Some weeks seem more productive than others.

Some weeks seem more productive than others.

After a week of some large and dramatic moves in both directions the S&P 500 barely budged when the final numbers were tallied for the week.

Normally when you don’t actually go anywhere you don’t feel so exhausted, but I felt that way after this week came to its inglorious conclusion. Who knew that reversion to the mean could be so tiring?

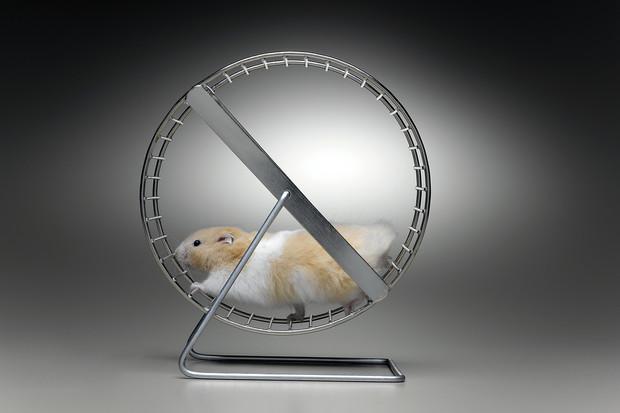

I don’t know what actually goes through the minds of hamsters that just keep running, yet go nowhere. I don’t think that they ever learn or maybe they just don’t care because it’s all about the spinning rather than the destination.

If you’re investing the destination is probably much more important to you than the spinning that may seek to interpret past events or predict the future.

Normally, I like those weeks that seem as if they were just spinning wheels and going nowhere. If you sell options you love the idea of the market not going anywhere. That way you can sell the same option over and over again upon expiration. But in order to have that as an attractive option you need to have occasional spikes and plunges in prices. Those movements create the uncertainty that entice people to buy those options and support the premiums that are willing to be paid.

This week, however, despite those market movements in opposite directions, the volatility just kept going lower and lower, as did the option premiums.

There’s no really good way to spin that, unless you can think of a reason that risk without reward can be a good thing. No matter how much I may keep running in that wheel, I don’t think that I would ever come to that conclusion, although the ensuing dizziness may be reward enough.

The record books will eventually show a week in which the index changed less than 0.05%, but will somehow lose the details and the character of a week that evoked lots of emotions.

Included in those emotions were the elation that may have come with setting more new record closing highs and the fears that accompanied two successive triple loss days in the DJIA. The confusion that remained at the end of the week will certainly not be reflected anywhere.

It was also another week in which attention was focused on bonds and interest rates, but the more you listen to those discussions the more dizzy you may get. It wasn’t too long ago that the spin feared for the equity markets if the 10 Year rate would have exceeded 2.9%. Then the spin changed and the fears centered on the rate dipping below 2.7%.

With the equity markets not having been destructed as either of those two levels were attained we are now being told to fret about the 2.5% level.

In the interim the 2.9% level was exceeded and the 2.7% level was breached, yet we kept setting new market records. You can be certain that along the way there was lots of spinning and if hamster behavior is any indication, there will be lots more to come, none of which will likely advance any of our interests.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or "PEE" categories.

I did very little trading last week, perhaps the slowest week in 5 years. However, some of the selections considered look even better to me after some price corrections of the past week and I may consider some of those selections as much as those from this week.

Among the many things that confuse me is the seeming disconnect between retail earnings and reports of increasing employment. That is also one that seems hard to spin. You would expect that increasing employment would lead to increasing discretionary spending, but the general trend has been to see retail revenues lower and many have been punished for not even being able to achieve already lowered previous guidance.

Kohls (KSS), despite regaining some of its earnings related losses on Friday would seem to be a beneficiary of an improving economy fueled by increasing employment. With its price drop this week it is now trading at the mid-point of its recent range. With an upcoming dividend later in the June 2014 cycle and an always attractive option premium, owing to its occasional price gyrations, despite a low beta, Kohls is always a good consideration.

Best Buy (BBY), on the other hand, may be an understandable casualty of a changing retail dynamic. Yet it has been an excellent covered option trade since its last earnings report when it plunged to its current level. Having traded at that level for the past three months has made it an excellent covered option trade. However, with earnings due to be announced this week my thoughts turn to the possibility of selling puts. The 1% ROI that I generally seek for a one week trade is attainable at a strike level about 10% below the current price and outside of the 7.7% Implied Move range. However, based upon past earnings, shares can certainly move well outside of the expected range and put sellers should be prepared to either take ownership of shares or attempt to roll the puts over to a future date.

