Many years ago people were fascinated by the movie “The Three Faces of Eve.”

Many years ago people were fascinated by the movie “The Three Faces of Eve.”

It was the story of a woman afflicted with what was known at the time as “Multiple Personality Disorder,” although many incorrectly believed that the story was one characteristic of an individual with schizophrenia.

For her performance of all 3 characters, none of whom was aware of any of the others, Joanne Woodward won an Oscar for “Best Actress.” Yet 30 years later, in a sign of an unjust society, neither Eddie Murphy nor Arsenio Hall received any notice whatsoever from The Academy for each portraying 4 distinct characters.

While there’s still hope that such acting genius may someday be rewarded, there’s very little hope of being able to understand just what face the market will be showing from day to day.

Doug Kass, a well known hedge fund manager is fond of Tweeting that the market has no memory from day to day and that observation, while not seeming to be offering a diagnosis, has it well characterized.

Lack of memory for important information not explained by ordinary forgetfulness is one of the cardinal signs of Dissociative Identity Disorder and this market, however one wishes to characterize it, may have the same affliction as was suffered by Eve. But as long as it keeps reaching new record highs, it too will keep winning awards for its performance.

While some may say that the market is “acting schizophrenic,” they neither know the distinction between that malady and Dissociative Identity Disorder, nor understand the use of adverbs. While volatility may also be a hallmark of the disorder the rapid alternations between market plunges and surges are doing nothing to enhance volatility. In fact, for all of the uncertainty, volatility remains within easy striking distance of its 52 week low and was virtually unchanged last week.

In a week with very little economic news scheduled until this past Friday’s Employment Situation Report and with most key companies having already reported earnings, there was little reason to expect many large moves. However, as has been the case in recent weeks, there hasn’t always been the requirement of an identifiable reason for the market making a large move. What has also been the case is that so often the very next day brought about a reversal of fortune or mis-fortune of the previous day and another subsequent Doug Kass Tweet.

Those Kass market memory Tweets are fairly common and I do believe that he recalls having sent them on many previous occasions. While I offer him no diagnosis based on those Tweets, they do perfectly sum up the market that we’ve come to know.

The problem is that which just don’t know which market will be showing up from day to day and sometimes from hour to hour.

The problem is that which just don’t know which market will be showing up from day to day and sometimes from hour to hour.

I wonder if Eve had that same problem?

Compounding the inherent uncertainty occurs when an otherwise dependable and reliable source seems to turn on you.

Mid-week we got to see a Janet Yellen face that we had only seen once previously. It was the face that unlike its more commonly visible counter-part, wasn’t the one that sought directly or indirectly to calm and prop up stock markets.

During her tenure, especially during her post-FOMC Statement release press conferences, most of us have come to appreciate the boost of confidence Janet Yellen has supplied markets, as well as having an appreciation for the manner in which she balances pragmatic and social concerns with monetary policy.

But this week instead it was that Yellen character that questions stock market value, almost in the same way as a predecessor pointed a finger at “frothy exuberance.”

While not quite as bad as the racy and wild side of Eve that tried to murder her child, the value questioning side of Janet Yellen sent markets for a tumble. But just as after her 2014 comments about “substantially stretched” valuation metrics in bio-technology companies, the impact may be short lived, as it was this week.

Perhaps some thanks for that should go to the auspiciously timed release of the Employment Situation Report that avoided creating either a “bad news is good news” or “good news is bad news” by delivering numbers that were right in line with expectations.

Of course, when considering how much contra-distinction there has been in recent monthly Employment Situation Reports one might be excused for believing that they too suffer from Dissociative Identity Disorder and it may be injurious to one’s portfolio health to base too many actions on any given month’s data.

This coming week is another very slow one for economic news. While earnings season is now winding down the catalyst or the retardant for the market to get to the next new set of highs may be the slew of national retailers reporting earnings this week.

Some 6 months ago those retailers were among those optimistically talking about how they would benefit from increased consumer spending as a result of lower energy prices.

About that….

Those same retailers may be putting on a different face when reporting this week if those gains haven’t materialized, as there are no indications that the GDP has grown as expected.

To the contrary, actually.

Only one of the major retailers will report before this Wednesday’s Retail Sales Report, but it was the CEO of that company, Terry Lundgren, who was initially among the most optimistic regarding the prospects for Macys (NYSE:M) and who months later made the very astute observation that the energy savings experienced by consumers hadn’t accumulated sufficiently to create the feeling of actually having more discretionary cash to spend.

