While I don’t necessarily believe that space aliens will descend upon us with laser rays blazing, there’s reason to increasingly believe that possibility as we learn more and more about the existence of conditions elsewhere in the universe that may be compatible with sustaining life.

While I don’t necessarily believe that space aliens will descend upon us with laser rays blazing, there’s reason to increasingly believe that possibility as we learn more and more about the existence of conditions elsewhere in the universe that may be compatible with sustaining life.

Still, even with that knowledge, I don’t let it control my life and quite frankly will probably never do anything that in any way is impacted by the thought of an encounter with an alien.

The principle reason for not elevating the alarm level is that there is no point in history to serve as an example. The pattern of life on earth has been so far devoid of such occurrences, as best we know. Right now, that’s good enough for me.

However, I just don’t completely discount the possibility, because I believe that it’s of a very low probability. Besides, the vaporization process would be so swift that there would be no time for remorse or regrets. At least that’s what I expect.

By the same token I don’t expect a complete meltdown in the market, even though I know it has and can, likely occur again. Despite its probability of occurrence and my belief of that probability, I’m not really prepared for one if it were to occur, even with the extraordinarily low cost of portfolio protection. The chances of a complete meltdown, as we know, is probably more likely to occur in the near term than the prospect of laser waving aliens in our lifetimes.

For all practical purposes one is a real probability and the other isn’t, yet they aren’t necessarily placed into different risk categories at the moment.�

This week’s events, however, served as a reminder that the unexpected should always be expected. With the nice rebound on Friday from Thursday’s news of the tragic downing of the civilian Malaysian airplane, the lesson may be lost, however.

One thing that we seem to have forgotten how to do in the past 5 years is to expect the unexpected. Instead our expectations have been fueled by the relentless climb higher and a feeling of invincibility. To a large degree that feeling has been justified as every attempt to fight back against the gains has been stymied in quick and due course.

I probably wasn’t alone in having that invincible feeling way back in 2007. The vaporization process was fairly swift then, as well.

Even when faced with challenges that in the past would have sent markets tumbling, such as international conflict, we haven’t seen the application of age old adages such as “do not stay long going into a weekend of uncertainty.” This Friday’s market rebound was another example in a long string of uncertainty being expected to not lead to the unexpected.

In essence with the certainty of an ever climbing market having become the �new reality there’s been very little reason to exercise caution, or at least to be prepared to act in a cautious manner in the expectation that perhaps the unexpected will occur.

Our minds are wired to like and identify patterns. That’s certainly the strategic basis for stock trading for many. Predictability brings a degree of comfort, but too much comfort brings complacency. The prevailing pattern simply argues against the unexpected, so we have discounted its probability and to a large degree its possibility.

While we may be correct in discounting complete market meltdowns, as their occurrence is still relatively uncommon, that complacency has us discounting intermediate sized moves that can easily come from the unexpected. The world is an increasingly complex and inter-connected place and as seen in the past week there needn’t be advanced warning signs for any of an infinite number of unexpected events to occur.

We did get lucky this past week, but we probably expected the luck to continue if the unexpected did strike. What would really be unexpected would be to draw a lesson from our fragility standing near market highs.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or “PEE” categories. With many companies reporting earnings this coming week a companion article, “Taking a Gamble with Earnings,” explores some additional potential trades.

As Thursday’s trading was coming to its close at the lows of the session more and more stocks were beginning to return to what seemed to be more reasonable trading levels.

The problem, of course, is dealing with the unexpected and trying to predict what comes next when there are really no data points to characterize what we’ve seen. Someday when we look back at these events and the market impact we may see a pattern, but at the moment the question will be “which pattern?” Is it one that’s simply a blip and short-lived as the event itself is self-limiting or is the pattern consistent with the beginning stages of what is to become an ongoing and escalating series of events that serve to erode confidence and place continuing strains on the market?

In other words, did we just witness a typical over-reaction and subsequent rebound or are we ready to witness a correction?

I think its the former, but it opens the possibility of additional incidents and escalation of hostilities in a part of the world that is far more meaningful to the world’s economies than unheralded internecine conflicts occurring in so many other places.

Interestingly, with that kind of backdrop, this week, while we begin to sort out what the short term holds, “Momentum” kind of stocks, particularly those with little to no international exposure in the hotbed areas, may be more conservative choices than the more Traditional selections.

While I like British Petroleum (BP), General Electric (GE) and Deere (DE) this week, predominantly due to their recent price drops, there is certainly reason to be wary of their exposure to parts of the world in conflict.

British Petroleum certainly has known interests in Russia and could be at unique risk, however, I believe that we will be seeing a lesser chest thumping Russia in the n

ear term as there is some reason to believe that existing sanctions and perhaps expanded ones are beginning to get attention at the highest levels. Above all, pragmatism would dictate not injuring the source of hard currency.

I’ve been waiting a while to re-purchase shares of British Petroleum and certainly welcome any opportunity, even if still at a price higher than my last entry. With earnings scheduled to be reported July 29, 2014 and a healthy dividend sometime during the August 2014 option cycle there may be opportunities over the coming weeks with these shares to generate ongoing income.

General Electric reported its earnings this past Friday and also announced the impending IPO of its consumer finance business. The market was unimpressed on both counts.

