There have been countless stories, books and movies written about the day and days after events that wiped out the world, leaving behind only a few hardy survivors. or perhaps none at all.

“Aftermath” tales are popular and filled with fantasy of how the human race rebuilds itself after unspeakable disaster.

For all we know, our world has already had such disasters. Ice ages, meteor strikes come to mind., but the human race, if present during those times, had much less to lose and certainly much less of a hurdle to climb to return to its previous state.

It’s one thing to survive Armegeddon without having access to your vital cave drawing tools, but it’s a whole different situation if you don’t have access to your 4G and no place to plug your iPad recharger.

It’s one thing to survive Armegeddon without having access to your vital cave drawing tools, but it’s a whole different situation if you don’t have access to your 4G and no place to plug your iPad recharger.

Much less is written about the aftermath of wonderful things happening.

Once you get to paradise can you really get to a better place than that? No one fantasizes about how much better things would be if only there was a 73rd virgin.

It would probably be fairly depressing to write about how banal existence becomes when there’s no likelihood of improvement.

We were all pretty ecstatic when news of Osama bin Laden’s death was reported, but how long did that last?

And sure, it was like a little bit of heaven on earth when the polling indicated that Tim Tebow was a better choice than Tom Brady for the new Jockey underwear ad campaign, but the joy was fleeting.

I’m not one much to dwell on “half lives,” but there’s probably a strong correlation between the half life of an event’s aftermath and the need to portray it to others.

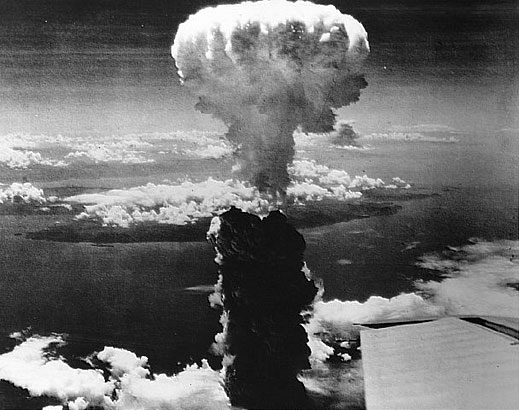

The half life of a nuclear glow off the horizon is probably longer than the giddiness over the announcement of a dividend.

So today, in the immediate aftermath of Apple’s dividend announcement it shouldn’t come as too much of a surprise that it’s completely forgottten news.

Time to move on.

Apple has shown itself to be pretty resilient to tthe rare bits of potentially harmful news that comes its way. Remember the iPhone antenna issue? Handled perfectly.

Alright, that was an engineering issue. What about issues related to Apple’s role as a guardian of all that is good in society? As it turns out, FOXConn was just a piece of performance art and even when it was thought to be an accurate portrayal of horrible conditions in a plant responsible for getting those wonderful products into our ravenous hands, Apple didn’t even shrug, as its stock price just kept right on surging.

Give mis-steps in engineering or in its societal responsibility, engineering is far more important for Apple.

Today comes word that the lower right hand of the new Apple iPad, when held in the portrait position, has a battery that seems to get too hot.

Of course there will likely be a video released sometime soon purporting to show flames being generated when an iPad is placed on top of some papers. It wouldn’t be the first time, yet which of us would trade those cave drawing tools for the iPad’s capabilities?

Besides, fire’s a good thing in the cave. Keeps us warm and roasts our captured game. Without fire, we would be barbarians, just as we’d be without our iPads.

If only that were true and the battery did prove to be problematic. The iPad battery could end up being the very device that saves the human race in the event of the next world wide disaster The fact that 4G reportedly has a more difficult time penetrating the walls of caves than does 3G is meaningless when compared to the utility of fire and warmth.

With no news today to dwell upon the market just wandered aimlessly stuck in a mildly lower range. For a brief moment I was hopeful that we would see some meaningful retracement and digestion of gains, so that I could put my remaining cash to work.

Of course I’ve been hoping for that for nearly 3 month.

The market took its negative lead from a statement made by a BHP Billiton official and for some reason took his statement, which was just a re-iteration of old news, as breaking news, with regard to demand for basic metals and Chinese growth.

On slow news days you just make news out of nothing at all. With Europe and Iran temporarily out of sight and with the Apple news fully baked, you need something to stir the masses.

But like with Milli Vanilli, sooner or later comes the realization that there’s less than meets the eye, or ear.

Instead of reversing its unwarranted downward moves upon the realization that there was nothing new being injected into the mix, the market just made believe that nothing had happened and just simply stopped the drop. A reversal would have made everyone look foolish.

And we can’t have that.

I almost bought back shares of RIMM and the ProShares Energy ETF that I had assigned a few days ago, but they quickly reversed from their lows and I never got to make those trades

So on this boring day with a downward trend I just took the opportunity to sell some puts on British Petroleum, Barclay’s Silver ETN and MolyCorp. I’d much rather be buying shares and selling calls, but selling puts at least keeps the income stream running.

With the volatility just getting lower and lower it’s getting harder to find rewarding option premiums without taking undue risks.

Although I don’t particularly like risks, the lure of the premiums ends up becoming an addiction and I’ve found that my holdings have been slowly taking on a different profile that is becoming unrecognizable to me.

It wasn’t that long ago that I could count on Dow Chemical, Microsoft, DuPont, JP Morgan and Goldman Sachs always being held, but at the moment, I don’t have a single one of those.

Instead, they’ve been replaced by Green Mountain Coffee Roasters, MolyCorp, ProShares UltraShort Silver and some other pretenders. The hard part is extricating yourself from some of those positions and working back toward the more reliable shares.

Momentum may be good for options premiums, but there’s that pesky half life issue.

MolyCorp, for example, is here today and if we’re to believe that the future depends on rare earth metals, will still be here tomorrow. But once the glow is gone, so is the premium.

The glow surrounding DuPont and the others may not be as bright, but can probably be counted on to burn a lot longer.

Whether it’s an iPad battery or stock, it’s all about the heat, if you want there to be a day after.

Check out Recent PortfolioTransactions and

Transaction Performance