It wasn’t too long ago that China did what it continues to believe that it does best.

It wasn’t too long ago that China did what it continues to believe that it does best.

It dictated and restricted behavior.

You really can’t blame them, as for the past 67 years the government has done a very good job of controlling everything within its borders and rarely had to give up much in return.

This time it believed that it could control natural market forces with edicts and with the imposition of a very market un-natural prohibition against selling shares in a large number of stocks.

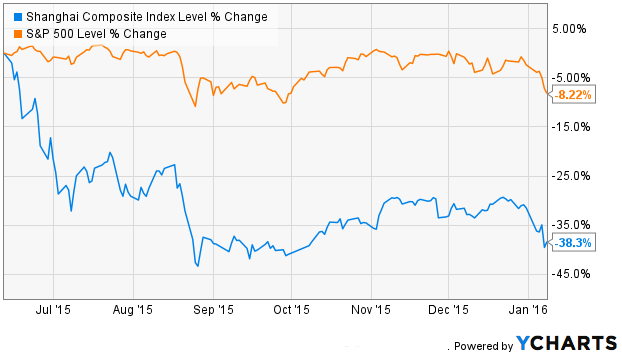

In the immediate aftermath of that decision nearly 2 months ago, the Shanghai Index had actually fared quite well, especially when you consider that in the month prior that index had taken a free fall and dropped 30% over the course of 27 days.

A subsequent 21% rebound over 15 days after the introduction of new “rules” to inactivate gravitational pull, likely re-inforced the belief that the government was omnipotent and emboldened it as it went forth with a series of rapid and significant currency devaluations, even while sending confusing signals when it moved in to support its currency.

I’ve often wondered about people who engage in risky behaviors, such as free fall jumping. What goes on in their mind, besides the obvious thrill, that tells them they can battle nature and natural laws and be on the winning side?

As with lots of things in life, we have the tendency to project in a very optimistic way. A single victory against all odds suddenly becomes the expected outcome in the future, as if nature and its forces had never heard of the expression “fool me once, shame on me….”

Given China’s track record in getting what it wants they can’t be blamed for believing that they are bigger than the laws that govern markets.

When you believe that you are right or invincible, you don’t really think about such pesky matters as consistency and the likelihood that things will eventually catch up with you.

While it may not be unusual to place some restrictions on trading when things are looking dire, the breadth of the Chinese stock trading restrictions was really broad. The suggestion that those responsible for rampant speculation and “malicious” short selling might suffer anirreversible form of punishment simply sought to ensure that any remaining miscreants severed their alliance with their normal behavior.

But when you’re on a streak and no one questions you, what reason is there to not continue in the same path that got you there? It’s just like not selling your stock positions and pocketing the gains.

Since those restrictions were imposed the Shanghai Index has actually gone 1% higher, which is considerably better than our own S&P 500 which has declined 5% after today’s free fall.

So clearly erecting a dam, even if on the wrong side of the natural flow, has helped and the score is Chinese Government 1, Natural Forces 0.

Except of course if you drill down to the past few days and see a drop of about 13%, while the S&P 500 has gone down 6%.

When the dam breaks, it’s not just the baby in the bath water that’s going to get wet, but more on that, later. That downdraft that we felt on our shores blew in from China as we got sucked in by the vacuum created from their free fall.

As with other instances of trying to do battle with nature there may be the appearance of a victory if you have a very, very short timeframe, but at some point the dam is going to burst and only time can really get things back under control enough to allow an opportunity to rebuild.

This past week was the worst in over 4 years as the S&P 500 fell 5.8%. At this point people are looking at individual stocks and are no longer marveling about how many are in correction territory, but rather how many are approaching or are in bear territory.

I haven’t kept track, but 2015 has been a year in which it seems that the most uttered phrase has been “and the markets have now given up all of their gains for the year.”

While I don’t spend too much time staring at charts and thinking about technical factors, you would have had a very difficult time escaping the barrage of comments about the market having dipped below its 200 Day Moving Average.

The level that I had been keeping my eye on as support was the 2045 level on the S&P 500 and that was breached in the final hour of trading on Thursday, leaving the 2000 level the next likely stop.

That too was left behind in the dust, as is the usual case when in free fall.

As mentioned earlier in the month, those technicals were showing a series of lower highs and higher

lows, which is often interpreted as meaning that a break-out is looming, but gives no clue as to the direction.

Now we know the direction, not that it helps any after the fact.

While the DJIA ended the week down a bit more than 10% off from its all time highs, allowing this to now be called a “correction,” the broader S&p 500 is only 7.8% lower. While many elected to sell on their way out in the final hour of the week, I wasn’t, but don’t expect to be very actively buying next week, without some sign of a functioning parachute or at least some very soft land at the bottom.

Buying is something that I will probably leave to those people who are more daring than I tend to be.

However, even they seem to have been a little more careful as this most recent sell-off hasn’t shown much in the way of enticing dare devils to buy on the substantial dips.

Even people prone to enjoying the thrill of a nice free fall are exercising some abundance of caution. While I prefer not to join them on the way down, I don’t mind keeping their company for now.

