Close

|

Daily Market Update – June 6, 2016 (Close) Everyone wanted to know what Janet Yellen was going so say today after Friday’s real shocker of an Employment Situation Report. As the market did so frequently last week, in fact, in 3 of its 4 trading days, it recovered from steep losses. It did so also in response to that news on Friday, but it really leaves many to wonder what’s next. What most firmly believe is that an interest rate hike next week is not next. What we might have reasonably expected to hear today was some dancing around the news and whether the economy may in fact be prone to a recession or whether the Federal Reserve Chairman believes that the economy is strong enough to warrant an interest rate increase. Guess what? What we heard was a lot of hedging, which is a investor’s way of saying “dancing around.” It could have been pretty interesting this afternoon, but the market took the less than clear Yellen-speak as representing the best of all worlds. She basically said that the economy was on track, but that there may not be enough to warrant an interest rate hike just yet. Ahead of that speech and follow up period for questions, the market’s futures trading were understandably pretty flat, just as the previous week ended exactly unchanged, even as volatility dropped another 10%. With a little more money to spend, I wasn’t that eager to do so, but am still very willing, even after not having spent any today. Instead it was watching the market show some optimism and not minding seeing existing positions move higher, especially energy and commodities. With lots of ex-dividend positions this week and the monthly cycle coming to its end next week, I just want to have some predictable stream of income and those may be sufficient to keep me happy, especially if there can be a few more days like today with existing holdings continuing to out-perform the broader market. I still wouldn’t completely rule out taking a plunge, though. Once again, I wouldn’t mind rolling over the single expiring position this week, even if it is in the money. When volatility is high, either in general or for a specific stock, that is often not a bad thing to do as the accumulating enhanced premiums give you a larger and larger cushion. If the stock is already deeply in the money, that amount is just further cushion. Otherwise, I don’t expect too much action this week either. Willing or not, it does take more than that to pull the trigger when it’s really not very clear what the sentiment is right now. It’s hard to tell whether the market is happy that there is a lower chance of a rate hike or whether it will come to its senses and realize that a rate hike would have meant that the economy looked to be headed in the right direction. After Friday’s Employment Situation Report and downward revisions to previous months, it may be harder to come to the conclusion that things are moving in the right direction, even as the unemployment rate is dropping. Along with increasing gas prices and slowed job growth, what reason is there to be happy? At least Janet Yellen didn’t burst anyone’s hopes and dreams today, as she said little of substance, bu So many questions, yet so few answers. |

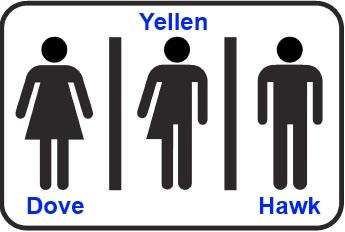

While so many people are still confused over the “Transgender Bathroom” issue, the real confusion came from this week’s Employment Situation Report.

While so many people are still confused over the “Transgender Bathroom” issue, the real confusion came from this week’s Employment Situation Report.