I really didn’t see this past week coming at all.

I really didn’t see this past week coming at all.

Coming off of an absolutely abysmal week that saw the market refuse to follow up good news with further gains and instead plunging some 400 points in 2 days there were so many reasons to believe that markets were finally headed lower and for more than just a quick dip.

While I strongly believe in not following along with the crowd there has to be some bit of you that tells the rest of you not to completely write off what the crowd is thinking or doing. On horse racing, for example, the favorite does still have its share of wins and the Cinderella long short story just doesn’t happen as often as everyone might wish.

To completely ignore the crowd is courting disaster. At least you can occasionally give the crowd their due.

But this past week wasn’t the week to have done so. This was absolutely the week to have ignored virtually everyone. Unfortunately, this was also the week that I chose not to do so and went along with the crowd. The argument seemed so compelling, but that probably should have been the first clue.

What made this past week so unusual was that hardly anyone tried to offer a reason for the inexplicable advance forward. Not only did the market climb strongly, but it even reversed a late day attempt to erase large gains and ended up closing at its highs for the day. We haven’t seen anything like that lately, as instead we’ve seen so many gains quickly evaporate. For the most part I felt like an outsider because i didn’t open very many new positions last week, but it was rewarding enough to have heard such little pontification, as few wanted to admit that the unexpected had occurred.

With the S&P 500 now less than 2% from its high, it does make you wonder whether the concept of a correction being defined on the basis of a 10% decline is relevant anymore. Although its much better to think in terms of relative changes, as expressed by percentages, but perhaps our brains are wired to better understand absolute movements. Maybe we interpret a 400 point move as being no different from any other 400 point move, regardless of what the baseline is for either and simply take the move as a signal to reverse.

It’s tempting to think that perhaps we’re simply returning to the recent pattern of small drops on the order of 5% and then returning to unchecked climbs to new records. Of course, that would be in the realm of the "expected."

I have little expectation for what the next week may bring, as trying to figure out what is now driving the markets seems very futile of late. While I don’t think of "going along for the ride" as a very satisfying strategy I may be content to do so if the market continues moving higher for no apparent reason. But without any real indication of a catalyst I’m not terribly excited about wholeheartedly endorsing the move higher in a tangible way.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or "PEE" categories.

Not all stocks shared in last week’s glory. JP Morgan Chase (JPM) and Unitedhealth Group (UNH) in part accounted for the DJIA lagging the S&P 500 for the week.

JP Morgan and Unitedhealth both felt some backlash after some disappointing earnings reports. For JP Morgan, however, it has been about a year since there’s actually been anything resembling good news and yet its stock price, up until the past week had well out-performed the S&P 500. I’ve been waiting for a return to a less pricey entry point and after the past week it’s arrived following a 9% drop this month. With little reason to believe that there’s any further bad news ahead it seems to offer low enough risk for its reward even with some market weakness ahead.

Unitedhealth Group’s decline was just slightly more modest than that of JP Morgan and it, too, has returned to a price level that I wouldn’t mind owning shares. I haven’t done so with any regularity but the entry price is getting less expensive. As more news emerges regarding the Affordable Care Act there is potential for Unitedhealth Group to go in either direction. While its most recent earnings disappointed, there may be some optimism as news regarding enrollments by younger people.

Fastenal (FAST) is a company that I like very much, but am a little reluctant to purchase shares at this level, if not for the upcoming dividend that I would like to capture. I’ve long thought of Fastenal as a proxy for the economy and lately shares have been trading near the upper end of its range. While that may indicate some downside weakness, Fastenal has had good resilience and has been one of those monthly contracts that I haven’t minded rolling over in the past, having owned shares 5 times in the past 6 months.

You probably can’t get much more dichotomous than Kohls (KSS) and Abercrombie and FItch (ANF). While Kohls has reliably sat its current levels and doesn’t live and die by fads and arrogance, Abercrombie has had its share of ups and downs and always seems to find a way to snatch defeat from victory. Yet they are both very good covered option trades.

