I won’t quibble over a day here or there.

International dateline, questionable reporting, time differences, you can take your pick.

I was born on at 3:30 AM on April 7th in Hungary, but in a logical world, now that I live in the U.S., I should be celebrating my birthday on April 6th.

I don’t. That would be stupid, albeit, logical.

Yesteday, May 1st, we learned of Osama bin Laden’s death. One of my kids joined the  throng at the White House, the other donned his National Guard uniform and sent me a photo.

throng at the White House, the other donned his National Guard uniform and sent me a photo.

I already have the days’ newspaper wrapped in plastic.

Was the glorious day on May 1st, was it April 30th? Who knows and who cares?

But it may by no means be coincidence that Adolph Hitler’s date of death was reportedly April 30th and officially reported May 1st.

Sure, as a child I remember all of those wierd Lincoln and Kennedy similarities.

This is different.

As Americans, we have often been immune from the sense of relief and pure joy when evil dies.Fortunately, 3000 miles of ocean, a strong military and an abiding sense of justice has kept us safe for most of our history.

We haven’t had to endure the daily evils of the likes of Idi Amin or the long list of others.

Even though it’s been almost 10 years since the World Trade Center attacks, we’ve taken some solace that the evils guys probably never were able to close both eyes at night.

Even though it appears that Bin Laden’s final home was more luxurious than the caves we had been hoping that he had been living in, I don’t think you ever really get used to the unexpected sound of overhead explosions.

To some, it may be inappropriate to compare Bin Laden to Hitler. Since I never met the vast majority of my family because they perished during the Holocaust, I feel like I can take a pass on any complaints.

It’s akin to why some people can get away with Gangsta rap lyrics while others can’t.

The only difference between Bin Laden and Hitler is that Bin Laden was deprived the opportunity to carry out his master plan.

If not for the United States and its dogged effort to find Bin Laden, the “spiritual” leader of al Qaeda (talk about an oxymoron), they would have been far more devestation.

In their tortuous logic, these terrorist zombies will claim that if it were not for the United States there would be no al Qaeda.

No on knew better how useful it was to them to have the United States and Israel be considered the enemy than the leaders of the Arab world.

The longer they could divert attention to the great “Satans” the less likely they would be to suffer the wrath of their own people.

That world is changing.

Democrarcies never go to war with one another.

The Middle East is on a precipice. Just a tip in the right direction and true democracy may overwhelm the region.

The outcome? Once the people see the lies fed to them by their own governments for generations, they are likely to be even more angered by all of the lost opportunities to be part of the civilized world.

In fact, they are likely to discover that neither the United States nor Israel are evil. Only their previous ruling regimes could rightfully take that honor.

Even the “beloved” Saudi regime knew all too well that the more it fomented chaos elsewhere, the less likely its own legitamacy would be questioned.

They realized that 50 years ago.

They, nor anyone else, had love for the Palestinians, but as long as they could stoke the fires against the Israelis, the longer they could delay that fire encroaching on their own turf.

But the winds have changed.

April 30th, May 1st? Doesn’t really matter.

Today, I feel more safe and more optomistic than in a very long time.

I haven’t even checked my portfolio even once, now an hour into the open. Talk about a shift in winds.

As my brain is aging, there’s only room for a limited number of “where were you when…” kind of memories. I’ll have to displace something to make room for where I was when news of Bin Laden’s death was announced.

It happened to come on the birthdate of my uncle who died as a relatively young man, having physically survived Aushcwitz, but not otherwise.

For me, yesterday was a little bit of a birthday present to him from Adolph and Osama.

For the rest of the world, it also meant a pre-emption of the closing 30 minutes of Trump’s Celebrity apprentice.

As the Passover Seder song says, if all that would have been done for us was to deliver us from The Donald, “Dayenu”. It would have been sufficient.

But the gifts kept coming.

Sorry, Mark McGwire, I no longer remember whgere I was when you hit your 62nd.

And so it goes.

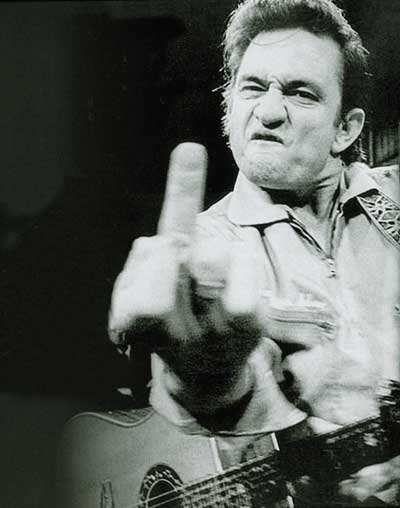

The cash that I’m talking about is Johnny Cash.

The cash that I’m talking about is Johnny Cash.

Lots has happened since then, most of which explains why I didn’t receive an invitation to the Royal Nuptials.

Lots has happened since then, most of which explains why I didn’t receive an invitation to the Royal Nuptials.

As much as I’ve been amazed at the reach of Twitter and how it really does level a playing field, after all, I can “talk” to Rainn Wilson, it has also bought distress into my life.

As much as I’ve been amazed at the reach of Twitter and how it really does level a playing field, after all, I can “talk” to Rainn Wilson, it has also bought distress into my life. that’s really not all that important. It takes alot for me to make an extra click or two.

that’s really not all that important. It takes alot for me to make an extra click or two. But you have to love Sallie Mae if you’re a trader. Even investors have to admire Sallie Mae, although the ride from $6 to $10 was bumpy, as it was from $12 to $14.

But you have to love Sallie Mae if you’re a trader. Even investors have to admire Sallie Mae, although the ride from $6 to $10 was bumpy, as it was from $12 to $14.