You have to be impressed with the way the market has rallied back from the morning of the most recent Employment Situation Report just 2 weeks earlier.

At the low point of that morning when the market seemed appropriately disappointed by the very disappointing numbers and the lowered revisions the S&P 500 had sunk to a point more than 11% below its recent high.

At its peak point of return since that low the S&P 500 was only 4.9% below its summer time high.

The difficulty in sustaining a large move in a short period of time is no different from the limitations we see in ourselves after expending a burst of energy and even those who are finally tuned to deliver high levels of performance.

When you think about a sprinter who’s asked to run a longer distance or bringing in a baseball relief pitcher who’s considered to be a “closer” with more than an inning to go, you see how difficult it can be to reach deep down when there’s nothing left to reach for.

Sometimes you feel as if there’s no choice and hope for the best.

You also can see just how long the recovery period can be after you’ve been asked to deliver more than you’ve been capable of delivering in the past. It seems that reaching deep down to do your best borrows heavily from the future.

While humans can often take a break and recharge a little markets are now world wide, inter-connected and plugged into a 24/7 news cycle.

While it may be boring when the market takes a rest by simply not moving anywhere, it can actually expend a lot of energy if it moves nowhere, but does so by virtue of large movements in off-setting directions.

We need a market that can now take a real rest and give up some of the histrionics, even though I like the volatility that it creates so that I can get larger premiums for the sale of options.

The seminal Jackson Browne song puts a different spin on the concept of “running on empty,” but the stock market doesn’t have the problems of a soulless wanderer, even though, as much as it’s subject to anthropomorphism, it has no soul of its own.

Nor does it have a body, but both body and soul can get tired. This market is just tired and sometimes there’s no real rest for the weary.

After having moved up so much in such a short period of time, it’s only natural to wonder just what’s left.

The market may have been digging deep down but its fuel cells were beginning to hit the empty mark.

This week was one that was very hard to read, as the financial sector began delivering its earnings and the best news that could come from those reports was that significantly decreased legal costs resulted in improved earnings, while core business activities were less than robust.

If that’s going to be the basis for an ongoing strategy, that’s not a very good strategy. Somehow, though, the market consistently reversed early disappointment and drove those financials reporting lackluster top and bottom lines higher and higher.

You can’t help but wonder what’s left to give.

As usual, the week’s potential stock selections are classified as being in the Traditional, Double Dip Dividend, Momentum or “PEE” categories.

American Express (NYSE:AXP) and Wal-Mart (NYSE:WMT) may be on very different ends of the scale, but they’ve both known some very bad days this year.

For American Express it came with the news that it was no longer going to be accepted as the sole credit card at Costco (NASDAQ:COST) stores around the nation. While that was bad enough, the really bad news came with the realization of just how many American Express card holders were actually holders of the Costco co-branded card.

There was a great Bloomberg article this week on some of the back story behind the American Express and Costco relationship and looks at their respective cultures and the article does raise questions about American Express’ ability to continue commanding a premium transaction payment from retailers, as well as continuing to keep their current Costco cardholders without the lure of Costco.

What American Express has been of late is a steady performer and the expectation should be that the impact of its loss of business in 2016 has already been discounted.

American Express reports earnings this week, but it’s option premiums aren’t really significantly enhanced by uncertainty.

Normally, I look to the sale of puts to potentially take advantage of earnings, but with American Express I might also consider the purchase of shares and the concomitant sale of calls and then strapping on for what could be a bumpy ride.

Wal-Mart, on the other hand only recently starting accepting American Express cards and that relationship was seen as a cheapening of the elite American Express brand, but we can all agree that money is money and that may trump everything else.

Apparently, however, investors didn’t seem to realize that Wal-Mart’s well known plan to increase employee salaries was actually going to cost money and they were really taken by surprise this week when they learned just how much.

What’s really shocking is that some very simple math could have spelled it out with some very reasonable accuracy since the number of workers eligible to receive the raise and the size of the raise have been known for months.

