What an oddly serene, yet uncomfortable week coming up.

Here we were, on Good Friday, on the precipice of another year in which lunar coincidence allows Passover and Easter to coincide.

For many, serenity comes from family time, celebration and sometimes the re-inforcement of faith, culture and heritage.

In honor of the holiness of Good Friday, even capitalists will put away their arms and take the day off from their all consuming efforts. After all, the Prince of Peace wasn’t exactly a fan of the 1%, so what better way to honor the message of peace than to take a day off from advancing your personal caches of wealth?

In honor of the holiness of Good Friday, even capitalists will put away their arms and take the day off from their all consuming efforts. After all, the Prince of Peace wasn’t exactly a fan of the 1%, so what better way to honor the message of peace than to take a day off from advancing your personal caches of wealth?

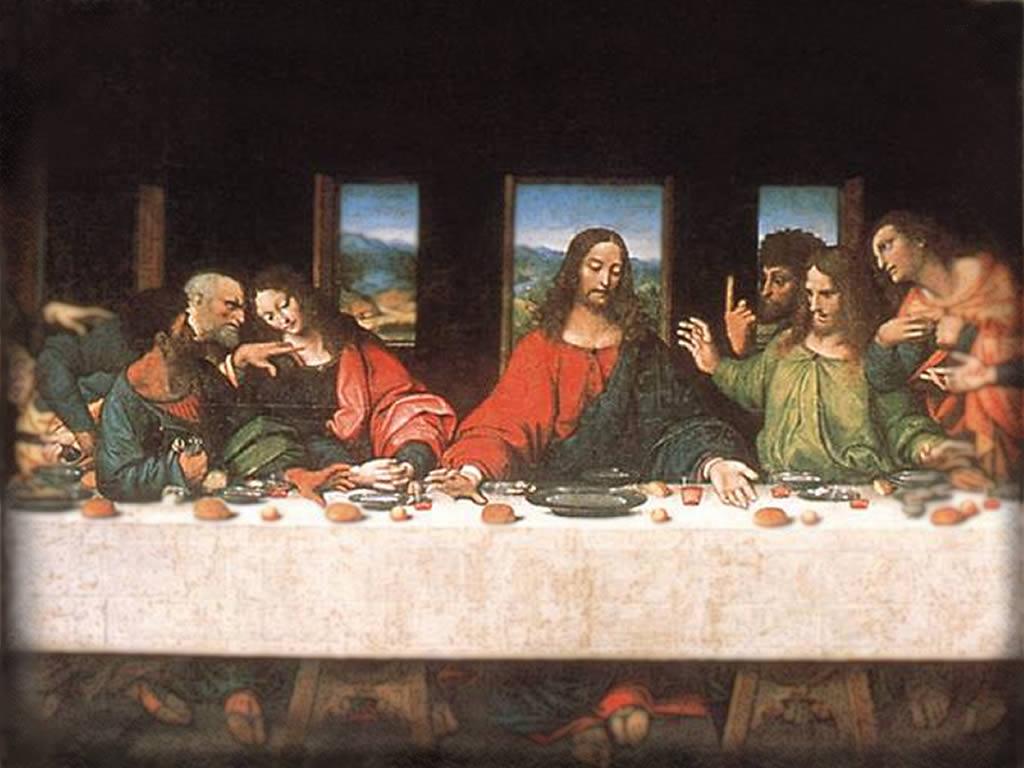

I may not recall much from my college Theology class days, but I’m fairly certain that among the things that was not discussed at that Last Supper Seder was hedging strategies for the coming week.

Even those Jewish people without much in the way of belief will retell the story of the Exodus from Egypt in whatever metaphors are appropriate for their own friends and family. Again, hedging strategies are not likely to play a role in the re-telling of the story.

But still, what a perfect day to release the employment numbers.

Our currency may say “In God We Trust,” but report releases rest for no deity.

The disappointment of having added only 120,000 non-farm payroll jobs had the abbreviated futures trading people heading for the exits. Yet, there was really no way for most of us to do anything in response to protect ourselves for what seems likely to come on Monday.

How odd to have a fairly clear vision of what is likely to happen in the markets a full three days in the future. Although, in that same time span, how many would have predicted a Resurrection?

For me, equally odd is the fact that I had absolutely no call contracts assigned, nor did I have any sold put contracts expire, nor be assigned.

In an example of bad timing, on Wednesday evening, I thought about buying back the put options I had sold on Kohls and some ProShares UltraShort Silver, as they still had two weeks until expiration and were well out of the money.

Since I expected that I’d otherwise have little or no cash forthcoming, closing out those contracts would have freed up substantial sums.

But both Kohls and the ProShares took big hits during the Thursday session and I had no compelling reason to cut those profits by closing out the positions.

What that means is that other than what meager cash I had in the portfolio account, there’s no influx coming that will need to be re-invested.

That’s too bad, considering that Monday morning is likely to offer some good bargains.

Typically, if I write a “Weekend Update” I use it as a blueprint for what I’m hoping to do for my own accounts in the coming week, but that’s not going to happen this week.

Despite the fact that when I was younger I always strove to be on the “shirts” side in a game of “skins” versus “shirts.” it’s so much easier to have some credibility when writing about the coming week when you actually do have some skin in the game.

So take everything that I say with that very big caveat. Compund that with the fact that despite the fact that we’re all expecting a large drop on Monday morning, by then the unemployment numbers will be old news.

But, if I did have money, I would be on the lookout to repurchase shares of some of my previous favorites that have come down in price to where I had lost them to assignment in the past month or so.

On that basis alone, Caterpillar and Goldman Sachs are very close to the $105 and $115 levels, respectively, at which I would re-purchase shares.

Additionally, Riverbed Technology is getting near that level at which I would sell puts, as is Focus Media.

For example, at its closing price on Wednesday of $27.19, you can get a $0.47 premium by selling a $25 put that expires in 2 weeks.

RIverbed would have to fall 8% in order for your contract to be assigned. In return you get a 1.9% return, based on a $25 potential purchase. It was last at that level two months ago, but it could happen again.

I would still take that bet, because Riverbed has always been very kind to me, but still, I won’t because I won’t have the money.

The numbers are similar for Focus Media. At its Thursday close of $25.10, it would have to drop 12.3% to reach a $22 strike price on the April 2012 put contract, for which you would receive a $0.35 premium, or 1.6% for two weeks. It too, was last at that level two months ago.

Also, since I don’t have the money, I won’t be adding shares of Freeport McMoRan, in an effort to execute a Double Dip Dividend play, as it goes ex-dividend, at its new increased level, on Wednesday.

I suppose that I could sell a kidney, or two, if I was really convinced of these plays, but most individuals involved in the underground organ markets are hard to find for people like me and eBay is of no help.

Maybe they’re taking the holidays off, as well.

So, I’ll likely sit and watch as the markets open on Monday, thinking the same thoughts of a week ago, as I was holding my “winning” Mega-Millions lottery ticket.

What if?

Join the Option to Profit Subscription Service. or get more information

Check out Recent PortfolioTransactions and

Transaction Performance