequent press conference prepared statement and questions and answers may have been confusing enough to send traders back to their new found friend.

Logic.

Perhaps it was Yellen’s response that she couldn’t give a recipe to define what would cause the FOMC to act or perhaps it was the suggestion that the FOMC needn’t wait until their next meeting to act that sent markets sharply lower as they craved some certainty�.

Or maybe �it was a sudden realization that if markets had gone higher on the anticipation of a rate increase, logic would dictate that it go lower if no increase was forthcoming.

And so the initial response to the FOMC decision was the right response as the market may have shown earlier in the week that it was finally beginning to act in a mature fashion and was still capable of doing so as the winds shifted.

Perhaps the best question of that afternoon was one that pointed out an apparen

t inconsistency between expectations for full employment in the coming years, yet also expectations for inflation remaining below the Federal Reserve’s 2% target.

Good question.

Her answer “If our understanding of the inflation process is correct……we will see further upward pressure on inflation, may have represented a very big “if” to some and may have deflated confidence at the same time as a re-awakening was taking place that suggested that perhaps the economy wasn’t growing as strongly as had been hoped to support continued upward movement in the market.

That’s the downside to focusing on fundamentals.

As usual, the week’s potential stock selections are classified as being in the Traditional, Double Dip Dividend, Momentum or “PEE” categories.

As the market continues its uncertainty, even as it may be returning more to consideration of fundamentals, I continue to like the idea of going with some of the relative safety that may be found with dividends.

Last week I purchased more shares of General Electric (GE), hoping to capture both the dividend and the volatility enhanced premium. Those shares, however were assigned early, but having sold a 2 week option the ROI for the 3 days of holding reflected that additional time value and was a respectable 1.1%.

Even though I still hold some shares with an October 2, 2015 $25 expiration hanging over them, this week I find myself wanting to add shares of General Electric, once again, as was the case in each of the last two weeks.

Although there is no dividend in sight for another 3 months, the $25 neighborhood has been looking like a comfortable one in which to add shares as volatility has made the premiums more and more attractive and there may also be some short term upside to shares to help enhance the return.

A covered option strategy is at its best when the same stock can be used over and over again as a vehicle to generate premiums and dividends. For now, General Electric may be that stock.

Verizon (VZ) doesn’t have an upcoming dividend this week, but it will be offering one within the next 3 weeks. In addition to its recently increased dividend, the yield was especially enhanced by its sharp decline in share price at the end of the week as it gave some dour guidance for 2016.

There’s not too much doubt that the telecommunications landscape is changing rapidly, but if I had to put my confidence in any company within that smallest of sectors to survive the turmoil, it’s Verizon, as long as their debt load isn’t going to grow by a very unneeded and unwanted purchase of a pesky competitor that has been squeezing everyone’s margins.

I see Verizon’s pessimism as setting up an “under promise and over deliver” kind of scenario, as utilities typically find a way to thrive, but rarely want to shout up and down the streets about how great things are, lest people begin taking notice of how much they’re paying for someone else’s obscene profits.

Among those being considered that are going to be ex-dividend this week are Cypress Semiconductor (CY) and Green Mountain Keurig (GMCR).

I already own shares of Cypress Semiconductor and have a way to go to reach a breakeven on those shares which I purchased after its proposed buyout of another company fell through. I’ve held shares many times over the years and have become very accustomed to its significant and sizable moves, while somehow finding a way to return back to more normative pricing.

Following this past Friday’s decline its well below the $10 level that I’ve long liked for adding shares. With an ex-dividend date on Tuesday, if the trade is to be made, it will be likely done early in the week.

However, the other consideration is that Cypress Semiconductor is among the early earnings reporters and it will be reporting on the day before its next option contract expires. For that reason, if considering a share purchase, I would probably look at a contract expiration beyond October, in the event of further price erosion.

Also going ex-dividend but not until Monday of the following week are Deere (DE) and Dow Chemical (DOW).

Like so many other stocks, they are badly beaten down and as a result are featuring an even more alluring dividend yield. However, their Monday ex-dividend date is something that can add to that allure, as any decision to exercise the option has to be made on the previous Saturday.

That presents opportunity to look at strategies that might seek to encourage early assignment through the sale of in the money call options utilizing expanded weekly options.

While Caterpillar (CAT) and others are feeling the pain of China’s economic slowdown, that’s not the case for Deere, but as is often the case, there are sympathy pains that become all too real.

Dow Chemical, on the other hand has continued to suffer from the belief that its fortunes are closely tied to oil prices. It;s CEO refuted that barely 9 months ago and subsequent earnings reports have borne out his contention, yet Dow Chemical continues to suffer as oil prices move lower.

