That may be a bit of an over-statement. There’s probably a psychiatric diagnosis for someone who professes deep emotional attachment to inanimate objects.

That may be a bit of an over-statement. There’s probably a psychiatric diagnosis for someone who professes deep emotional attachment to inanimate objects.

But when it comes to being a poster child for a covered option strategy, not too many can do a better job of demonstrating what is possible than Caterpillar (CAT).

Caterpillar reported earnings this morning and by noon its shares were about 5% lower. Its earnings and its reduced guidance were not the sort of things that inspire confidence. It’s CEO, Douglas Oberhelman, has been vilified, pilloried and himself been used as a poster child of an “out of touch” CEO in the past. Today’s news confirms that feeling for many. If there is such a thing as a “rational market,” today’s response is reflective of that kind of market.

Even objective people, such as Herb Greenberg of TheStreet.com described Oberhelman’s appearance on CNBC this morning as seeming or sounding “distraught.” That’s not a terribly good image to present if one’s objective is to inspire confidence in leadership and offer support for share price.

Caterpillar has long been the stock that everyone loves to hate. Down almost 6% year to date, essentially all of it coming today, it has certainly lagged the broader market and has had very tangible opportunity costs, even prior to today’s disappointments.

The smart money bid shares up quite strongly yesterday, approaching $90, a level not seen in 7 months. Presumably, it was the smart money, because it seems unlikely that individual investors would commit with such urgency in advance of a scheduled risk factor.

Certainly, the very high profile position taken by famed short seller, Jim Chanos, calling a short of Caterpillar as his best trade idea of 2014 and pointing out that Oberhelman “routinely misses forecasts,” hasn’t done much to propel shares forward.

But that’s the point.

What has made Caterpillar such a wonderful covered option stock, whether owning shares and selling calls or selling puts, is its mediocrity. It has simply traded in a narrow price range alternating between disappointment and hope. That creates the perfect environment in which to put a stock to work, not be capital appreciation of shares, but rather through production of premium income and dividends.

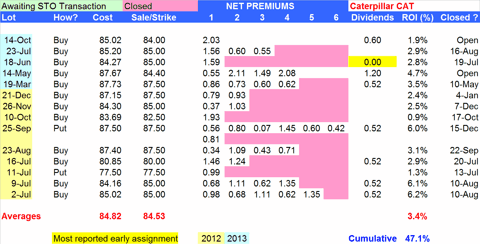

In the example illustrated below, representing Trading Alerts sent to subscribers during a 15 month period, there were 14 different occasions initiating new positions or selling puts. The average share price was slightly above today’s noon time price of Caterpillar shares. In essence indicating no movement in price over that time. Including dividends, however, Caterpillar shares would have shown a 2.4% ROI during that period.

By contrast, the approach of serial purchase of shares or sale of puts, awaiting assignment or rolling over option contracts when possible, as expiration occurs or is likely to occur has had an ROI of 47%, assuming equal lots of shares purchased in all transactions. During that same time period the S&P 500 appreciated 30.8%

By contrast, the approach of serial purchase of shares or sale of puts, awaiting assignment or rolling over option contracts when possible, as expiration occurs or is likely to occur has had an ROI of 47%, assuming equal lots of shares purchased in all transactions. During that same time period the S&P 500 appreciated 30.8%

In the example above very little of the gain can be attributed to capital appreciation of shares. In fact, most of the share purchases was coupled with the sale of in the money or near the money options in an effort to optimize option premiums at the expense of capital gains.

Over the course of the time period evaluated Caterpillar shares did reach a high of $99 on February 1, 2013. Perhaps not coincidentally, that occurred during a period of time that I didn’t own shares, having had shares assigned in early January 2013 and not finding a comfortable re-entry point until March.

For the buy and hold investor with perfect timing who had purchased shares on July 2, 2013 and sold them on February 1, 2013, the ROI including dividends would have been 18.9% for the 7 month period.

I’m one usually loathe to annualize, because I believe it tends to inflate returns, but assuming the 18.9% return could be maintained for an entire year, the annual ROI would have been 32.4%

Not shabby, but remember, that required perfect timing and the ability, discipline and foresight to sell at the top and further assumed that performance could be replicated.

Compare that to sticking with the mediocrity exhibited by Caterpillar and using it as a tool of convenience. Trading in and out of positions as its price indicated, rather than based on technical or fundamental factors. That can be left to the smart money.

With shares taking today’s hit I’m likely to consider adding shares, with already two open lots in hand, one of which is set to expire next week at $84 and the other at the end of the November 2013 cycle with an $87.50 strike price.

If not now, the one thing that I feel fairly certain about is that Caterpillar will present other opportunities and price points at which to find entry and capitalize on its inability to thrive in a thriving market.

Thank you, Doug Oberhelman. We need more CEOs who can walk that share price tight wire and stay within narrow confines. It would take the strain of thought and luck out of the investing process.