With Kohls having recently joined Abercrombie in the list of those stocks offering expanded weekly options it is an increasing attractive position that offers considerable flexibility, good option premiums and a competitive dividend.

Abercrombie, because of its volatility tends to offer a more attractive option premium, but still offers an attractive enough dividend. Following some recent price weakness I may be more inclined to consider the sale of puts of Abercrombie and might be willing to take assignment of shares, if necessary, rather than rolling over put contracts.

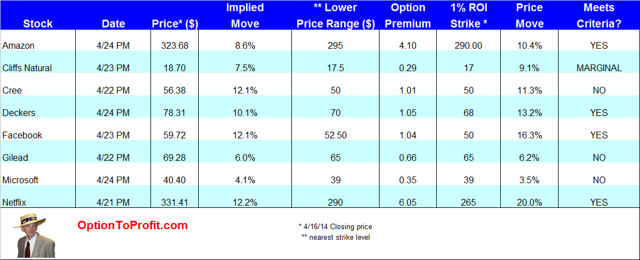

This week there are a number of companies reporting earnings that may warrant some consideration. A more complete list of those for the coming week are included in an earlier article that looks at opportunities in selling put contracts in advance of, or after earnings. Of the companies included in that article the ones that I’ll most likely consider this week are Cree (CREE), Facebook (FB) and Deckers (DECK).

All are volatile enough in the own rights, but especially so with earnings to be released. I have repeatedly sold puts on Cree over the past few months with last week having been the first in quite a while not having done so. It can be an explosive mover after earnings, just as it can be a seemingly irrational mover during daily trading. It has, however, already fallen approximately 8% in the past month. My particular preference when considering the sale of puts is to do so following declines and Cree certainly fulfills that preference, even though my target ROI comes only at a strike level that is at the very edge of the range defined by its implied volatility.

Deckers has only fallen 5% in the past month and it, too can be explosive at earnings time. As with Cree, for those that are adventurous, the sale of deep out f the money puts can offer a relatively lower risk way of achieving return on investment objectives. In this case, while the implied volatility is 10.1%, a share drop of less than 13.2% can still return a weekly 1% ROI.

Facebook has generally performed well after earnings announcements. Even the past quarter, when the initial reaction was negative, shares very quickly recovered and surpassed their previous levels. As with all earnings related trades entered through the sale of puts my goal is to not own shares at a lower price, but rather to avoid assignment by the rollover of put contracts, if necessary, in the hope of waiting out any unforeseen price declines and eventually seeing the put contracts expire, while having accumulated premiums.

Finally, it seems as if there’s hardly a week that I don’t think about adding or buying shares of Coach (COH). Having already owned it on 5 occasions in 2014 and having shares assigned again this past week, it’s notable for its stock price having essentially stayed in place. That’s what continually makes it an attractive candidate.

This week, however, there is a little more risk if shares don’t get assigned, as earnings are reported next week and Coach has been volatile at earnings for the past two years.

For that reason, this week, Coach may best be considered as a trade through the sale of puts with the possible need to rollover the puts if assignment seems likely. That rollover, if necessary, would then probably be able to be done at a lower strike price as the implied volatility will be higher in the week of earnings.

Traditional Stocks: Momentum Stocks: JP Morgan, Kohls, United Healthcare

Momentum: Abercrombie and Fitch, Coach

Double Dip Dividend: Fastenal (ex-div 4/23)

Premiums Enhanced by Earnings: Cree (4/22 PM), Deckers (4/24 PM), Facebook (4/23 AM)

Remember, these are just guidelines for the coming week. The above selections may become actionable, most often coupling a share purchase with call option sales or the sale of covered put contracts, in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week with reduction of trading risk.

I really didn’t see this past week coming at all.

I really didn’t see this past week coming at all.