I don’t know whether is the cacophony of “Heils”or perfectly synchronized goose stepping that color my perception, but something makes me uncomfortable when there appears to be near universal agreement on most any topic.

Yes. Starving children in Africa is bad. No argument there. Everyone can agree on that point. Even Malthusians, deep down, probably fret about the tragedies that befall the most vulnerable, despite believing in the necessity of those tragedies. And yes, the repeated elections of Saddam Hussein represented the will of the people, but otherwise, too many people being on the same page develops a level of comfort that tend to overlook what should be obvious.

For me, that level of comfort begets discomfort. It’s that point at which irrational exuberance becomes over-heated frothy exuberance, almost as if it had been left overnight on top of a new iPad.

This morning Goldman Sachs came out with what could only be described as an extraordinarily bullish call, at that point that we’re now about 7% below the 2007 highs. They pronounced bonds as being “dead,” which has no impact on me, since I never understood bonds, nor ever planned on being old enough to fall into the trap of asset allocation. Not to be overly exaggerating the opportunity, they reportedly said that “stocks offer the best opportunity of a lifetime.”

This morning Goldman Sachs came out with what could only be described as an extraordinarily bullish call, at that point that we’re now about 7% below the 2007 highs. They pronounced bonds as being “dead,” which has no impact on me, since I never understood bonds, nor ever planned on being old enough to fall into the trap of asset allocation. Not to be overly exaggerating the opportunity, they reportedly said that “stocks offer the best opportunity of a lifetime.”

But where were they and everyone else 6,000 points ago?

The answer comes when you read the fine print and learn that Goldman Sachs data indicated that the average life span of a Muppet is less than 4 years and their short term memory may be even less.

The on-air comments this morning included the suggestion that U.S. banks are so strong at this point that they could buy European banks and put them out of their misery. Additional comments took a variation of the risk on – risk off theme and applied it to China and the U.S.

More amazingly, there was discussion relating to holding accountable the talking heads that had been bearish over the past few thousand points on the Dow.

Now that’s got to be a boldly bullish perspective when you’re willing to call your mainstays out on the carpet, other than for the fact that there’s an endless source of people clamoring to be a talking head and willing to say whatever it takes to get attention and notoriety.

Amazingly, there’s still lots of debate over the roles of the Federal Reserve and the Treasury Department in any recovery.

Still, since there’s still active debate going on some 80 years after the New Deal began to take shape, it probably shouldn’t be too surprising that there are those that can’t stomach the thought of a correlation.

Economic cycles being what they are, three years to realize that recession has taken hold and that recovery has begun seems about right. At least in normal times.

But no one alive seems to believe that what we’ve gone through have been normal times, hence the proliferation of people using the phrase “The new normal,” as a politically charged way of placing blame on those at the helm while the iceberg was calving.

Going back to the Great Depresion, while there may still be debate as to whether the New Deal played a substantive role in economic recovery, there’s not much debate that the process took much more than 3 years. There’s also plenty of reason to believe that the business of World War II helped quite a bit, as did government educational and housing policy regarding returning soldiers.

All in all, it took more than 15 years to get going again.