It reminds me of the shock expressed by Captain Renault in the movie “Casablanca” as he says “I’m shocked to find gambling is going on in here,” as he swoops up his winnings.

Following the decline and with a month still to go until earnings are reported, this new bit of uncertainty has enhanced the option premiums and a reasonable premium can possibly be found even when also trying to secure some capital gains from shares by using an out of the money strike price.

The Wal-Mart news hit retail hard, although to be fair, Target’s (NYSE:TGT) decline started as a plunge the prior day, when it fell 5% in the aftermath of an unusually large purchase of short term put options.

While I would look at Target as a short term trade, selling a weekly call option on shares, in the hope that there would be some recovery in the coming week, there may also be some longer term opportunities. That’s because Target goes ex-dividend and then reports earnings 2 days later during the final week of the November 2015 option cycle.

DuPont (NYSE:DD), Seagate (NASDAQ:STX) and YUM Brands (NYSE:YUM) don’t have very much in common, other than some really large share plunges lately, something they all share with American Express and Wal-Mart.

But that’s exactly the kind of market it has been. There have been lots of large plunges and very slow recoveries. It’s often been very difficult to reconcile an overall market that was hitting all time highs at the same time that so many stocks were in correction mode.

DuPont’s plunge came after defeating an activist in pursuit of Board seats, but the announcement of the upcoming resignation of its embattled CEO has put some life back into shares, even as they face the continuing marketplace challenges.

Dupont will report earnings the following week and will be ex-dividend sometime during the November 2015 option cycle.

While normally considering entering a new position with a short term option sale, I may consider the use of a monthly option in this case in an effort to get a premium reflecting its increased volatility and possibly also capturing its dividend, while hoping for some share appreciation, as well.

Seagate Technology is simply a mess at a time that hardware companies shouldn’t be and it may become attractive to others as its price plunges.

Storage, memory and chips have been an active neighborhood, but Seagate’s recent performance shows you the risks involved when you think that a stock has become value priced.

I thought that any number of times about Seagate Technology over the course of the past 6 months, but clearly what goes low, can go much lower.

Seagate reports earnings on October 30th, so my initial approach would likely be to consider the sale of weekly, out of the money puts and hope for the best. If in jeopardy of being assigned due to a price decline, I would consider rolling the contract over. The choice of time frame for that possible rollover will depend upon Seagate’s announcement of their next ex-dividend date, which should be sometime in early November 2015.

With that dividend in mind, a very generous one and seemingly safe, thoughts could turn to taking assignment of shares and then selling calls in an effort to keep the dividend.

Caterpillar (NYSE:CAT) hasn’t really taken the same kind of single day plunge of some of those other companies, but its slow decline is finally making Jim Chanos’ much publicized 2 year short position seem to be genius.

It’s share price connection to Chinese economic activity continues and lately that hasn’t been a good thing. Caterpillar is both ex-dividend this week and reports earnings. That’s generally not a condition that I like to consider, although there are a number of companies that do the same and when they are also attractively priced it may warrant some more attention.

In this case, Caterpillar is ex-dividend on October 22nd and reports earnings that same morning. That means that if someone were to attempt to exercise their option early in order to capture the dividend, they mist do so by October 21st.

Individual stocks have been brutalized for much of 2015 and they’ve been slow in recovering.

Among the more staid selections for consideration this week are Colgate-Palmolive (NYSE:CL) and Fastenal (NASDAQ:FAST), both of which are ex-dividend this week.

I’ve always liked Fastenal and have always considered it a company that quietly reflects United States economic activity, both commercial and personal. At a time when so much attention has been focused on currency exchange and weakness in China, you would have thought, or at least I would have thought, that it was a perfect time to pick up or add shares of a company that is essentially immune to both, perhaps benefiting from a strong US Dollar.

Well, if you weren’t wrong, I have been and am already sitting on an expensive lot of uncovered shares.

