Study after reputable study indicates and continually confirms just one thing. An absolute and universal truth that ultimately forms the foundation of so many things that we do.

Size does matter.

Additionally studies also validate the concept that “Stupid is as stupid does”, sometimes referred to as “The Gump Principle” in academic circles.

Despite the denial that we all go through, size is everything. Bigger, better and more. It’s all about size. Don’t be swayed by the girth argument. You want girth? Find yourself a steroid juiced linebacker and then get back to me.

As an aside, before you try to point out what appears to be an exception to that rule, the short ugly guy in sweat pants with the babes hanging off each arm? It’s the size of the bankroll. That usually trumps everything else or every figurative shortcoming.

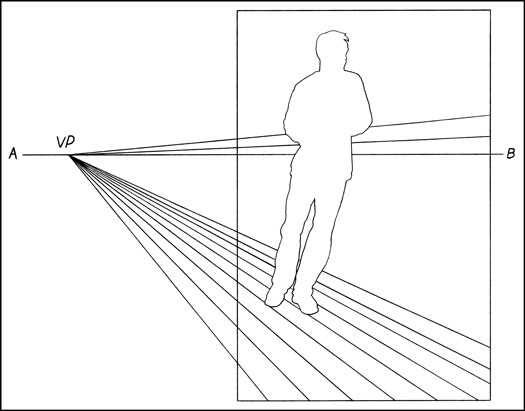

Depending on your perspective, you can have a sliding scale on what constitutes appropriate size, however.

Depending on your perspective, you can have a sliding scale on what constitutes appropriate size, however.

Take yesterday afternoon. After a big drop it looked as if the Jamie Dimon effect was being to take hold. He spoke in calm, reassuring and upbeat tones about what the American economy has going for it.

In the interview background, in otherwise scenic Monterey, California was a Chase Bank ATM. High magnification video indicated that 40% of customers attempting to withdraw cash were greeted with insufficient funds notices. The sight of them kicking the machine really didn’t require high power magnification.

Luckily CNBC has that 7 second audio delay that MSNBC forgot to use.

As Dimon spoke, the market picked up about 200 points. Granted it was still down 150, but by comparison, with a new persepctive on size, down 150 seemed minscule.

Down 150 is the new up 25. What used to elicit a shriek of disbelief of orgasmic frenzy levels now barely even gets a “meh”.

We are still talking about stocks, right?

As I awoke Wednesday morning I discovered that I had some unexpected cash sitting in my account. Someone had exercised some of the now deep in the money ProShares Ultrashort VIX ETF that I owned.

That’s where the Gump Principle comes in and did so from both sides.

For starters, in hindsight, I shouldn’t have sold those calls. I left lots of money on the table as the volatility index has been on a tear as the market has been plumbing new depths. Even more so, as the ETF was levereged.

So idiot that I can be, I made my 10% return on shares and options for the 3 weeks of holding, but it could have been much more.

Based on the past 2 weeks, even much, much more wouldn’t have been nearly enough to be enough.

But I wondered about the guy that actually exercised the option. Why? Why do it, especially with more than a week remaining and no divdend to be captured? If you want to lock in profit, why not sell the option instead of shelling out the cash and then presumabaly selling the shares?

My guess is that there was a breakdown in the perfection of options pricing so that purchasing the shares resulted in perhaps a lower yield, but greater gains.

That would mean either an idiot on the ask side or the bid side of that proposed transaction. Maybe both, so good luck getting them together to make a market. Greed is a form of stupidity.

In an exercise of my own greed, I quickly used the proceeds and snapped up some more shares of down-beaten DuPont, which goes ex-dividend on Thursday.

The numbers were small, but right now anything looks good. Purchased at $54.45, then a $0.41 dividend and a $1.12 options premium for 7 trading days. That’s the best I could do right now, but from my perspective it’s a big deal. It’s especially a big deal if this most recent plunge follows the same playbook as that in 2009. At that time I loaded up on high yielding quality companies and kept my fingers crossed, while selling 5% and 10% out of the money calls. In that way, I accepted less income in anticipation and hopes of greater capital gains.

So let’s review.

Monday we were down 600, Tueday up 450 and Wednesday down 520.

To put it into a personal standardized perspective, while pointing out the disequilibrium, on Monday I Iost 220 Color TV’s, while on Tueday I was given 146 and Wednesday I returned 100. (Don’t understand? See Some Things Don’t Get Old)

To me, that’s actually a very positive trend. How’s that for a warped perspective? And one that’s pretty stupid, too.

But the reason that I see it as a good trend is that the simple math always dictates that it requires more effort to recover from a drop than it does to actually drop.

Think of that concept as being no different from gravitational forces. As I get older that analogy is much more apropos as I gaze into a full length mirror. You know, they really should make bras for those things.

For example, let’s take numbers ripped from the headlines. When the Dow falls 2000 points from the 12,719 level to 10,719 in one month , that’s a 15.7% drop. However, from that level it takes an 18.7% gain to get back to the summit.

But in my case despite seeing the market give back Tuesday’s gain and then nearly another 20% on top of that, I was still left with 46 Color TV’s.

Wow. See what I mean. Down 150 is the new up 25.

It’s all in the perspective and being stupid enough to accept that perspective. That’s a winning combination, or as we know in the aftermath of the Charlie Sheen debacle, “Winning is the new losing”. It’s the kind of denial and re-definition of standards that still makes it so profitable to deluge the world with penis extender e-mails. Want and believe enough and you can convince yourself of anything.

Now, if only I could figure out a way to re-monetize those TV’s and buy some gold, or at least those gold clad Buffalo nickels, that are priced at a gold equivalent of $20,000 per ounce.

That’ll show the world who’s stupid.