Sooner or later the projections for significant growth in GDP will have to be written off as just the rants of economists who had surrendered their better judgment to their racy and wild alternate egos and who can’t be blamed for their actions.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or “PEE” categories.

After the last two weeks, I think, that even after a previous lifetime of toiling away for a paycheck and not really appreciating its significance, I finally understand the meaning of “TGIF.”

The strong recoveries seen in each of the past two Fridays helped to rescue some weeks that were turning out to be fairly dour.

The downside, however, is that when the coming week is about to begin, so many of the stocks that you had been eying for a purchase were up sharply to end the previous week.

There are probably worse problems to have in life, so I won’t dwell too long on that one, but that is where this past Friday’s 267 point gain in the DJIA has us beginning the new week.

Sinclair Broadcasting (NASDAQ:SBGI) has quietly become the largest television station operators in the United States. While seemingly the only topics discussed these days are about streaming signals, satellites and cable there’s still life left in terrestrial television. The family controlled company certainly believes in the future of traditional television broadcasting as over the past several years the company has actively amassed new stations around the country.

Following an initial move higher after it reporting earnings shares gave up some ground and are now about 9% below its recent high from last month, at which time I had my previous shares assigned.

I purchased shares on 5 occasions in 2014 and have been waiting for a chance to do so in 2015. With its recent decline and with this being the final week of a monthly option cycle, I would consider once again adding shares in the hopes of a quick assignment. However, if not assigned, shares are then ex-dividend May 28th and I would consider selling either June or the July 2015 options on those shares.

Mattel (NASDAQ:MAT) has suffered of late.

It literally started 2015 off by being named one of the worst run companies of 2014 on New Years Day. Its shares continued to stumble even after its CEO unexpectedly resigned a few weeks later as the lure of its Barbie was waning in a world of electronic toys more welcomingly embraced by some of its competitors.

More recently some of the negativity that characterized 2015 had abated as the market actually embraced the smaller than expected loss at the most recent earnings report. While some of the gains have been since digested, Mattel may have now seen what the near term bottom looks like.

With earnings now out of the way for a short while and an upcoming ex-dividend date the following week, I am considering adding shares, but bypassing the week remaining on the monthly May 2015 contract and going directly to the June contract and banking on some share gains and not just option premiums and dividends for the effort.

Fastenal (NASDAQ:FAST) is one of those stocks that I always like to own, as it is an assuming kind of company that tends to reflect what is going on in the economy and is relatively immune from currency exchange issues

.

Most recently, after having positively reacted to earnings it failed to climb back toward where it had been at the time of its January earnings report. However, it does appear as if it is building a base to make that assault. As with Sinclair Broadcasting and Mattel, Fastenal only offers monthly options, so any potential purchase this week paired with an option sale could look at the May 15, 2015 contracts, effectively making it a weekly contract, or go directly to the June 2015 expirations, especially if believing that there is some capital appreciation in store for shares.

DuPont (NYSE:DD) and Teva Pharmaceuticals (NYSE:TEVA) have both spent a lot of time in the news lately and both are ex-dividend this week.

DuPont is one stock that came to mind when bemoaning the strong gains seen this past Friday, as it was definitely a beneficiary of broad market strength. It continues to be embroiled in a fight with activists which may have profound ramifications with how investors look at and value a company’s intellectual and research pursuits.

The question of how valuable research activities are to a company if they are part of a separate company is one that pits short term and long term outlooks against one another. Although I tend to trade for the short term, and while I believe that Nelson Peltz is generally a positive influence on the companies in which he has taken a significant financial stake, I disagree with the idea of splitting off assets that are at the core of developing intellectual property.

However, as long as the fighting continues, there is opportunity to see shares climb even higher. It is precisely because of the uncertainty that comes along with the ongoing conflict that DuPont is offering an exceptionally high option premium, particularly in a week that it is ex-dividend.

The world of pharmaceutical companies was once so staid. Every self respecting portfolio was required to own shares in a high dividend paying blue chip pharmaceutical company, many of whom have been swallowed up over the years in the process of creating even larger and less responsive behemoths.

From nothingness, generic drug companies and bio-pharmaceutical companies are becoming their own behemoths and are recently at center stage with seemingly daily merger and acquisition activity.

Teva has joined the crowd seeking to grow through acquisition and may be willing to fight for the opportunity to grow. Of course, its target may have some other ideas, including possibly seeking to purchase Teva itself.