As usual, the week’s potential stock selections are classified as being in the Traditional, Double Dip Dividend, Momentum or “PEE” categories.

I succumbed a little to the sell off late in the week on Thursday and purchased some shares of Bank of America (NYSE:BAC) in the final hour, right before another leg downward in a market that at that point was already down nearly 300 points.

That simply was a lesson in the issue that faces us all when prices seem to be so irrationally low. Distinguishing between a value priced stock and one that is there to simply suck money out of your pocket isn’t terribly easy to do.

As the sell off continued the following day to bring the August 2015 option cycle to its end the financial sector continued to be hit very hard as interest rates continued their decline.

It wasn’t very long ago that the 10 Year Treasury was ready to hit 2.5% and many were looking at that as being the proverbial “hand writing on the wall,” but in the past month those rates have fallen more than 40% and suddenly that wall is as clean as that baby that is continually mentioned as having been thrown out with the bath water, which coincidentally may be the second most uttered phrase of late.

After committing some money to Bank of America, I’m actually considering adding more financial sector positions in the expectation that the decline in interest rates will be coming to an end very soon as there’s some reason to believe that the FOMC’s dependence on data may be lip service.

Generally, the association between interest rates and the performance of stocks in the financial sector is reasonably straight forward. With some limitations, an increasing interest rate environment increases the margins that such companies can achieve when they put their own money to work.

MetLife (NYSE:MET) is a good example of that relationship and its share price has certainly followed interest rates lower in the past few weeks, just as it dutifully followed those rates higher.

The decline in its shares has been swift and has finally brought them back to the mid-point of the range of the past dozen purchases. While that decline has been swift, the range has been fairly consistent and as the lower end of that range is approached there’s reason to consider braving some of the prevailing winds.

With the swiftness of the decline and with the broader market exhibiting volatility, the option premiums now associated with MetLife are recapturing some of the life that they had earlier in this year and all throughout 2014.

I often like to consider adding shares of MetLife right before an ex-dividend date, but I find the current stock price level to be compelling reason enough to consider a position and perhaps consider a longer term option contract to ride out any storm that may continue to be ahead.

Blackstone (NYSE:BX) hasn’t exactly followed that general rule, but lately it has fallen back in line with that very general rule, as it has plunged in share price since its earnings report and news of some insider selling.

As an example of how easy it has been to be too early in expressing optimism, I thought that Blackstone might be ready for a purchase just 2 weeks ago, but since then it has fallen 12%, although having had nothing but positive analyst comments directed toward it during those weeks. It, too, seems to have been caught in a significant downdraft and continued uncertainty in its near term fortunes are reflected in the very rich option premiums it’s now offering.

My major concern with Blackstone at the moment is whether its dividend, now at an 8.4% yield, can be sustained.

At a time when uncertainty is the prevailing mood, there’s some comfort that could come from having dividends accrue, as long as those dividends are safe.

While it’s dividend isn’t huge, at 2.5% and very safe, Sinclair Broadcasting (NASDAQ:SBGI) again looks inviting as it followed other media companies lower this week and is now at a very appealing part of its trading range.

They have no worries about exchange rates, the Chinese economy or any of those “stories du jour” that have everyone’s attention.

Having reached an agreement with DISH Network earlier in the week to allow retransmission of its signal it saw shares plummet the following day.

Sinclair Broadcasting is ubiquitous around the nation but not exactly a household name, even in its home turf in the Mid-Atlantic. It offers only monthly options and has generally been a longer holding for me, having owned shares on six occasions in the past 15 months.

Lexmark (NYSE:LXK) was one of the early and very pronounced casualties of this most recent earnings season and it has shown no sign of recovery. The market didn’t even cheer as Lexmark announced workforce reductions.

What Lexmark has done since earnings hasn’t been encouraging as its total decline has been in excess of 30%, with a substantial portion of that coming after the initial wave of selling upon earnings being released.

Lexmark also only offers monthly options and it has a dividend yield that’s both enticing and unnerving. The good news is that expected earnings for the next quarter are sufficient to cover the dividend, but there has to be some concern going forward, as Lexmark has found itself in the same situation as its one time parent IBM (NYSE:IBM) having pivoted from its core business and perhaps needing to do so again.

With virtually no exposure to China you might have thought that Deere (NYSE:DE) would have had somewhat of an easier time of things as reporting its earnings for the past quarter.

If so, you would have been wrong, but getting it right hasn’t been the norm of late, regardless of what company is being considered.

The drop seen in Deere shares definitely came as a surprise to the options markets and to most everyone else as they became yet another to beat on earnings, but to miss on revenues.

As is the general theme, as volatility is climbing, at nearly its highest level in 3 years, the premiums are welcoming greater risk taking, even as they provide some cushion to risk.

Following its loss on Friday, even Starbucks (NASDAQ:SBUX) is now among those in correction, having sustained that decline over the past 2 weeks. With some significant exposure in China it may be understandable why Starbucks was a full participant in the market’s weakness.

