Oh, and congratulations, too.

Oh, and congratulations, too.

Shame and congratulations on you for completing the world’s most successful corporate issuance of bonds. $52 Billion in bids clamoring for $17 Billion of product.

Remember when Apple (AAPL) products had that kind of demand?

Remember when its stock had that kind of demand?

Remember, the cynics say that dividends and stock buybacks are the sort of things that you do when you can’t propel the business forward.

A few years ago, in a ruling that will forever remain controversial, the United States Supreme Court essentially ruled, that in at least a narrow definition, corporations were people.

For most purposes that designation is somewhat non-sensical, but for the all important world of campaign financing making corporations animate objects had a great benefit. Namely, the privilege of donating obscene amounts of money to political campaigns.

But along with all of the great privileges of belonging to the human race, there have to be some downsides, as well. Social obligations and the burdens and joys of human emotions come to mind.

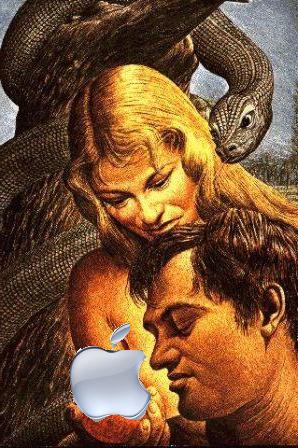

Like Adam and Eve in the Garden of Eden, one of the very first human traits that they exhibited after they had done something very wrong and against the “rules” was to feel shame. Ironically, what they did wrong was to have eaten from “The Apple.”

This week, Apple should feel shame.

They borrowed money, as much as 75 basis points above US Treasuries in order to fund a planned $50 Billion buyback and the costs of three years worth of dividend payments.

From a business perspective, Apple should be congratulated, having found a way to satisfy increasingly noisy shareholders and hold the tax man at bay. Although I do wonder why they even had to go 75 basis points above US Treasuries, you can’t argue with the success of the initiative. You would, however, think that Apple was more credit worthy than our own government, but apparently they don’t even measure up to Microsoft (MSFT) in that regard.

While the interest payments are a deductible expense, the real beauty is that Apple is able to put cash directly and perhaps indirectly back in the hands of shareholders without the need to repatriate tons of foreign cash and pay US taxes once having done so. Of course, they also figured out a way to turn down the heat on Tim Cook, just a bit.

Having been an Apple shareholder as recently as last week, I suppose I would have lauded that move by Tim Cook, but now, I find it shameful.

Firstly, not that I expect any devastating news at Apple, but suddenly shareholders have taken a subordinate position to new bond buying stakeholders. The risk to shareholders is certainly small in that regard, but it is also certainly unnecessary.

Secondly, what happened to the ideals?

Although he was a ruthless competitor, the late Steve Jobs had ideals. First and foremost, they related to the products offered by Apple. But they also extended to the financial practices that eschewed capital markets and were ruggedly self-reliant in order to meet its corporate objectives.

While Apple still has exquisite products, among my previous critiques of the company quality of products has never been at issue, they are straying from the founder’s ideals on all counts.

While it can be safely said that the last time Apple ventured into the bond market, it did so to save itself from financial ruination, Steve Jobs had not yet returned to the company. We’ll never know whether Apple under Jobs’ leadership would have been driven to the point of desperation, but we do know that in the 25 subsequent years that source was never tapped again.

Whatever the basis for his ideals, they included a disdain for share buybacks and dividends. As recently as a 2010 shareholder meeting, Jobs stated that Apple needed to keep its cash for growth opportunities and further said that paying a dividend or buying back stock would not change the stock price. You can argue those points, but what you can’t argue is that Jobs’ idealism exchanged the illusory effects of dividends and buybacks for the real effects of stock appreciation.

So here we are. Shares had fallen in excess of $300, the pipeline appears dry and questions regarding TIm Cook’s continuing leadership have popped up.

In response, Apple has gone where the beleaguered go. They have gone the route of buybacks and dividends. Nothing terribly creative, but a step designed to quiet some of the complaints from shareholders and activists.

Yet, they went to the bond markets to get the necessary cash to perform what may in and of itself been unnecessary. By all reports they did so to avoid repatriation of foreign held cash and to avoid paying U.S. taxes upon those funds.

Remember the 2012 elections? Remember candidate Romney and the controversy surrounding his taxes? There was never a question as to whether Romney had broken the law or done anything illegal. It was an issue of his taking advantage of every loophole in the tax code that was imaginable. Not illegal, but most people innately believed that there was just something wrong about navigating a path that no one creating regulation or legislation could have imagined would exist.

Bill Gates and Warren Buffett believe that to be the case. I suppose that’s another way that Apple doesn’t measure up to Microsoft.< /p>

On its surface you know that there is something wrong when an individual can have an IRA valued in excess of $100 Million. Not because the amount is so large, but rather because of the annual contribution thresholds. For example, assuming Mr. Romney made a maximum $5,000 contribution each year for 30 years and achieved an annual 35% return, he would still only have $40 million.

Shameful.

Yet here Apple has garnered its own shame. Exploiting the tax code in a way that the average person, perhaps even investors in Apple, intuitively know is wrong. Maintaining a significant cash reserve overseas to avoid paying taxes just doesn’t pass the smell test for most people, despite being legal.

But by so doing, they are also not re-investing any significant portion of their $150 Billion cash reserve into the business, nor are they pursuing meaningful acquisitions. The money sits in a low interest environment.

Given that shameful disregard for shareholders,you could understand why there was a growing chorus for something substantive to be done.

While corporations traditionally did not have social responsibilities, that too is a burden of now joining the human race. Among the social responsibilities is to put their money to work and to pay taxes, without hiding behind the loopholes or the unanticipated escape routes found in existing regulations and legislation.

I’m not really certain whatever happened to Adam and Eve after their banishment from the Garden of Eden. Their expulsion was swift, and perhaps the entire human race paid a steep price for their actions.

I think Apple’s recent action will result in the same steep price for its shareholders as the euphoria around the offering has already disappeared. The future looks less optimistic as Apple settles into a state where they are no different from the rest and beginning to rely on smoke, mirrors and lapses in tax policy to perpetuate their leadership.

In the meantime, without anything substantive in its future, Apple will remain a trading vehicle that may offer risk to those looking at it as a long term value.

While I can’t hold Apple in esteem for their anti-social behavior, and blatant thumbing of its corporate nose at its responsibilities, I do think that if offers some exceptional short term opportunities, especially when coupled with a covered call program.

I look forward to more of those positions as shares come back down in price to the $410-420 range, which I anticipate occurring prior to next week’s ex-dividend date.

As long as they’ve already made a deal with the devil, I may as well get my piece.