All in all, if you think about the man made tragic events of the past week in Brussels, the very rational and calm manner in which world markets reacted was really re-assuring.

All in all, if you think about the man made tragic events of the past week in Brussels, the very rational and calm manner in which world markets reacted was really re-assuring.

When we sometimes scratch our heads wondering whether the market will this time interpret good news as being bad or whether it will deem it good, you know that something is amiss.

It’s nice when clear and rational heads are in charge of things.

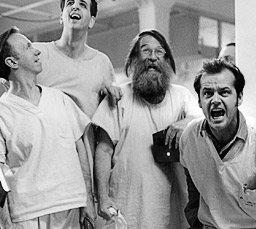

So often the way the market seems to react to events it’s not too easy to describe the action as having been rational and you really do have to wonder just who is running the place.

The same may be said for the Federal Reserve and its Governors.

It wasn’t always that way, though.

We always knew who was running the place.

While dictatorships may not be a good thing, sometimes a benevolent dictatorship isn’t the worst of all possible worlds.

There was a time that the individual members of the Federal Reserve and the FOMC kept their thoughts to themselves and knew how to behave in public and in private.

That is, up until about 11 years ago when newly appointed and now departed President of the Dallas Federal Reserve Bank, Richard Fisher, had made a comment regarding FOMC monetary tightening policy and was subsequently taken to the woodshed by Alan Greenspan.