With only monthly option contracts and earnings already having been reported, I would select a slightly out of the money option strike or when the December 2015 contracts are released possibly consider the slightly longer term and at a higher strike price, in the belief that Fastenal has been resting long enough at its current level and is ready for another run.

Colgate-Palmolive is a company that I very infrequently own, but always consider doing so when its ex-dividend date looms.

I should probably own it on a regular basis just to show solidarity with its oral health care products, but that’s never crossed my mind.

Not too surprisingly, given its business and sector, even from peak to trough, Colgate-Palmolive has fared far better than many and will likely continue to do so in the event of market weakness. While it may not keep up with an advancing market, that’s something that I long ago reconciled myself to, when deciding to pursue a covered option strategy.

As a result of it being perceived as having less uncertainty it’s combined option premium and dividend, if captured, isn’t as exciting as for some others, but there’s also a certain personal premium to be paid for the lack of excitement.

The excitement may creep back in the following week as Colgate reports earnings and in the event that a weekly contract has to be rolled over I would considered rolling over to a date that would allow some time for price recovery in the event of an adverse price move.

Reporting earnings this week are Alphabet (NASDAQ:GOOG) and Under Armour (NYSE:UA).

Other than the controversy surrounding its high technology swim suits at the last summer Olympics, Under Armour hasn’t faced much in the way of bad news. Even then, it proved to have skin every bit as repellent as its swim suits.

The news of the resignation of its COO, who also happened to serve as CFO, sent shares lower ahead of earnings.

The departure of such an important person is always consequential, although perhaps somewhat less so when the founder and CEO is still an active and positive influence in the company, as is most definitely the case with under Armour.

However, the cynic sees the timing of such a departure before earnings are released, as foretelling something awry.

The option market is implying a price move of about 7.5%, while a 1% ROI may possibly be obtained through the sale of puts 9% below Friday’s closing price.

For me, the cynic wins out, however. Under Armour then becomes another situation that I would consider the sale of puts contracts after earnings if shares drop strongly after the report, or possible before earnings if there is a sharp decline in its advance.

I’m of the beli

ef that Google’s new corporate name, “Alphabet” will be no different from so many other projects in beta that were quietly or not so quietly dropped.

There was a time that I very actively traded Google and sold calls on the positions.

That seems like an eternity ago, as Google has settled into a fairly stodgy kind of stock for much of the past few years. Even its reaction to earnings reports have become relatively muted, whereas they once were things to behold.

That is if you ignore its most recent earnings report which resulted in the largest market capitalization gain in a single day in the history of the world.

Now, Alphabet is sitting near its all time highs and has become a target in a way that it hasn’t faced before. While it has repeatedly faced down challenges to its supremacy in the world of search, the new challenge that it is facing comes from Cupertino and other places, as ad blockers may begin to show some impact on Alphabet’s bread and butter product, Google.

Here too, the reward offered for the risk of selling puts isn’t very great, as the option market is implying a 6% move. That $40 move in either direction could bring shares down to the $620 level, at which a barely acceptable 1% ROI for a weekly put sale may be achieved.

With no cushion between what the market is implying and where a 1% ROI can be had, I would continue to consider the sale of puts if a large decline precedes the report or occurs after the report, but I don’t think that I would otherwise proactively trade prior to earnings.

Finally, VMWare (NYSE:VMW) also reports earnings this week.

If you’re looking for another stock that has plunged in the past week or so, you don’t have to go much further than VMWare, unless your definition requires a drop of more than 15%.

While it has always been a volatile name, VMWare is now at the center of the disputed valuation of the proposed buyout of EMC Corp (NYSE:EMC), which itself has continued to be the major owner of VMWare.

I generally like stocks about to report earnings when they have already suffered a large loss and this one seems right.

The option market is implying about a 5.2% move next week, yet there’s no real enhancement of the put premium, in that a 1% ROI could be obtained, but only at the lower border of the implied move.