If looking for a respite from dividends, both Bank of America (BAC) and Bed Bath and Beyond (BBBY) may be worth a look this week.

The financial sector was hard hit the past few days and Bank of America was additionally in the spotlight regarding the issue of whether its CEO should also hold the Chairman’s title.

As with Jamie Dimon before him who successfully faced the same shareholder issue and retained both designations, no one is complaining about the performance of Brian Moynihan.

Even as I sit on some more expensive shares that have options sold on them expiring in two weeks, I have no reason to complain.

Following a second consecutive day of large declines, Bank of America is trading near its support that has seemed to hold up well under previous assault attempts. As with other stocks that have suffered large declines, there is greater ability to attempt to capitalize on price gains without giving up much in the way of option premiums.

Bed Bath and Beyond reports earnings this week and has seen its price in steady decline for the past 4 months. Unlike others that have had a more precipitous decline as they’ve approached the pleasure of a 20% decline, Bed Bath and Beyond has done it in a gradual style.

While those intermediate points along the drop down may represent some resistance on the way back up, that climb higher is made easier when the preceding decline

wasn’t vertical.

When considering an earnings related trade I usually look for a weekly return of 1% or greater by selling put options at a strike price that’s below the bottom range implied by the option market. The preference is that the strike price that provides that return be well below that lower boundary, The lower, the better the safety cushion.

For Bed Bath and Beyond the implied move is about 6.3%, but there is no safety cushion below a $56.50 strike level to yield that 1% return. Therefore, instead of selling puts before earnings, I would consider, as has been the predominant strategy of the past two months, of considering the sale of puts after earnings are announced, but only if there is a significant price decline.

Finally, Green Mountain Keurig is going ex-dividend this coming week, but it hardly qualifies as being among the relatively safe universe of stocks that I would prefer owning right now.

I usually like to think about opening a position in Green Mountain Keurig through the sale of puts. However, with the ex-dividend date this week that would be like subsidizing someone who was selling those puts for the dividend related price decline.

Other than the dividend, there’s is little that I could say to justify a long term position on Green Mountain and even have a hard time justifying a short term position.

However, Green Mountain’s ex-dividend day is on Friday and expanded weekly options are available.

I would consider the purchase of shares and the concomitant sale of deep in the money expanded weekly calls in an attempt to see those shares assigned early.

As an example, with Green Mountain closing at $56.74 on Friday, the October 2, 2015 $54.50 call option would have delivered a premium of $3.08.

For a rational option buyer to consider early exercise on Thursday, the price of shares would have to be above $54.79 and likely even higher than that, due to the inherent risk associated with o�wning� shares, even if only for minutes on Friday morning after taking their possession.

However, if assigned early, there would be a 1.5% ROI for the 4 days of holding even if the shares fell somewhat less than 3.4%.

Their coffee and their prospects for continued marketplace success may both be insipid, but I do like the tortured logic and odds of the dividend related trade as we look ahead to a week where logic seeks to re-assert itself.

Traditional Stock: General Electric, Verizon

Momentum Stock: Bank of America

Double-Dip Dividend: Cypress Semiconductor (9/22), Deere (9/28), Dow Chemical (9/28), Green Mountain Keurig (9/25)

Premiums Enhanced by Earnings: Bed Bath and Beyond (9/24 PM)

Remember, these are just guidelines for the coming week. The above selections may become actionable – most often coupling a share purchase with call option sales or the sale of covered put contracts – in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week, with reduction of trading risk.

This past week was the first full week of earnings for this most recent earnings season and you could be excused for wondering just how to interpret the data coming in.

This past week was the first full week of earnings for this most recent earnings season and you could be excused for wondering just how to interpret the data coming in.

The Talking Heads were really something.

The Talking Heads were really something.

Good luck to you if you have staked very much on being able to prove that you can make sense of what we’ve been seeing in the US stock market.

Good luck to you if you have staked very much on being able to prove that you can make sense of what we’ve been seeing in the US stock market.

Michael Batnick

Michael Batnick

When I was a kid just about the funniest word any of us had ever heard was “fink.” Way back then that was pretty much the way Mad Magazine felt too, as it used that word with great regularity.

When I was a kid just about the funniest word any of us had ever heard was “fink.” Way back then that was pretty much the way Mad Magazine felt too, as it used that word with great regularity. This was one of those rare weeks where there wasn’t really any kind of theme to guide or move markets.

This was one of those rare weeks where there wasn’t really any kind of theme to guide or move markets.