Many stock charts look similar lately. For those old enough to remember Alan Greenspan’s first year as Chairman of the Federal Reserve Bank, the upward slope was all that many new investors and stock brokers had known for 5 years.

Many stock charts look similar lately. For those old enough to remember Alan Greenspan’s first year as Chairman of the Federal Reserve Bank, the upward slope was all that many new investors and stock brokers had known for 5 years.

You may or may not recall how that second year went for him. It was the year that the stock market re-discovered the concept of gravity and the more complex notion of negative numbers.

To hear the one time Federal Reserve Chairman intone yesterday that the market is greatly undervalued sends whatever message you would like to hear when you digest his words.

“Irrational exuberance is the last term I would use to characterize the performance at the moment.”

The key to escaping responsibility and a stain on your prognosticating ability is the phrase “at the moment.” I use that a lot myself, as any moment can end up being the inflection point. It’s just too bad that the television cameras aren’t rolling at that point.

There’s much speculation lately about the source of any new money coming into the markets. Whether it’s refugees from the bond market or those that have sat on the sidelines since being shaken out sometime in the past 5 years. I’m not certain why the answer seems so hard to ascertain, but with all of the smug talk about those investors who represent the “smart money,” you might believe that any new money at the margins would be somewhat less smart. After all, besides perhaps being late to the party, they were either in bonds or cash all of this time.

How smart is that? Well, it depends on what side of the inflection you’re on when the question is asked.

Regardless of where any new money may be coming, all such funds are faced with the same dilemma. Do you chase something that’s already left the station or do you wait for the next opportunity to come along?

In a way, if you sell calls on your positions, you’re regularly faced with those question upon assignment. If you sell lots of weekly call options the question is a frequent one.

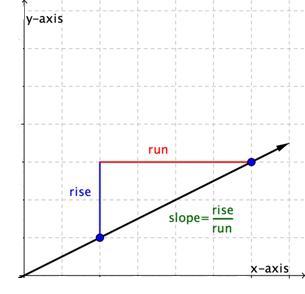

If you believe in history repeating itself, images such as this may be of concern:

Unless of course you’re very concrete, in which case there’s still three months left to frolic in higher prices and invest with impunity.

Unless of course you’re very concrete, in which case there’s still three months left to frolic in higher prices and invest with impunity.

Approaching my fourth week of negativity and seeing a decrease in option income as a result of re-investing less of the proceeds of assigned shares, something has to reach a breaking point. Since the theoretical number of consecutive days that the market could go higher is unlimited, it may make sense to temper the conviction that only negative things wait ahead, especially for those unprepared.

Granted, the “doomsday preppers” that are featured on basic cable these days may not be the best of role models, there has to be something in-between that offers a compromise.

I think that compromise is avoiding most anything that your grandfather never had to opportunity to purchase.

The week’s selections are categorized as either Traditional, Momentum, or “PEE” (see details). Although my preference is to now look for high quality, dividend paying stocks as a defensive position, sadly, there are none such going ex-dividend this week.

I don’t recall the last time I considered so many stocks at any single time from the Dow Jones Index. In a month where the first 10 trading days took us higher, of the following Dow Index stocks only one outperformed the S&P 500.

Caterpillar (CAT) is approaching one of my favorite price points for its shares. Despite no negative news, other than what may be inferred though always questionable Chinese economic data, shares have been languishing and get more appealing daily. Those other heavy machinery companies without the potential Chinese exposure have been enjoying the market climb.

Home Depot (HD) has been a favorite stock ever since I dared to compare it to Apple (AAPL) in terms of performance, at a time that Apple was hitting on all cylinders. There’s nothing terribly exciting and there’s probably very little new information that can be added about Home Depot. It simply offers safety,a decent premium and continues to hit on all cylinders even as other more flashy companies have done otherwise. Let others debate whether increased housing sales are good or bad or whether it is a better buy than Lowes (LOW). It is simply a reliable portfolio partner.

JP Morgan Chase (JPM) is no longer made of Teflon, although its share price continues to be fairly resistant. With Congressional hearings starting today and findings that JP Morgan was indifferent, at best, to the risks that it was assuming in what became known as the “London Whale Trades,” it will re-join its banking brethren who are, by and large, seeing their stocks enjoy the results of the stress tests. The

increased dividend announced is a nice little touch, as well an inducement to add shares.