The structure of the current buyout proposal may be a factor in limiting the price move that option buyers and sellers are expecting and may be responsible for the anticipated sedate response to any news.

While that may be the case, I think that the downside may be under-stated, as has been the case for many stocks over the past few months, so the return is not enough to get me to take the risk. But, as also has been the case for the past few months, it may be worthy considering to pile on if VMWare disappoints further and shares continue their drop after earnings are released.

That should plump up the put premium as there might be concern regarding the buyout offer on the table, which is already suspect.

Traditional Stocks: American Express, DuPont, Target, Wal-Mart

Momentum Stocks: Seagate Technology, YUM Brands

Double-Dip Dividend: Caterpillar (10/22 $0.71), Colgate-Palmolive (10/21 $0.38), Fastenal (10/23 $0.28),

Premiums Enhanced by Earnings: Alphabet (10/22 PM), Under Armour (10/22 AM), VMWare (10/20 PM)

Remember, these are just guidelines for the coming week. The above selections may become actionable – most often coupling a share purchase with call option sales or the sale of covered put contracts – in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week, with reduction of trading risk.

The Talking Heads were really something.

The Talking Heads were really something.

To call the stock market of this past week “a dog” probably isn’t being fair to dogs.

To call the stock market of this past week “a dog” probably isn’t being fair to dogs.

Fresh off of his estate’s victory in a copyright infringement suit, Marvin Gaye comes to my mind this week as I can’t help but wonder what’s going on.

Fresh off of his estate’s victory in a copyright infringement suit, Marvin Gaye comes to my mind this week as I can’t help but wonder what’s going on. Anyone who has seen the classic movie “Casablanca” will recall the cynicism of the scene in which Captain Renault says “I’m shocked, shocked to find that gambling is going on in here!” seconds before the croupier hands him his winnings from earlier.

Anyone who has seen the classic movie “Casablanca” will recall the cynicism of the scene in which Captain Renault says “I’m shocked, shocked to find that gambling is going on in here!” seconds before the croupier hands him his winnings from earlier. You would think that when the market sets record closing highs on the S&P 500 that there would be lots of fireworks after the fact and maybe lots of excited anticipation before the fact.

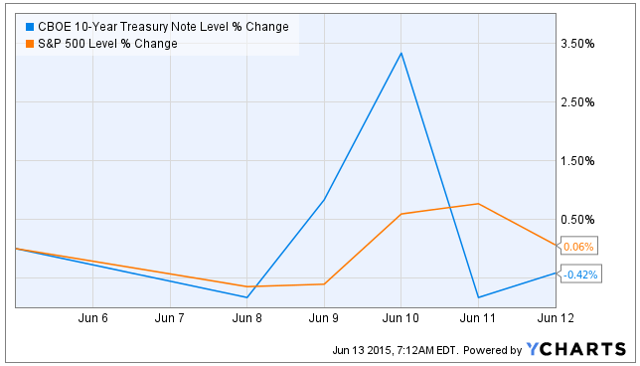

You would think that when the market sets record closing highs on the S&P 500 that there would be lots of fireworks after the fact and maybe lots of excited anticipation before the fact. Instead of the straight line higher or the “V-shaped” recoveries that so many refer to, and that have characterized upward reversals in the past few months, this most recent reversal has been a stagger stepped one.

Instead of the straight line higher or the “V-shaped” recoveries that so many refer to, and that have characterized upward reversals in the past few months, this most recent reversal has been a stagger stepped one. About 2 years after he began trying to convince the world that he was the biggest and baddest central banker around, unafraid to whip out any part of his arsenal to fight a slumping European economy, Mario Draghi finally has decided to let actions speak for themselves.

About 2 years after he began trying to convince the world that he was the biggest and baddest central banker around, unafraid to whip out any part of his arsenal to fight a slumping European economy, Mario Draghi finally has decided to let actions speak for themselves.