The CNBC morning show, Squawk on the Street, has a daily Tweet prompt asking viewers for their opinion on a wide range of topics.

Most of the time it’s an attempt to inject a little bit of humor into the news of the day.

Today’s thought surrounded yet another appearance by Ben Bernanke, this time in front of an august collection of elected officials far more genteel than those Philestine Congressman.

Senators. They’re the higher and more refined form of elected official. They are usually less likely to be involved in petty scandals or felonies. They very often have better hair than their counterparts, as well.

What if you were Chairman of the Federal Reserve, Ben Bernanke, what parting words would you like to leave with the Senate committee that you were appearing in front of today?

You just know that he can’t always have the highest regard for the questions coming his way and probably even less regard for the lengthy and rambling preambles to each question.

I’m sure there’s a cottage industry somewhere that has Cambodian laborers painting thought bubbles over Bernanke’s image as some clever humorist then finds the words to make the photo chuckle provoking.

Since I have lots of time on my hands, especially given the boring nature of the markets for the first two days of this week, I responded to the prompt, as I do a couple of times each week and ultimately had my Tweet glow in its 3 seconds of fame.

I guess they won’t accept two “winners” on the same day, because I sent a second one while listening to the testimony, questioning and answering:

“Hello, my name is Bernanke. How do you thank me?” I think was actually better than the “winning” submission.

“Hello, my name is Bernanke. How do you thank me?” I think was actually better than the “winning” submission.

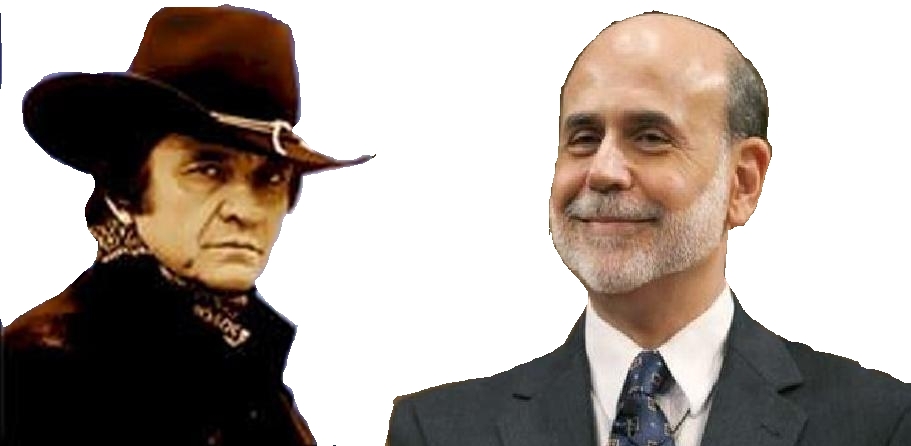

I think that most everything in life can have a parallel drawn to something Johnny Cash sang.

Maybe they just have something against homages to Johnny Cash, who has also inspired my investing philosophy.

Maybe it was the alcohol, maybe the drugs, not likely the adultery, but there’s certainly an anti-Cash agenda.

Bernanke himself seems to have an anti-cash agenda, at least as it comes to personal savings.

Bernanke is such a popular whipping boy. There’s absolutely no chance of losing political capital by hurling missives at him, as Bernanke has no constituency. He may also not have any pain receptive mechanisms.

He’s the city manager in a world of mayors.

The one thing that I’ve learned over the past two weeks is that when Bernanke speaks, it’s time to short the shorts.

At least when it comes to silver.

The past couple of days have been very unusual ones for me.

I feel a bit like RIchard Pryor’s character in the film “Brewster’s Millions.”

It’s not always that easy spending money, especially if there are rules attached.

My rules are simple. Try not to lose money that can’t be recovered within my lifetime and if paying for a hooker or drugs, never use credit or checks.

For the past two days the money has been burning a hole in my pocket as I’ve been patiently sitting and awaiting a short term breakdown to start putting the proceeds from all of those past week assignments to work.

