Although the first week of this most recent earnings season has been less than spectacular, as the financial sector has suffered under a low interest rate environment, I continue to look at the more speculative portion of my portfolio as being available to generate quick income from stocks before or after earnings are announced.

During a week that stocks, interest rates, oil, precious metals and currencies have all gyrated wildly, what’s a little added speculation with earnings?

The process of trading in anticipation or after earnings news is one that seeks to balance risk with reward, accepting a relatively small reward in exchange for taking on a level of risk that appears to be less than the market is expecting.

The basic concepts and considerations in the approach are related to:

-

price move implied by the option market;

-

personal ROI goal;

-

individual temperament for risk, and

-

time and ability to trade in or out of risk in response to events.

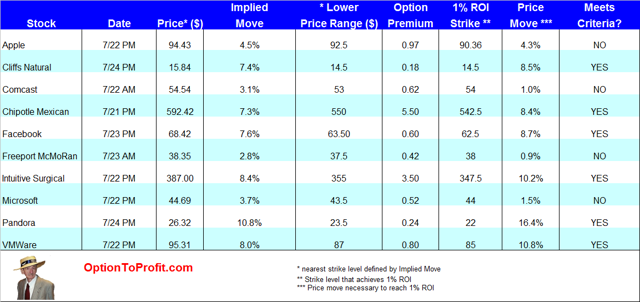

The concepts are covered in previous articles, but in summary, the objective is to find a stock that can deliver an acceptable ROI when selling a weekly put option at a strike level that is lower than the bottom of the range defined by the option market’s implied volatility for that stock.

For my tolerances I seek a 1% ROI for a weekly position at a strike price that is outside the boundaries implied by the option market.

While achieving the desired ROI is an objective metric, and should be done within the context of acceptable risk, the decision process to initiate a trade is frequently based upon share behavior.

My preference, when it appears that both the risk and the reward measures are satisfactory, is to sell puts into share weakness in advance of earnings. If that condition isn’t met, I may also consider the sale of puts after earnings if there is significant price weakness after the report.

After Friday’s strong close, which may have come as a surprise to most everyone after a week of declines, many stocks reporting earnings next week may now be coming off of Friday’s advances. Insofar as Friday’s performance may have represented a reflexive bounce higher, I would be initially reluctant to jump into any put sale related trades for concern about an equally reflexive drop lower.

However, a number of the positions covered in this article have already suffered large losses in advance of their earnings report, some perhaps due to altered guidance and many are already well off from their highs, even as the S&P 500 is barely 4% lower after a quick triple bottom.

I tend to be more interested in those stocks that have already fallen than I am in those whose shares are moving higher prior to earnings, as that moves the strike level that I would have to use to achieve my desired 1% ROI for the week higher, and may also shift premium enhancement on the call side of the equation, rather than to the put side, which also contributes to a lower ROI.

While the traditional opinion and belief is that put sellers must be willing to own the shares in which they have sold puts, I often do not want to take ownership unless an ex-dividend date is approaching. While many sell puts in order to gain an entry into share ownership at a lower and more attractive price, I do so generally in order to capture the income stream from the option sales.

For that reason, it is important to have liquidity in the options market in order to be able to concurrently close the position and open a new one for a forward week if assignment is unwanted. Ideally, that would also be done at a lower strike price, however, in an otherwise low volatility environment, as we currently have, despite some recent increase, that is a difficult objective unless there is additional stock specific volatility, as may be seen in the energy sector currently.

Whether able to rollover to a lower strike level or not, the primary goals are to delay or prevent assignment and to collect additional net premiums in an attempt to ultimately see the position expire or be closed.

Among the stocks for consideration this week are many that can be readily recognized for inherent risk, which may also influence price behavior on a regular basis regardless of upcoming earnings or guidance.

