|

(see all trades this option cycle)

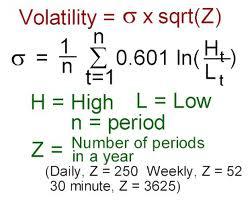

Daily Market Update – February 3, 2014 (9:00 AM) The week comes to its start that the Nikkei is now officially in correction territory. Our own markets aren’t looking very committal this morning, as the single biggest piece of news is likely to come at the end of the week as the new Federal Reserve Chairman, Janet Yellen, will be closely watching the Employment Situation Report, especially after last month’s surprisingly abysmal numbers. Here, we’re still far away from official correction territory and the DJIA and the S&P 500 have diverged a bit with the narrower DJIA showing nearly a 50% greater loss, with it having gone down 5.4% as compared to just 3.6% for the S&P. The safety perceived in the boring blue chips isn’t supposed see that sort of divergence happening on more than an occasional day or two when it is usually due to a single or two outliers that have just had an unusual day. But this is now a relatively prolonged divergence that to some degree is a consequence of having added high priced Visa and Goldman Sachs to the index, while Alcoa was shown the door. In the meantime volatility, which I always harp about in the hopes that it will increase, has done so, having gone slightly more than 50% higher in the past month and still having a long way to go until it returns even to 2011’s levels, which in turn were quite a bit lower than a couple of years prior. With the possibility of increasing volatility will come greater reliance on monthly options rather than weekly. The reasons for that are because the monthly options will finally be returning a decent premium in exchange for the additional time and also the longer term options give some opportunity to perhaps ride out any short term market decline that could occur when you blink your eyes. With low volatility there is greater use of weekly options because it provides a better premium, but also because it doesn’t tie you down during a higher moving market. The downside is that if the share price moves against you you won’t have coverage for very long. That’s the trade-off. With increasing volatility usually comes a decrease in the number of new positions opened as it reflects a market that isn’t consistently continuing higher and higher and resulting in an unending stream of assignments. But that increasing volatility also makes it easier to get a decent premium even using out of the money strikes. Coupled with longer term options even the orphaned positions suddenly have some hope of at least becoming contributing members to a portfolio. In so many ways, even though at first blush it may seem as increasing volatility is a decided negative, there are many more opportunities that present themselves, especially if the increase in volatility isn’t accompanied by a rapidly plunging market. A slow decline in the broad index punctuated with some large moves up and down is all it takes to start seeing the volatility increase and the premiums follow right along. We’ve certainly seen more of those large moves in the first month of 2014 than we saw in all of 2013. This week starts off with cash reserves replenished a bit, but again, not as much as I would have liked. This will likely mark another week when I’m not going to dip too deeply into those reserves, but I am probably willing to go from 30% to about 20%, which might leave room for 5 or so new positions, although if Apple, which goes ex-dividend this week is one of them, I may end up with fewer. As a reminder, if Apple is a possibility, the mini-options are available for those that don’t want a full 100 share position. The mini-options allow contracts to be written on every 10 share lot and trades with good liquidity. As with last week I’m going to sit back and see whether any early gains can persist after the first 60-90 minutes of trading. That has been a key for the past two weeks. Opening strength has been hard to maintain and there has been a price to be paid for jumping in trying to get ahead of the curve or thinking that value was about to disappear. With only a handful of positions set to expire this Friday, despite starting to think more long term, if volatility continues higher, I w Lately, that hasn’t been a sure thing as week end fades have become the norm.

Access prior Daily Market Updates by clicking here OTP Sector Distribution* as of January 31, 2014 * Assumes equal number of shares in positions

Posting of trades is not a recommendation to execute trades

|

|

|

Monday through Thursday? See “Daily Market Update” with first edition published by 12 Noon and Closing Update published by 4:30 PM Friday? See Week in Review for summary statistics and performance Sunday? See Weekend Update for potential stock choices for coming week Any day? See Performance for open and closed positions Subscribers may see ROI statistics on all new, existing and closed positions on a daily updated basis |

|

|

|

|

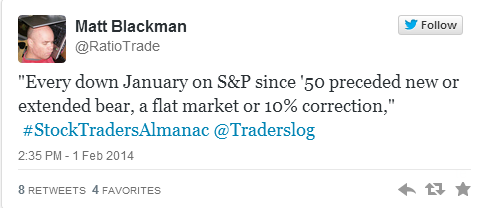

But as long as we were talking about historical norms and how disappointing it was waiting for the historically predicted January Rally that never came, the cries welcoming back volatility may have lost track of what historical levels of volatility have been.

But as long as we were talking about historical norms and how disappointing it was waiting for the historically predicted January Rally that never came, the cries welcoming back volatility may have lost track of what historical levels of volatility have been.