But lately, it doesn’t matter whether the news is good or bad. Even the lower openings of the past few days are simply preludes to their evaporation and a slow melt upward.

It’s not quite clear to me how December 31st marked such a difference in overall market repsonse and volatility, but you can’t miss the obvious difference in the sense of fear and urgency in the markets.

There is none.

For the third time in the past couple of weeks as the good Chairman spoke, gold and silver, which had been heading downward to offset their recent unbridled rises, abruptly reversed their course.

Holding the ProShares UltraSHort Silver ETF that hasn’t been a good thing. Each time I thought that there was going to be a chance for the price of the underlying ore to give up some of its recent gains there was Bernanke.

Whatever thoughts I may have had of finally selling calls on the remaining unhedged shares also evaporated.

At some point you learn. I think that’s what they mean when they say “Don’t fight the Fed.”

This time, I decided to sell puts on the current month. Short the shorts.

I mentioned that the past couple of days have been unusual ones for me, but selling puts isn’t entirely unusual. I even have a short chapter (no pun inteneded) in the Option to Profit book on the occasional use of that strategy.

But there was more.

Today marked the second day that I was really hard pressed to find anything to buy. Prices just seemed too high, and unfortunately that also applied to the shares of the stocks that I had recently been assigned.

That’s a problem since I justify my staying at home by buying stocks and then selling calls to generate income.

Income equals money for things like mortagage payments, food and the like.

What was unusual was that I strayed from my script of “Old Reliables.” I rarely wing it, only on special occasions letting a new stock enter the portfolio.

It’s not that I have high standards, it’s just that I’m not very capable of knowing who to let in or when, so instead, I just try to keep the gate closed.

Doing so is entirely consistent with my overall philosophy of maintaining an anti-social personna.

Yesterday I let in MolyCorp. Not only wasn’t it an Old Reliable, but it’s also a lot more speculative of an investment than I ordinarily prefer.

The hope by the close on Monday was that Tuesday would be different. Maybe Tuesday would see the fall in prices that was justified, to me at least.

Well, that didn’t happen, despite the fact that it looked promising for a while, with the Dow down as much as about 50 points and silver actually down nicely, as well.

And then along came Bernanke and it all turned around.

With the heat building up in that pocket of mine something had to give.

Turned out that it was my principles.

I purchased shares of Research in Motion and Boeing. The last time I held RIMM, its shares were assigned away from me at $62.50, right before its one way trip to the abyss.

I thanked anyone in the vicinity for my good fortune in not getting stuck with RIMM and swore that I’d never buy it back.

But desperate times cause a man to do desperate things.

And Boeing? Well, I guess I could justify its purchase as part of a Double Dip Dividend strategy as it goes ex-dividend tomorrow, but the news that there may be a problem with the composite skins of its delayed Dream Liner would probably cause someone with common sense to look elsewhere for a stock prurchase.

Not me, I needed and craved the cash.

Then I replaced assigned shares of British Petroleum and Morgan Stanley and added more Mosaic shares.

All of that made a dent, but not much. Yet the prices were so unwelcoming elsewhere.

But that’s where selling puts came into play.

I eventually sold puts on the ProShares UltraShort Silver and Chesapeake Energy, as I tried to further rationalize that I wouldn’t mind owning shares if they were assigned at their strike prices of $10 and $22, respectively.

I’ll get back to you on that.

I’ve learned that my principles are wavering and my faith can be easily shaken.

After the past two days, I’m not even certain that I know who I am.

In the meantime, I least I can gain some sense of security knowing that Ben Bernanke is a constant and predictable part of our lives and that he won’t let anything bad happen to us.

Maybe those up for election wouldn’t deign to thank you, but even when I see my assets withering in reposnse to your words, I know you have our back.

When it’s all said and done, we’ll all be the better for it and I can see my holdings as “The Portfolio in Black.”

Check out Recent PortfolioTransactions and

Transaction Performance