Like DuPont, the uncertainty in the air has it offering a very appealing option premium even in a week that shares are ex-dividend. With shares having recently declined by about 10% in the past month, it’s possible that some of the downside risk that may be associated with a fight or a failed conquest attempt has already been discounted.

Zillow (NASDAQ:Z) reports earnings this week having declined about 25% since its last earnings report. Its CEO, a darling of cable business news blamed the prolonged regulatory process encountered during its proposed purchase of its competitor Trulia, for leaving the company “trending a couple quarters behind where we’d like to be.”

But that comment was from last month, so the expectation would be that the market is prepared for whatever may come their way as earnings are reported this week.

That kind of logic is fine until faced with counter-examples, such as SanDisk (NASDAQ:SNDK) which despite warning upon warning, still managed to surprise everyone. Of course, the same could be said for early 2014 when markets seemed to be surprised by how bad weather impacted earnings after having heard nothing but how weather was effecting sales for months.

In this case the option market is implying an 8.1% move for Zillow after earnings are reported. That’s fairly mild after the past 2 weeks of having seen declines on the order of 25% coming from companies that couldn’t place many excuses for its performance at the feet of currency exchange woes.

Finally, it takes a lot for me to consider a new stock and to think about putting it into portfolio rotation. It’s even more difficult to do that with a company that has less than 6 months of public trading behind it.

I recently found my second ever blog article, one from 8 years ago, which was about peer lending re-posted on an aggregator site. At the time, I looked at peer lending as a potential means of diversifying one’s portfolio, especially with the aim of generating income streams.

While the early leader of the concept is still around, it was LendingClub (NYSE:LC) that finally brought it to the equity markets.

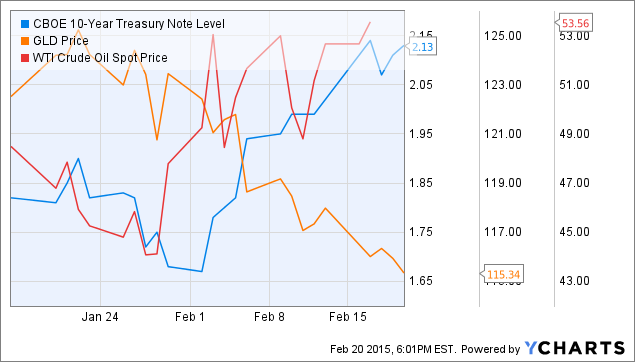

Its earnings last week, despite being slightly better than the consensus, did nothing to stem the downward price spiral since the IPO. The stock’s close tracking of the 10 Year Treasury Note broke down in March, but I believe that with the stock approaching its IPO price that concordance with interest rates will soon be re-established.

If that proves to be the case and there is a suggestion that the bond market may now be on the right path in predicting the inevitable rise in rates, the LendingClub and its shares are likely to prosper.

Like an unusual number of stocks presented this week, LendingClub also offers only monthly options. However, without a dividend to consider, I would look at any potential purchase of shares as a short term trade and would sell the May 2015 options, which are offering a very attractive premium as the possibility of further share price declines are being factored in by the options market.

Traditional Stocks: Fastenal, Mattel, Sinclair Broadcasting

Momentum Stocks: LendingClub

Double Dip Dividend: DuPont (5/13), Teva Pharmaceuticals (5/15)

Premiums Enhanced by Earnings: Zillow (5/12 PM)

Remember, these are just guidelines for the coming week. The above selections may become actionable, most often coupling a share purchase with call option sales or the sale of covered put contracts, in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week with reduction of trading risk.

When I was a kid just about the funniest word any of us had ever heard was “fink.” Way back then that was pretty much the way Mad Magazine felt too, as it used that word with great regularity.

When I was a kid just about the funniest word any of us had ever heard was “fink.” Way back then that was pretty much the way Mad Magazine felt too, as it used that word with great regularity. This was one of those rare weeks where there wasn’t really any kind of theme to guide or move markets.

This was one of those rare weeks where there wasn’t really any kind of theme to guide or move markets. Fresh off of his estate’s victory in a copyright infringement suit, Marvin Gaye comes to my mind this week as I can’t help but wonder what’s going on.

Fresh off of his estate’s victory in a copyright infringement suit, Marvin Gaye comes to my mind this week as I can’t help but wonder what’s going on.

T

T

This week I’m choosing “risk on.”

This week I’m choosing “risk on.”