This week I’m considering the sale of puts of shares of Cree (NASDAQ:CREE), Freeport McMoRan (NYSE:FCX), F5 Networks (NASDAQ:FFIV), General Electric (NYSE:GE), International Business Machines (NYSE:IBM), Intuitive Surgical (NASDAQ:ISRG), Netflix

(NASDAQ:NFLX), Starbucks (NASDAQ:SBUX), SanDisk (NASDAQ:SNDK) and United Continental Holdings (NYSE:UAL).

Generally I don’t spend too much time considering the relative merits of the stocks being considered for earnings related trades, preferring to remain agnostic to those issues and simply following guidelines outlined above.

Looking at this week’s list, there is no shortage of stories in advance to scheduled earnings, such as SanDisk releasing altered guidance or Freeport McMoRan feeling the sudden weight of collapsing copper prices, in addition to its growing exposure to gold and energy prices.

While I don’t use margin to add stock positions, it is often perfectly suited for this kind of trading activity. I generally use these trades in an account hat has margin privileges. While selling cash secured puts decreases the amount of margin that is available to you, it does not draw on margin funds and, therefore, doesn’t incur interest expenses. Those expenses will only be incurred if the shares are assigned to you and are subsequently purchased through the use of the credit extended.

One thing noticed among the positions cited above is that fewer are meeting my criteria and being assigned a “YES” designation. That may reflect an increasing sense of pessimism among option market traders as compared to previous quarterly earnings periods. Normally I would only consider those with a “YES” rating, but may now also consider those that are “MARGINAL.”

If considering the sale of put options, there is always a possibility of early assignment, especially if shares go far below the strike price and when using a weekly contract. If that occurs, the seller of the put contracts should be prepared to either own shares or attempt to rollover the put option to a forward date.

The lower the volatility environment the less benefit there is to the put holder to delay assignment for deep in the money positions. In the event of early assignment the opportunity is then created to begin managing shares and enhancing return through the sale of call options. However, where possible, it may be best to consider pre-emptive action in order to prevent or delay assignment.

Finally, in the current market environment, moves, especially downward, seem to be sudden and magnified. If pursuing any of these earnings related trades it helps to have exit strategies planned in advance and to limit falling prey to surprise, as that may be the one thing that can be counted upon.

Somewhere buried deep in my basement is a 40 year old copy of the medical school textbook “Rapid Interpretation of EKG’s.”

Somewhere buried deep in my basement is a 40 year old copy of the medical school textbook “Rapid Interpretation of EKG’s.” So it’s probably not too difficult to identify where this (non-life threatening) premature ventricular contraction (PVC) is occurring.

So it’s probably not too difficult to identify where this (non-life threatening) premature ventricular contraction (PVC) is occurring. What they have instead seen is a kind of periodicity that has brought about a “mini-correction,” on the order of 5%, every two months or so.

What they have instead seen is a kind of periodicity that has brought about a “mini-correction,” on the order of 5%, every two months or so. Also faring relatively poorly in a decreasing rate environment has been AIG (NYSE:

Also faring relatively poorly in a decreasing rate environment has been AIG (NYSE: What a week.

What a week. The problem is that it can be a precarious balance for the Russian President between the need to support his ego and the need to avoid cutting off one’s own nose while spiting an adversary.

The problem is that it can be a precarious balance for the Russian President between the need to support his ego and the need to avoid cutting off one’s own nose while spiting an adversary.

With the S&P 500 having reached an all time high this past week you could certainly draw the conclusion that a government shutdown is a good thing and flirting with default is a constructive strategy. At a reported cost of only $24 Billion associated with closure and nothing more than a symbolic “Fitch slap” credit watch issued, perhaps we should look forward to the next potential round in just a few months.

With the S&P 500 having reached an all time high this past week you could certainly draw the conclusion that a government shutdown is a good thing and flirting with default is a constructive strategy. At a reported cost of only $24 Billion associated with closure and nothing more than a symbolic “Fitch slap” credit watch issued, perhaps we should look forward to the next potential round in just a few months.