|

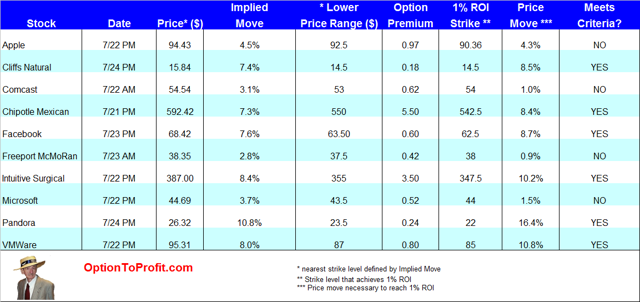

Daily Market Update – July 23, 2014 (Close) As far as Wednesdays go this one looked to be exceptionally quiet as far as stimulants or catalysts for the market. With the market being unable to string two consecutive days moving in the same direction for the past 7 days and also being unable to string two consecutive weeks moving in the same direction for the past seven weeks, the expectation was that today may be a lower moving day, despite some decent earnings news after the closing bell yesterday. And while the market did erase some losses and finished the day at a respectable level, with in fact the S&P 500 reaching another new high, for the DJIA it was a down day. The relative performance of the two indexes being reverse their experiences of the previous week. Even Apple and Microsoft reporting earnings after yesterday’s close seemed to have done nothing. Nether too much for their own stocks and certainly nothing to boost or depress the markets this morning. Ultimately, perhaps based on some comments from Tim Cook regarding the nature of Apple’s performance, its shares did come to a nice gain to end the day, however. While there’s no shortage of earnings reports today the early ones don’t appear to have any impact either and the market was about as flat as you can get to start the day’s trading. There were also virtually no economic reports scheduled to be released today. So I didn’t have much expectation for doing much today in what is now officially the slowest week of the year, with only two trades thus far having entered the day. That ended up getting doubled with a couple of early rollovers. With lots of positions set to expire on Friday there’s certainly a hope that something will happen between today and Friday, but that something really does need to be a higher move in order to get some rollover trades done. With some opportunity at hand in eBay and Transocean to execute rollovers for shares that seemed unlikely to be assigned, it was a way to fend off the continuing boredom. While the expectation isn’t there even in the absence of any anticipated event you just never do know what the sentiment will be once things get going for real. While the pre-open trading can give you a pretty good clue if it shows large moves in either direction it really does little to alert you to what the trading session holds when the early moves are small. That’s especially been the case the past few days, but has always really been the case. Eventually the day’s trading takes on a life of its own. Today it showed little hints of life, though, What has really been missing form the past couple of years of earnings is seeing blow out numbers from a company propel the entire market. There was a time when Boeing, IBM, Intel, Microsoft and others could do that. Of course, the flip side was that those same companies could drive the market lower, as contagion can spread in both directions. While I suppose that’s good it would be nice to see something good spreading throughout, but no one company seems to be in a position to be perceived as a leader. While Chipotle Mexican Grill’s earnings advance was great, I don’t think that’s poised to take on a leadership role. Nor Intuitive Surgical. Outside of people that hold those shares, or those that wish they held shares, no one cares. As once said, it’s “much ado about nothing.” That no company is presenting itself as a leader is consistent with a market that has been one that has seemed to move sector by sector, with nearly each taking its turn in the sun and grabbing some glory, while not falling too far behind when the sunlight has dimmed. Collectively, that keeps taking the market higher and higher, a sector at a time and under everyone’s radar, while eluding everyone’s attempts to predict the next winning sector. Unless something big breaks soon, I can at least predict more of the same down the line.

|