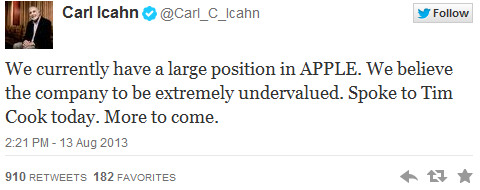

This afternoon came news via a simple 140 space statement that Carl Icahn currently had “a large position” in Apple (AAPL).

This afternoon came news via a simple 140 space statement that Carl Icahn currently had “a large position” in Apple (AAPL).

By all accounts his discussion with CEO Tim Cook were cordial. Icahn himself, in another 140 space blast referred to it as “nice,” and he anticipated speaking to Cook again shortly.

I currently own Apple shares that somewhat surprisingly weren’t assigned away from me last week in an effort to grab the dividend. Considering that shares were trading at about $465 prior to the ex-dividend and the strike price sold was $450, my expectation had been that assignment was a certainty. Especially since option premiums were no longer showing any time premium with such a deep in the money option.

But as many know when it comes to Apple stock, rational thought isn’t always a hallmark of ownership.

I still think back to a comment made to an earlier Seeking Alpha article I had written in May 2012, when Apple was trading at about $575

“I guess it’s hard to not have a certain bias towards a company that has turned $30,000 of your dollars into $600,000 and may if things go right turn it into a $1,000,000.”

I always wondered whether that individual had taken interim profits or whether subsequent to May 2012 had secured some profits as Apple dropped some 200 points. The fact that its author was a CPA wasn’t lost upon me.

At the time, I thought that an investing strategy of hoping to turn $30,000 into $1,000,000 was irrational, just as turning $600,000 into $1,00,00 was irrational.

What was abundantly clear, as I took a cynical view of Apple shares in repeated articles when analysts were calling for a $1,000 stock price was that emotion was at work among many investors. Part of the emotion was the fervent belief that Apple could only keep innovating and would always be an aspirational product with great margins.

However, one refrain that repeatedly was played was that Apple shares were destined to go much higher, based on an absurdly low price to earnings ratio.

The contention was that one the market starting placing a value on Apple shares more consistent with other technology stocks, Apple would soar far above its current level.

Of course, the seemingly rational analysis dismissed the fact that the market may in fact, have been rational in giving Apple a P/E in the 12 range, just like any well regarded retailer.

A retailer? Apple is a retailer and not a technology company? Granted, it is no longer “Apple Computer,” but why should Apple be considered anything but a technology company?

That’s where Carl Icahn comes in.

Despite his recent foray into Dell Computer (DELL), his history as an activist shareholder has not included many companies in the technology arena.

Icahn refers to Apple as being “undervalued” but he isn’t looking at a low P/E to buttress his opinion. He is looking at a continuing large cash position that he envisions as a means of expanding the already large share buyback, that to many has already been the source of Apple strength going from its near term lows to $450.

This is not a case of finding fault with leadership, this is not a case of someone seeking to prevent shareholders from being robbed blind in an insider buyout deal. Apple is very different from Dell in so many ways.

This is all about leveraging cash, without regard to product pipeline and without regard to product margins. This isn’t about cutting expenses or changing direction. It is as pure as you can get – it is about cash.

Icahn cares nothing about this company other than for the cash it holds. Cash which is unleveraged isn’t worth very much to him or anyone else. It certainly adds nothing to a company’s P/E.

Icahn cares nothing about this company other than for the cash it holds. Cash which is unleveraged isn’t worth very much to him or anyone else. It certainly adds nothing to a company’s P/E. It’s time to face the fact that the stock market has been entirely rational in assigning Apple the P/E it has for these past years. It was not going to ever be considered a technology company again. It is a retailer with a narrow range of products which are bought at the whims of a fickle consumer.

While not terribly different from David Einhorn’s earlier attempt to wiggle cash out of the Apple coffers, Icahn is relentless and scrappy. What starts as perhaps a nice discussion can quickly go elsewhere.

While there is a quick pop in Apple shares in the aftermath of the announcement and while I anticipate shares to move even higher, this is the end for the Apple that you knew and loved. It wasn’t the death of Steve Jobs, but rather the indirect impact of his absence that spells the end, as Apple becomes like so many other companies simply nothing more than a vessel for someone that will have as limited interest as a pedestrian day trader.

While I’ve believed that Apple was an eminently good trading stock once in went down below the $450 level in February 2013, I think that in the very near term its suitability as a trade is even further enhanced, despite the large move higher this afternoon.

In fact, in the case of Apple, I would even co

nsider the rare decision to purchase shares without immediate and concomitant sale of call options.

As long as Carl Icahn is on your side, you may as well consider him in the same vein as those who warn that you should “never fight the Fed,” even if you believe Apple is too large for even Carl Icahn to take on. That’s because this is now also a new era of cooperative behavior (against Bill Ackman, at least), where the big boys are capable of joining forces these days and will do so like vultures when there’s cash to be had.

The only caveat is that it’s not likely that you’ll enjoy dreams of turning $30,000 into a $1,000,00 and so I would be all for taking profits wherever they present themselves.