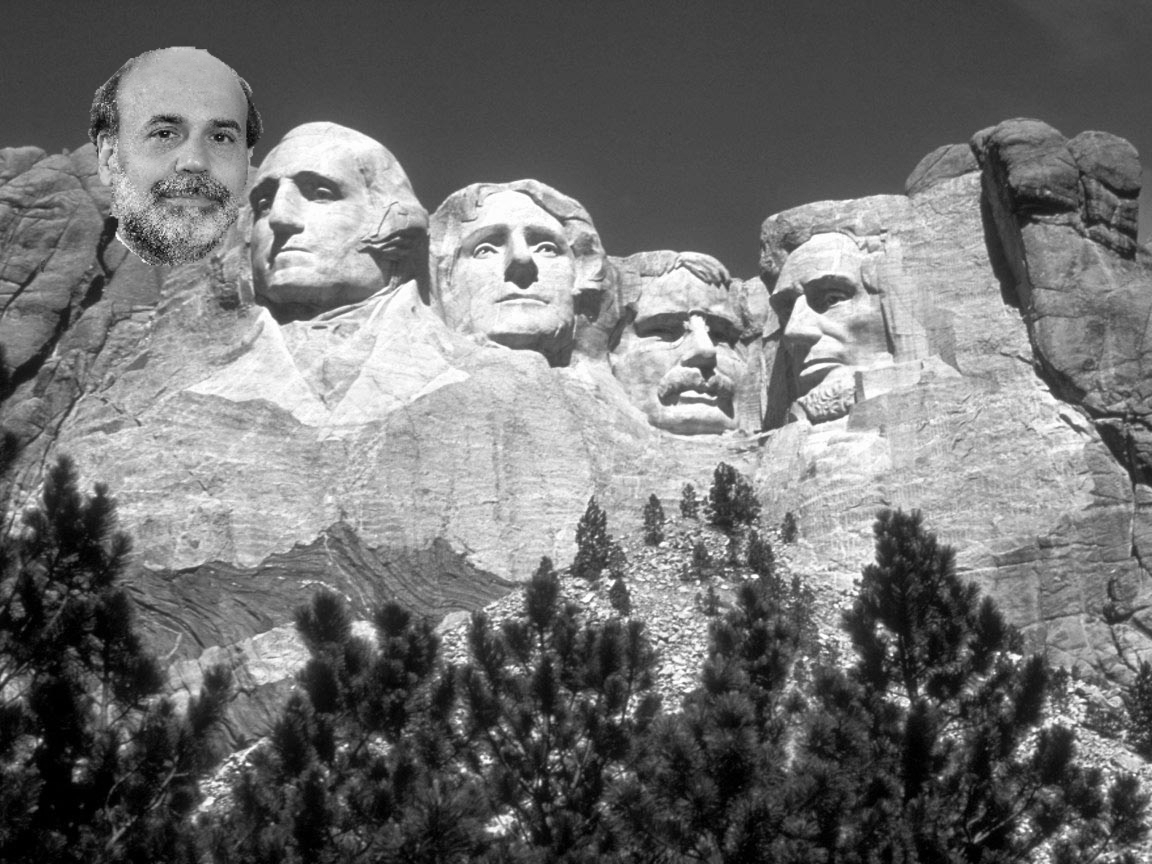

From my perspective, which is limited by my site of vision from the La-Z-Boy through the Family Room windows, there should be serious consideration given toward expanding Mount Rushmore and adding the images of Ben Bernanke, Henry Paulson and Timothy Geithner or at least creating a mirror mountain sculpture peering downward on the famed quartet.

If fiscal austerity is a consideration, make it just Bernake. Besides, how could you not love a guy that the New York Times once described as the grandson of a South Carolina Torah reader? But even then, think of all of the jobs that could be created by adding all three to our mountain of national heroes. Torah readers, or not.

The market took the new bullish tone as a big yawn. It seems as if Goldman Sachs has become this generation’s anti-E.F. Hutton.

“when Goldman speaks, no one listens.”

Basically, they asked the same question, wondering where these come lately guys had been, despite the fact that the market often acts as if yesterday’s news never happened. What other entity can live each day in a total vacuum always ignoring the very recent past and taking each bit of data streaming its way as the new gospel?

But to its credit the market dismissed the late to the party guys.

Normally, there is never any such thing as considering the conflicting information received from two different data sets just hours apart. It’s always the most recent that’s the accurate and actionable one.

Look for example at Green Mountain Coffee Roasters. Barely a week ago it plummeted on the news that what was thought to be its recent partner, Starbucks, was coming out with its own single serving home machine. With partners like Starbucks, you certainly didn’t need partners.

Then today comes word of an expanded Starbucks and Green Mountain Coffee Roasters relationship.

Who are you going to believe? Starbucks or Starbucks?

Based on the past, you have to believe Starbucks, at least its position today.

Unfortunately, I tried selling Green Mountain puts yesterday, but never was able to complete the same trade that I had on it last week, at the same levels. But knowing Green Mountain, it’s the gift that keeps giving, in one direction or another.

Otherwise, I still am worried about the cacophany. Granted, there’s no goose stepping going on and certainly today’s response is muted, but looking back to the start of this year, you really do have to wonder why this market is so different from the one that it left behind o December 31, 2011.

Those kinds of thoughts used to occur on a near daily basis back in 2011 when we’d see triple digit moves in opposite directions from one day to the next, despite the absence of tangible market shaking news.

At least Tuesday’s move was based on something, even though it was based old dataq from a BHP Billiton executive, that in fact seemed to be refuted by Australian mining officials who indicated that exports to Chin would be robust this year.

But all that matters to me is that there was a reason. That’s more comforting, even when the reason proves to be wrong, than when there is no reason.

The muted upward moves of 2012 should be the anti-Yikes, except for one thing.

It reminds me of the beginning of every single roller coaster ride ever invented. The slow upward climb, although non=threatening in and of itself and completely disarming, is absolutely correlated to and necessary for the abrupt fall.

Forget about words like “parabolic” as has been applied to Apple’s price climb.

At least in Apple’s case there has been tangible news, events and performance.

Parabolic worthy.

Granted, I don’t own shares of Apple, but I’m less worried about an abrupt fall in its shares, as I am for the overall market.

Although I don’t have a time stamp, the last time I really felt this way was nearly five years ago.

At that time I looked at my portfolio’s net value and realized that if I could get a 3% annual it would last me for the rest of my life and provide for a very comfortable retirement.

Bonds, savings treasuries. You know, old people’s stuff.

But no. Didn’t go that route.

This time around, my life expectancy is less, but so are returns on bonds, so there’s not even the slightest thought of going that route.

It just more of the same.

Hold on tightly to that rail, because there’s bound to be a drop soon.

Yikes!

Check out Recent PortfolioTransactions and

Transaction Performance