|

(see all trades this option cycle)

Daily Market Update – February 4, 2014 (Close) A couple of years ago the last time we really had a market that was going through some corrections the United States stock markets were in an unusual position. Rather than leading the world we were being wagged and our markets were following in response to European and Asian markets that were struggling with their own issues, particularly currency and monetary policy related. We’re not used to following. In addition to those kinds of woes the United States markets have continually fallen under the pressures of the Chinese markets, especially when it appeared as if the data was truthful. Over the past 18 months or so the US markets have not been held hostage by events in other markets, although Chinese economic news has still been impactful. Yesterday, however, there was some widespread belief that our own markets, which were already teetering a little, were sent over the cliff as the Nikkei and Russian stock markets gave the push, as they officially entered correction territory. With the Nikkei dropping another 4% in its trading overnight it’s comforting to see that our own markets are resisting, thus far, following that path lower. The word this morning was that the start to February was the worst seen since 1982. For his part, Peyton Manning says he’s seen worse starts, but for those that remember, 1982 was the beginning of the re-awakening of the stock market and the beginning of a 5 year bull market, until shortly after Alan Greenspan became Chairman of the Federal Reserve. If that’s what it takes to ignite a fire I’m all for it. Besides you really don’t appreciate the heights until you’ve seen the depths. The market crash in 1987 came just 2 months after Greenspan took office. The market decline in 2007 started almost 2 years after Bernanke took office. On the other hand, Janet Yellen’s first day was greeted with a 325 point loss, but today looks to be more hospitable. For those that were daring and made some of the new trades yesterday, i don’t think there will be many more this week, although I’m not closed to the idea, but am not drinking any Kool-Ade if the market enjoys some kind of substantive bounce back. Before making too much of an additional commitment I want to have some level of comfort that I’ll be seeing some assignments this week, but as we’ve seen the past few weeks it doesn’t take much to change everything. One day will do it, especially if it’s a Friday and the clock runs out on you. After yesterday’s fall there’s a lot of ground that needs to be recovered, but at least we do have a few days to do so, although Friday’s Employment Situation Report brings a new challenge. In the meantime it’s time for all of those who have been saying that they would be buyers on any dips to come and put their money where their mouths are. Instead many are seemingly busy either re-writing their personal history or patting themselves on the back for having predicted a correction consistently over the course of the past year. Like me. At least I did my part and opened some new positions. As the market came to a close it didn’t come even close to erasing yesterday’s loss. However, on a very positive note despite several attempts to pare back the gains today the market fought back, even though the opposition may have been taking a rest after all of its efforts yesterday. Most impressive was that it did so one last time during the final hour of trading. During the course of the day there were a number of trades that I had entered, including new positions in Intel, International Paper and Eli Lilly, but then canceled the orders, as I still had some doubts about today’s initial reaction to the stresses in the market and also mindful of the potential stress to come on Friday with the Employment Situation Report. I’d love to see tomorrow be another day like much of today even if only to have opportunity to pick up cover for some positions, as nothing beats selling calls into price strength. Hopefully, the Nikkei futures which are spiking 3% higher as our own markets come to a close will provide some leadership for us tomorrow. Sometimes it’s nice to be wagged for a change.

Access prior Daily Market Updates by clicking here OTP Sector Distribution* as of February 4, 2014 * Assumes equal number of shares in positions

Posting of trades is not a recommendation to execute trades

|

|

|

Monday through Thursday? See “Daily Market Update” with first edition published by 12 Noon and Closing Update published by 4:30 PM Friday? See Week in Review for summary statistics and performance Sunday? See Weekend Update for potential stock choices for coming week Any day? See Performance for open and closed positions Subscribers may see ROI statistics on all new, existing and closed positions on a daily updated basis |

|

|

|

|

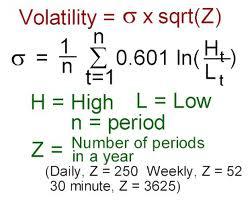

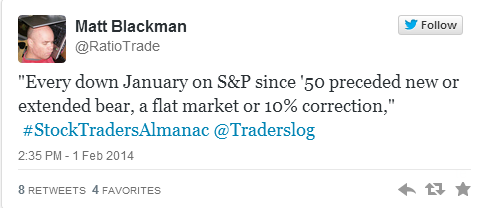

But as long as we were talking about historical norms and how disappointing it was waiting for the historically predicted January Rally that never came, the cries welcoming back volatility may have lost track of what historical levels of volatility have been.

But as long as we were talking about historical norms and how disappointing it was waiting for the historically predicted January Rally that never came, the cries welcoming back volatility may have lost track of what historical levels of volatility have been.