Like many other stocks, the sudden decline in the context of a market decline that has led to a surge in volatility, option premiums are beginning to look better and better.

As volatility increases, which itself is a reflection of increasing risk, there is the seeming paradox of more of that risk being mollified through the sale of in the money options. The cushion provided by those in the money options increases as the volatility increases, so that the relative risk is reduced more than an upward moving market.

Starbucks, after a prolonged period of very mediocre option premiums is now beginning to show some of the reason why option sellers prefer high volatility. It’s not only for the increased premium, but also for the premium on that premium which allows greater reward even when willing to see shares assigned at a loss.

As an example, at Starbuck’s closing price of $52.84, the weekly $52 option sale would have delivered a premium of $1.64, which would net $0.80, a 1.5% yield, if shares were assigned, even if those shares fell 1.6%.

Those kind of risk and reward end points on otherwise low risk stocks haven’t been seen in a few years and is very exciting for those who do sell options on a regular basis.

Finally, not many companies have had their obituaries prepared for release as frequently as GameStop (NYSE:GME) has had to endure for many years.

Somehow, though, even as we think that the model for gaming distribution is changing there exists a strong core of those still yearning for physicality, even if in a virtual world.

GameStop reports earnings this week and it is no stranger to strong moves. The option market, however is implying only an 8.8% move, which seems substantial, but as this most recent earnings season will attest, may be under-stated.

For those bold enough to consider the sale of puts before earnings, a 1% ROI can be achieved if shares fall less than 12.1%.

As with a number of other earnings related trades over the past few months, I’m not so bold as to consider the trade in advance of earnings, but might consider selling puts after earnings in the event of a large move downward.

Lately, that has been a better formula for balancing reward and risk, although it may result in some lost opportunities in the event that shares don’t plummet beyond the strike prices implied by the option market. That, however, can be a small price to pay when the moves have so frequently been out-sized in their magnitude and offering a reward that ends up being dwarfed by the risk.

Considering that GameStop has fallen only 4.6% from its highs, it may be under additional pressure in the event of even a mild disappointment or less than optimistic guidance.

While it may be premature to begin the flow of tears and recount the good memories of GameStop and a youth wasted, I would be cautious about discounting the concerns entirely as far as the market’s reaction may be concerned.

Traditional Stock: Blackstone, Deere, General Electric, MetLife, Starbucks

Momentum Stock: none

Double-Dip Dividend: Lexmark (8/26 $0.36), Sinclair Broadcasting (8/28 $0.16)

Premiums Enhanced by Earnings: GameStop (8/27 PM)

Remember, these are just guidelines for the coming week. The above selections may become actionable, most often coupling a share purchase with call option sales or the sale of covered put contracts, in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week, with reduction of trading risk.

For anyone who is capable of remembering the sentiment that pervaded markets less than 3 weeks ago, the continuing shattering of stock market records day after day has to come as a surprise.

For anyone who is capable of remembering the sentiment that pervaded markets less than 3 weeks ago, the continuing shattering of stock market records day after day has to come as a surprise.

About a year ago at this time, we were all waiting for what would turn out to be the first interest rate increase by the FOMC in nearly 9 years.

About a year ago at this time, we were all waiting for what would turn out to be the first interest rate increase by the FOMC in nearly 9 years. Jim Carrey made, what was by most accounts, a truly putrid move entitled “The Number 23.”

Jim Carrey made, what was by most accounts, a truly putrid move entitled “The Number 23.”

new year starts off with great promise.

new year starts off with great promise.

It wasn’t too long ago that China did what it continues to believe that it does best.

It wasn’t too long ago that China did what it continues to believe that it does best.

In an age of rapidly advancing technology, where even Moore’s Law seems inadequate to keep up with the pace of advances, I wonder how many kids are using the same technology that I used when younger.

In an age of rapidly advancing technology, where even Moore’s Law seems inadequate to keep up with the pace of advances, I wonder how many kids are using the same technology that I used when younger. An incredibly quiet and uneventful week, cut short by the Thanksgiving Day holiday, saw the calm interrupted as a group of oil ministers from around the world came to an agreement.

An incredibly quiet and uneventful week, cut short by the Thanksgiving Day holiday, saw the calm interrupted as a group of oil ministers from around the world came to an agreement.

This past week was one when neither decisions nor inputs were really required from investors as the market had its best week in about four months. With the exception of a totally inconsequential FOMC statement release, there was absolutely no economic news, or really no news of any kind at all. In fact, awaiting the scheduled remarks from Mario Draghi was elevated to the status of “breaking news” as most people were tiring of seeing celebrities getting doused with a bucket of ice, under the guise of being news.

This past week was one when neither decisions nor inputs were really required from investors as the market had its best week in about four months. With the exception of a totally inconsequential FOMC statement release, there was absolutely no economic news, or really no news of any kind at all. In fact, awaiting the scheduled remarks from Mario Draghi was elevated to the status of “breaking news” as most people were tiring of seeing celebrities getting doused with a bucket of ice, under the guise of being news.