I rarely look at the Communication Services or Utilities sectors unless I want safety and dividends. That was a good formula early on in the process of recovering from 2007 plunge. But it may also be a good formula to protect against downwinds. Not necessarily a very exciting approach, but sleeping at night has its own merits. AT&T (T), although not going ex-dividend this week is expected to announce its ex-dividend date sometime in the April 2013 option cycle. It will be my Ambien.

Merck (MRK) was the lone Dow component company to have out-performed the S&P 500 through March 14, 2013, purely on the big bump when it received favorable news regarding its controversial Vytorin product. Recently its option premiums have started to become more compelling. I had hoped to purchase shares last week in order to capture the dividend, however, the Vytorin news disrupted that, as I chose not to chase.

Starbucks (SBUX) is a bit more expensive than I would like in order to pick up new shares, but I always prefer to get shares when it hovers near a strike price. Although your grandfather may not have been able to ever purchase shares of this company, it definitely has a business model of which he would approve. Basic and simple, while offering an addictive product worked well for tobacco companies and is equally and consistently successful at Starbucks.

The lone Momentum stock this week is Coach (COH). Having just had shares assigned at $49 and still owning some higher priced shares at $51, I rarely like to chase stocks as their prices have gone higher than their assigned price. However, I think that the worst is over for Coach and it still carries cache, despite some equivocation regarding its status in the luxury sector of retail.

I’ve had shares of Coach come in and out of my portfolio on a consistent basis ever since the first assault on its future and subsequent 10% drop in share price. It’s sometimes a little maddening how out-sized its moves are, but it does tend to gravitate back toward its pre-assault home.

Although I do want to eschew risk, there may be some earnings related trades this week that may still offer a reasonable risk-reward scenario.

With the exception of LuLu Lemon (LULU), all of the potential earnings related stocks are ones that I’ve happily owned in the past year and would be comfortable owning again. LuLu Lemon, however, is the only one of those potential plays that would fall into the Momentum category, although all are retailers or consumer discretionary companies.

Retailing based on what may turn out to be a fad is always a risky proposition and LuLu Lemon has certainly shown that it’s capable of exhibiting large price moves, both earnings related and otherwise. Someday, it may be on the wrong side of being a fad, but there’s currently no indication of that happening and impacting this current upcoming earnings release. Although it is capable of a 15% move in either direction, those a bit more daring may find the premiums associated with a 10% move appealing.

My shares of Tiffany were assigned this Friday, having been held for 181 days, as compared to just 26 days for positions opened in 2012. It’s was an interesting run, with lots of ups and downs, but its performance beat the S&P 500 for its holding period by 4.9%. Now offering weekly options, it is even more appealing to me as a casual purchase. With earnings this week and a significant recent run-up in price, put options are aggressively priced and attractive, if you don’t mind the possibility of owning shares.

Williams Sonoma (WSM) is one of those stocks for which I wished weekly options existed, especially as it offers earning related opportunities at the very beginning of a monthly cycle. It too, is very capable of 10% moves in either direction upon earnings, but as Coach, does have a tendency to return if the market reacts negatively.

The final earnings related trade is Nike (NKE). Although it is also capable of 10% moves, it doesn’t offer premiums quite as enhanced as some of the other names. However, it certainly doesn’t carry the risk of being a fad and so, even with a precipitous drop there can be reasonable expectations for a return to health. Even in the event of assignments of puts sold to capitalize on earnings, there are worse things in the world than owning shares of Nike.

Traditional Stocks: AT&T, Caterpillar, DuPont, Home Depot, JP Morgan, Merck, Starbucks

Momentum Stocks: COH

Double Dip Dividend: none

Premiums Enhanced by Earnings: LuLu Lemon (3/21 AM), Nike (3/21 PM), Tiffany (3/22 AM), Williams Sonoma (3/19 PM)

Remember, these are just guidelines for the coming week. Some of the above selections may be sent to Option to Profit subscribers as actionable Trading Alerts, most often coupling a share purchase with call option sales or the sale of covered put contracts. Alerts are sent in adjustment to and consideration of market movements, in an attempt to create a healthy income stream for the week with reduction of trading risk.

Some of the stocks mentioned in this article may be viewed for their past performance utilizing the Option to Profit strategy.