For a company that many have said represents nothing but “dead money,” Microsoft (MSFT) has certainly been up and kicking lately.

For a company that many have said represents nothing but “dead money,” Microsoft (MSFT) has certainly been up and kicking lately.

Fresh off the post-Ballmer resignation news and subsequent rally, Microsoft shares gave back everything in this day’s trading, as it announced plans to purchase its smart phone partner, Nokia (NOK).

Nokia itself is no stranger to having been left for dead, as it’s one-time dominance has seen it eclipsed by Apple (AAPL) in sales, and by others in perceived technological prowess.

In executing a purchase of Nokia it also started speculation that they were in effect “buying” their one-time employee, Stephen Elop, most recently CEO of Nokia, as a prime candidate to be Ballmer’s successor.

I say “most recently” because Elop has stepped down as CEO of Nokia so as not to give the appearance of Nokia actually being the superior party in the deal, in the event that Elop becomes Microsoft’s new CEO.

While Berkshire Hathaway (BRK.A) has no current position in Microsoft, the ties between their founders, Warren Buffett and Bill Gates, respectively, is well know and runs deep, much like a river, which is coincidentally the origin of the name “Nokia.”

Buffett’s less known partner, Charlie Munger, who is almost 90 years old, is rarely in the public eye. He is, however, a legendary investor who takes a back seat to no one. When asked the secret to his success his reply was simply “I’m rational. That’s the answer. I’m rational.”

Today, that seemed to be in short supply, as news came out of Microsoft’s $7.2 Billion deal. The immediate reaction in share price was to drop market capitalization by about $17 Billion.

That seems irrational, perhaps as irrational as a similar increase in market capitalization barely a week ago when Ballmer announced his plans.

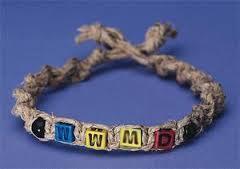

WWMD? What Would Munger Do?

For me, that was reason to purchase shares, just as Ballmer’s resignation announcement was reason to sell shares. I was willing to pick up new shares had Microsoft fallen back to $33, never expecting an opportunity to occur so quickly in the absence of a general market meltdown.

As with most of my holdings the Microsoft shares were covered with options. In this case the $33 strike price was eclipsed, but buying back the options at a loss was rational, because the share price accelerated more than did the “in the money” premium. In those rare occasions that I do that, I always sell the shares as soon as the options positions are close. To do otherwise invites the possibility, or with my lick, the probability that the underlying shares will drop just as quickly as they rose, thereby making it a losing proposition all around.

Of course, you might also make the case that you wouldn’t have expected a major deal, such as this one to have occurred under the leadership of a lame duck CEO, but Microsoft is no ordinary company and Steve Ballmer is no ordinary CEO. Whatever talk you may hear about “the law of large numbers,” there is no denying that those large numbers allow you to act with a certain amount of impunity and have a greater long term vision.

That’s the rational thing to do.

Tellingly, the decision to consummate this deal was made without informing ValueAct Capital Management of the decision. The activist shareholder was just informed that they would be receiving a seat on the Board of Directors, but they were not in the loop on this deal. Besides, how rational would it have been to let a 1% equity stake get in the way?

However, even if the Nokia purchase follows in the path of other Microsoft initiatives and its purchase is written off in its entirety, the $7 Billion purchase price is of little significance to Microsoft and presents a far less liability than it seems on the “Surface,” which is in its own liability category.

To start, the funds for this purchase are from cash held overseas. Unless there is a sudden change in United States corporate tax laws, those funds sit idly, reducing the Price to Earnings ratio. The only use for the funds is further overseas investment. The $7 Billion being spent on Nokia represents approximately 10% of Microsoft’s overseas cash. Even if Ballmer goes on a wildly drunken global spending spree it would be incredibly difficult to make a dent in that overseas pile.

For their money Microsoft escapes US taxes and receives tax advantages related to the purchase. The taxes saved alone are approximately $1.5 Billion had they repatriated the money. Additi

onally any expenses incurred in the United STates further reduce tax liability.

But there is more to the deal to offset the cost that just financial optics and tax engineering. The margins on Lumina units will jump from approximately $10 for software royalties to $50 for hardware. With a projected sale of 30 million units net revenue just increased by $1.5 Billion. Again, in absolute terms that’s not much for Microsoft, but relative to the cost of the Nokia purchase, it is substantial.

What is clear is that what we now think of as smart phones, in some form or another, will evolve into our personal computers. Without a strategy to be part of that evolution money in the bank is insufficient to ensure continued relevance.

Google (GOOG) gets it and secured their foothold with Motorola, a cell phone manufacturer that had also seen better and more heady days, but with a great patent portfolio. Microsoft is now making a commitment to go down a similar path and also securing potentially valuable patents along with the manufacturer of 80% of the Windows OS phones on the market.

I’ve long liked Microsoft because of its option premiums when utilizing a covered call strategy and its recent history of dividend increases. The company is widely expected to announce yet another dividend increase, but even at its current rate of nearly 3% it is far ahead of the mean yield for S&P 500 companies, even when considering only those that pay dividends.

WWMD?

It would be presumptuous to pretend to know, but Microsoft at the currently irrationally depressed level appears to be poised to out-perform the broad index and is preparing itself to leave behind its reactive ways for what we all know to be a lucrative communications market.

Just ask Verizon (VZ).

Disclosure: I am long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may add additional shares of MSFT