Strictly speaking, Pfizer’s (PFE) decision to separate from Zoetis (ZTS) is called a spin-off.

Strictly speaking, Pfizer’s (PFE) decision to separate from Zoetis (ZTS) is called a spin-off.

It did so initially on February 1, 2013 and there was much excitement about the prospects of being able to invest in the pets and livestock healthcare business, which was being touted as that portion of Pfizer that had the greater growth potential and by inference the greatest likelihood of out-performing the market and certainly out-performing stodgy old Pfizer, itself.

Certainly, if you are able to remember back to the heady days of Pfizer when Viagra was brought to an eager consumer demographic, there isn’t much reason to believe that sort of growth is in Pfizer’s future. From every logical point of view the best way to unlock shareholder value was to unleash hidden gems that were buried inside of a behemoth.

Additionally, if you look at the recent experience of the spin off by Conoco Phillips (COP) of its refiner arm, Phillips 66 (PSX) you might be of the belief that such spin-offs are akin to a license to print money.

By now Pfizer shareholders may have received the offer to exchange shares of Pfizer for Zoetis. With consummation of this offer, the separation of the two entities will be complete.

Pfizer refers to it as an “exchange offer to separate the Zoetis animal health business from Pfizer’s bio-pharmaceutical businesses in a tax-efficient manner, thereby enhancing stockholder value and better positioning Pfizer to focus on its core bio-pharmaceutical business.”I call that a divorce.

In some situations, I suppose that the children of divorce could see themselves as winners, particularly if they are able to leverage their parents against one another, but that sort of thing may be more common in situational comedies than in real life.

Perhaps shareholders of Pfizer see themselves as winners, as well, although, Zoetis shareholders may have a very different view of melding families.

On the surface, the offer looks very attractive. In a nutshell Pfizer shareholders are being given the opportunity to exchange $100 worth of their Pfizer shares for approximately $107.52 of Zoetis shares.

When in a red hot stock market, that kind of exchange is actually more than just appealing. Where else can you get a 7.52% return from one minute to the next?

For me, the decision isn’t quite so straightforward, as I have sold Pfizer calls with an expiration of June 22, 2013, while the deadline to respond to the offer is on June 17, 2013. There is no mechanism in the option market, particularly for contracts that may be exercised to identify those Pfizer shares that have been offered for tender.

There may, in fact, be some liability if, having sold calls and accepted the tender offer, the shares are subsequently assigned as a result of option exercise. That would be potentially onerous, especially if Zoetis shares were to go on a run higher, but I’m not overly concerned about that occurring.

But forget about me and my problems, or the problems of an option buyer. For the ordinary buy and hold investor the decision should be a fairly easy one to make.

Right?

Well not so fast.

For starters, the likelihood of being able to exchange all of your shares is small. There are over 7 billion shares of Pfizer and only about 400 million shares of Zoetis being offered. That’s good enough reason to inform shareholders that the exchange may be made on a pro-rata basis. Unlike a Facebook (FB) IPO offering you’re not likely to get more shares than you imagined.

Incidentally, about 75% of Pfizer’s shares are institutionally owned. The greatest likelihood is that those holdings are in excess of 100 shares per institution, but more on that later.

Assuming that everyone in the world salivates at the prospect of that 7.52% premium and the ability to cash in by selling shares of Zoetis, there are a number of considerations before counting your profits.

Among those considerations is that institutions, which currently only own approximately 18% of Zoetis shares, would be more facile in being able to unload shares quickly, as they are freely transferable upon exchange. That 7.52% premium may not be destined to withstand a lack of buyers, even if some discipline existed and there was an attempt to create orderly selling.

With the differential in the number of shares between the two companies, assuming that all shares were tendered, each shareholder would receive an allocation of about 6% of their request.

Before you get exp

osed to too much math, you should also know that there is a $30 fee to exchange shares. As with all investing transactions, there is an economy achieved in volume, especially when there’s a fixed price involved.

In the event that someone holds 100 shares of Pfizer, approximately 6 of those would be eligible for exchange, based on the assumption that all outstanding Pfizer shares would be offered for tender. The final number of shares of Zoetis received in exchange for Pfizer shares will be based upon an exchange rate as determined by the 3 day weighted closing price as announced on June 19, 2013, or after, if the deadline is extended by Pfizer.

For illustrative purposes, let’s assume the final Pfizer share price was $29. That would entitle the shareholder to $31.18 worth of Zoetis shares.

Your 6 share allocation would mean a profit on the exchange of $13.08, less the $30 transaction fee, leaving you with a loss of nearly $17.

That is an example of snatching defeat from the jaws of victory.

Of course if less than all shares are tendered the 100 share stock owner would fare better. If only 3 billion shares are offered for exchange he would break even.

Or would he?

The next part of the equation is what happens to Zoetis. At the moment the float is approximately 500 million shares, which will increase from one moment to the next to 900 million shares.

Then comes the real fun as there will certainly be those looking to quickly capitalize on that 7.52% differential before the opportunity disappears.

One can only imagine that would put some downward pressure on share price, which incidentally hasn’t fared terribly well since the initial spin-off.

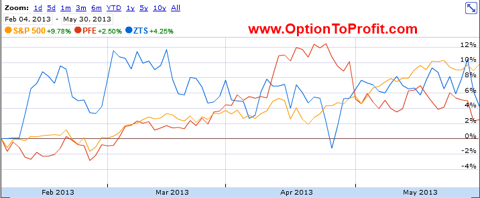

Zoetis became a publicly traded company in a successful IPO, having been priced above expectations and closing up 19% on its first day of trading, from an IPO price of $26. Unlike Phillips 66, however, it hasn’t left its parent in the dust.

In fact, despite an early positive showing, Zoetis has lagged Pfizer in its performance, while both have trailed the S&P 500.

In fact, despite an early positive showing, Zoetis has lagged Pfizer in its performance, while both have trailed the S&P 500.

As with many stocks that hold the promise of growth, Zoetis doesn’t offer a terribly appealing dividend, although that could change as it has already been increased for Phillips 66. Currently the Zoetis yield is 0.8%. Compare that to the stodgy Pfizer that is yielding 3.4%

Ultimately. in terms of the offer itself, the fewer that express an interest, the far better the offer would likely be as allocations would be increased and pricing pressure on Zoetis would be decreased.

A classic battle of greed versus common sense.

As an inveterate option seller, I have an additional consideration. Zoetis does offer option contracts, but unlike Pfizer it does not offer weekly contracts, nor does it have a multitude of unit denominated strike prices, making the prospects of holding shares less attractive for me.

With a bit more than two weeks until a decision is required my initial reaction to the offer has undergone quite a transformation, but I’ll still end up following the numbers and determining whether some additional return can be squeezed out of the transaction owing to the size of my Pfizer position

While I now anticipate the possibility of continuing to hold onto my Pfizer shares, I do hope that perhaps someone who hasn’t given the subject too much thought may end up exercising their $29 option early, at a price below the strike, as they may perceive Pfizer priced at anything greater than $27 to be the equivalent of Zoetis priced at $29 and hope to make a killing in what they believe to be an arbitrage opportunity.

Maybe divorce isn’t that bad? At least if you don’t think about it too much.