Increasingly for that more speculative portion of my portfolio I look at earnings season as being a great time to generate quick, albeit sometimes nerve wracking, income from those stocks that can be unpredictable in their typical daily trading and even more so when earnings and guidance are at hand.

Increasingly for that more speculative portion of my portfolio I look at earnings season as being a great time to generate quick, albeit sometimes nerve wracking, income from those stocks that can be unpredictable in their typical daily trading and even more so when earnings and guidance are at hand.

For those that haven’t tried this approach before, the basic concepts and considerations are related to:

- Implied volatility;

- desired ROI;

- temperament for risk; and

- nimbleness in trading

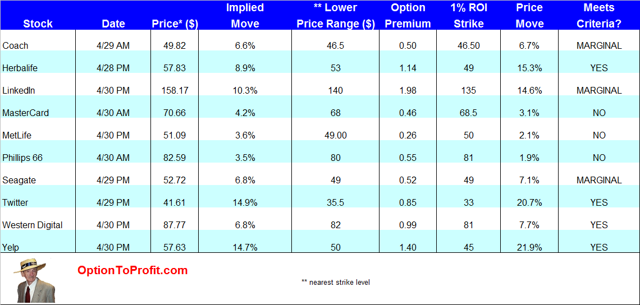

The concepts are covered in previous articles, but in capsulized form the goal is to find a stock that can deliver a desired ROI when selling a weekly put option at a strike level that is lower than the bottom of the range defined by the option market’s implied volatility for that stock.

That is the single objective metric. The remainder of the decision process is based upon share behavior. My preference is to sell puts into share weakness in advance of earning or to sell puts after earnings and subsequent weakness. A number of the positions covered in this article suffered large losses in Friday’s (April 25, 2014) sell off.

While I highlight specific stocks I lose interest when I see shares running higher prior to earnings, as it drives up the strike level that I would have to use to achieve my desired 1% ROI for the week and may also shift premium enhancement on the call side of the equation, rather than to the put side, which also contributes to a lower ROI.

While the traditional mantra for put sellers is that you must be willing to own shares, I do not want to take ownership unless an ex-dividend date is approaching. For that reason it is important to have liquidity in the options market in order to be able to concurrently close the position and open a new one for a forward week. Ideally, that would be done at a lower strike price, although the primary goals are to delay or prevent assignment and to collect additional net premiums.

Among the stocks for consideration this week are those that can be readily recognized for their inherent risk, which may also influence price behavior irrespective of earnings or guidance. Those companies high beta, or volatility, will provide higher premiums along with greater risk. Examining the past history of a stock’s movement after previous earnings releases may be helpful in evaluating the risk-reward proposition.

This week I’m considering the sale of puts of shares of Coach (COH), Herbalife (HLF), LinkedIn (LNKD), MasterCard (MA), MetLife (MET), Phillips 66 (PSX), Seagate Technology (STX), Twitter (TWTR), Western Digital (WDC) and YELP (YELP).

While I generally do not discuss relative merits of the stocks being considered for earnings related trades, preferring to remain agnostic to those issues and simply following the considerations outlined above, Twitter bears some additional comment.

While I generally do not discuss relative merits of the stocks being considered for earnings related trades, preferring to remain agnostic to those issues and simply following the considerations outlined above, Twitter bears some additional comment.

I an currently short Twitter puts, having been rolling them over weekly since their initial sale of March 24, 2014. While Twitter reports earnings this coming week, it also faces another potentially adverse event as the significant lock-up period comes to e end the following week. Although some important Twitter shareholders have indicated that they would not be selling shares at that time, there is the potential for the supply – demand equilibrium to be disrupted on underlying shares and exert downward pressure.

And of course, there’s always Herbalife and its own unique drama that can explode further on any given day. Inexplicably, while most traded lower to end this week, Herbalife didn’t follow.

Finally, while I don’t generally like the use of margin, it is often perfectly suited for this kind of trading activity. I tend to use these trades in a fully invested account that has margin privileges. Selling cash secured puts decreases the amount of margin that is available to you, however, it does not draw on margin funds and, therefore, does not incur interest expenses. Those expenses will only be incurred if the shares are assigned to you and are subsequently purchase through the use of credit.

As always, if considering the sale of put options, there is always the possibility of early assignment, especially if shares fall far below

the strike price selected and, as a result, the seller should be prepared to either own shares or pre-emptively rollover the put option to a forward date. The decision to do so may be helped by closely looking at prevailing option premiums to understand whether the holder of the put option may be better served by simply trading the option and achieving leveraged returns, as opposed to having to deliver shares for purchase, which diminishes return. For that reason, it is also important to have sufficient liquidity in the option market.