I haven’t owned shares of General Electric with the frequency that it deserved. With a generous and increasing dividend, price stability, low beta and decent option premiums, it certainly has had the appeal for ownership, perhaps even using longer term option contracts to better lock in some of those dividends. While it has significant international exposure the recent price weakness makes entry a little less risky, but even with the quality and size of General Electric unexpected bumpy rides can be possible when uncontrollable events create investor fear.

Deere is simply finally down to the price level that in the past was my upper range for purchase. With Caterpillar (CAT) reporting earnings later this week and trading near its 52 week high, there is room on the downside, as well as some trickle down to Deere shares. However, with Joy Global’s (JOY) recent performance, my anticipation is that Caterpillar’s Chinese related revenues will be enough to satisfy traders and offer some protection to Deere, as well.

On the Momentum side of the equation this week are Best Buy (BBY), Las Vegas Sands (LVS) and YUM Brands (YUM).

While Las Vegas Sands and YUM Brands certainly have international exposure, at the moment if you had to choose where to place your overseas bets, China may be relatively insulated from the unexpected elsewhere in the world.

Both companies are coming off weak earnings reports and the markets reacted accordingly. Both, however, have been very resilient to declines and finding substantive support levels in the past. With some shares of Las Vegas Sands recently assigned at current levels I would look for opportunity to re-purchase them. It’s volatility offers generous option premiums and the availability of expanded weekly options makes it easier to consider rollover opportunities in the event of unexpected price drops in order to wait out any price rebound, which has been the expected pattern.

YUM Brands is, like Deere, finally approaching the upper range of where I have purchased shares in the past. While I would like to see them even lower, I think that due to its dependence on the Chinese economy and market it may be a relative out-performer in the event of internationally induced market weakness.

Best Buy, unlike YUM Brands and Las Vegas Sands, has recently been on an upward price trajectory. I liked it much better when it was trading in the $26 range, but I believe it still has further upside potential in its slow climb back after unexpectedly bad earnings news 6 months ago. It too has an attractive option premium and a dividend and despite its recent price climb higher has come down nearly 5% in the past two weeks.

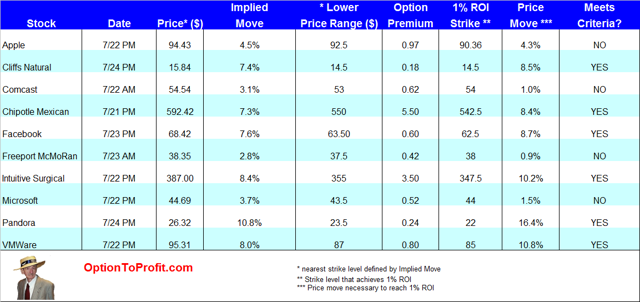

I have never purchased shares of Pandora (P) before, but love its product. At the moment I don’t particularly have any great desire to own shares, but Pandora does report earnings this week and is notable for its 10.8% implied price move. In the meantime a 1% ROI can be achieved at a strike price that is 16.4% below the current price. Those are the kind of characteristics that I like to see when considering what may otherwise be a risk laden trade.

Pandora has certainly shown itself capable of making very large earnings related moves and it is also certainly in the cross hairs of other and bigger players, such as Apple (AAPL) and Google (GOOG). However, even a scathing critic, TheStreet’s Rocco Pendola, has recently commented that its crushing defeat at the hands of those behemoths is not guaranteed.

Expected, maybe, but not guaranteed.

Facebook (FB) is also reporting earnings this coming week and in the two years that it has done so has predominantly surprised to the upside as it has quickly lived up to its vow to monetize its mobile strategy.

With an implied price move of 7.6% the strike level necessary to generate a 1% ROI through the sale of puts is 8.7% below Friday’s closing price. While shares can certainly make a move much larger than what is expected by the option market, in the event of an adverse move Facebook has some qualities that makes it an easier put option position to manage in the effort to avoid assignment.

It trades expanded weekly options and it does so with liquidity and volume, thereby having relatively narrow bid and ask spreads, even for deep in the money options.

Sooner or later, though, the expectation must be that earnings expectations won’t be met. I wouldn’t discount that possibility, although I think the options market may have done so a bit, so in this case I would be more inclined to consider the sale of puts after earnings, if share price drops on a disappointing report.

Finally, Apple reports earnings this week. It doesn’t really fulfill the criteria that I used when considering the sale of puts prior to earnings, in that it doesn’t appear that a 1% ROI can be achieved at a strike level outside of the range defined by the option market when calculating the “implied move.”

It’s probably useless trying to speculate on sales numbers or guidance. Based on its usual earnings related responses in the past, you would be justified in believing that the market had not expected the news. However, this quarter the implied move is on the small side, at only 4.5%, suggesting that not much in the way of a surprise is expected next week.

With the current option pricing, the sale of Apple puts doesn’t meet my criteria, but I would again� be interested in considering either the sale of puts after earnings, if the market’s response is negative or the outright purchase of shares and sale of calls, in anticipation of an ex-dividend date coming up in early August.

Sometimes it’s just

easier dealing with the expected.

Traditional Stocks: British Petroleum, Deere, General Electric

Momentum: Best Buy, Las Vegas Sands, YUM Brands

Double Dip Dividend: none

Premiums Enhanced by Earnings: Apple (7/22 PM), Facebook (7/23 PM), Pandora (P)

Remember, these are just guidelines for the coming week. The above selections may become actionable, most often coupling a share purchase with call option sales or the sale of covered put contracts, in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week with reduction of trading risk.

July 14 – 18, 2014

July 14 – 18, 2014