Under Armour (UA) is now down about 22% since announcing it would split its shares. Uncharacteristically, the boost in share price after the announcement of the split wasn’t maintained for very long. in fact within just days that premium was gone and shares have steadily eroded. With earnings out of the way shares are beginning to approach a pre-split price level at which they were range bound. As with most apparel and specialty retailers there is increased risk with share ownership. Under Armour, however, other than the recent descent following the split announcement has been a fairly steady performer and its CEO, Kevin Plank, has shown the ability to respond to potential crises.

Another area of confusion is the reason for a steady decline in The Blackstone Group (BX). I already own shares and have endured that decline. I certainly remember how its IPO was the equivalent of that of Facebook (FB) in anticipation and disappointment, but that’s ancient history. Whether actually heralding the market crash or simply serving as a cash out vehicle for some of its principals, Blackstone knows how to identify companies, rehabilitate them and bring them to market. I would think that a decreasing interest rate environment would be beneficial to Blackstone, although a potentially weakening IPO market may not. However, at its current share price, I think it is a good candidate not only for an attractive option premium, a generous dividend, but also for capital appreciation. This is a potential purchase that I would consider for a longer term holding and use of some longer term option contracts.

Ingersoll-Rand (IR) is now trading a little below the mid-point of its recent range since after a spin-off of assets. I haven’t owned shares in nearly two years. During that time until its spin-off, Ingersoll-Rand greatly outperformed the S&P 500, despite the latter’s stellar performance. For most of the time since then they have matched one another in performance, other than in the past month, when Ingersoll-Rand began to lag.

With some concerns about short term market volatility, the availability of only monthly options, a dividend payment this monthly cycle in addition to a fair premium, make Ingersoll-Rand attractive, once again after a long absence.

Chesapeake Energy (CHK) is one of my more frequently traded companies over the past few years. With or without Aubrey McClendon, its past Chairman, it is an always interesting company that still carries the legacy of McClendon and his antics.

After a fairly strong run higher over the past month there was some giveback on Friday as the market was disappointed with the results of some asset sales. While there may be more of those disappointments to come, as the company has been criticized for its strategic disposal of assets, it is a stock that has long offered great opportunity through the use of covered options, particularly for those with patience during its frequent large price moves. With that kind of risk vcomes the reward, or so goes the spin.

Unitedhealth Group (UNH) is well off its recent highs of the past two months and has badly trailed the S&P 500 recently. As the Affordable Care Act increasingly sheds political uncertainty there shouldn’t be too much concern for the ability of health care insurance companies to reconfigure their product offerings and pricing to maintain profit margins. Unitedhealth Group has some diversification, including patient demographics, health care information technology and financing that makes it resilient, even when the sector may be under attack.

International Paper (IP) goes ex-dividend this week. After some recovery from its recent price drop shares gave up a little of that recovery the past few days. Like Ingersoll-Rand it is now trading at a point below the mid-point of its recent range and I believe also offers the opportunity for share appreciation, option premium and dividend. That’s a nice combination, if realized

Finally, Bristol Myers Squibb (BMY) was just one of those companies that has recently felt the magnified wrath this market holds for any kind of adverse opinion or event. In this case it received a downgrade late in the week that called into question whether the company warranted being considered in the same category as the more biotechnology centered pharmaceutical companies.

After so much spin and from so many people that the company was a different breed and should be considered along the likes of Gilead (GILD), rather than the more staid and traditional likes of Pfizer (PFE) and others, the downgrade came as a shock and the market reflected that shock.

It likely won’t take too long for a different kind of spin to come along that will support the contention that Bristol Myers deserves a higher multiple than a company that needs to change its business address in order to expand profit margins.

Traditional Stocks: Bristol Myers Squibb, Ingersoll-Rand, Kohls, Unitedhealth Group

Momentum: Blackstone, Chesapeake Energy, Under Armour

Double Dip Dividend: International Paper (5/21 $0.35)

Premiums Enhanced by Earnings: Best Buy

Remember, these are just guidelines for the coming week. The above selections may become actionable, most often coupling a share purchase with call option sales or the sale of covered put contracts, in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week with reduction of trading risk.