Today was one of those days that you just wished that The End of Days had actually occured.

As if a 280 point drop in the Dow Jones wasn’t enough, watching Trump eat his Pizza with a fork and knife in a prototypical New York Pizzeria joint was enough to question everything in life.

During World War II, reportedly American GI’s tested suspected spies by peppering them with baseball related questions. That was one sure way to test someone’s stripes. If you fell for the old, was Joe DiMaggio your favorite Brooklyn Dodger question, your ass was toast. Especially if you answered “Yah”.

During World War II, reportedly American GI’s tested suspected spies by peppering them with baseball related questions. That was one sure way to test someone’s stripes. If you fell for the old, was Joe DiMaggio your favorite Brooklyn Dodger question, your ass was toast. Especially if you answered “Yah”.

No doubt, after seeing Trump elegantly dining on Pizza, one would be well justified to question the nation of Trump’s birth. Even Kenyan’s know how to eat Pizza.

They certainly don’t stack their slices and they’ll usually walk the extra 20 feet to bypass the Albanian Pizza place for a chance to get some really authentic New York Pizza, made my authentic Italians.

Let’s be clear, The Donald’s excuse for using a knife, fork, spork, whatever, doesn’t hold up to well. He said that he eats it that way so that he can bypass the dough, to keep his weight down.

The stacking sort of speaks a different story, unless Trump uses one of those Intuitive Surgical Da Vinci robotics to extricate the mozzarella and tomato sauce from between the soggy crusted slices.

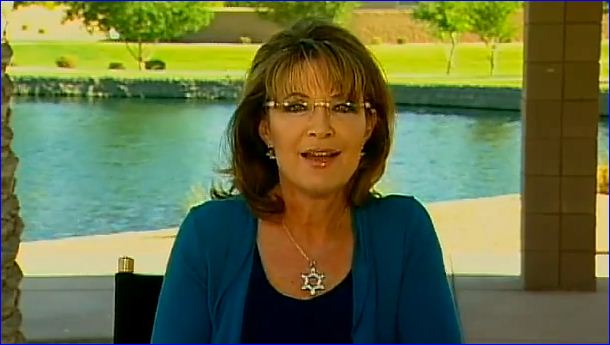

And then, there’s this image of Sarah Palin with her daughter Piper apologizing for pushing a cameraman. Well, as if the Jewish people don’t have enough problems, Palin is wearing a huge Star of David.

And then, there’s this image of Sarah Palin with her daughter Piper apologizing for pushing a cameraman. Well, as if the Jewish people don’t have enough problems, Palin is wearing a huge Star of David.

It was pretty unmistakenable. Maybe she was just trying to be prepared for any possible host awaiting her upon last week’s cancelled Rapturapalooza.

Don’t know, but once again it has me questioning everything. I had no problem with a Tina Turner beating Ike Turner or baseball bashing Rod Carew wearing the Star of David, but this? Too much. Just too much.

These sights were no way to end an absolutely horrid day.

Like most days that the markets are opened, I eagerly look forward to the days’ action.

Today was no different.

But like most days recently, our Dachshund, Laszlo, has been waking up and howling at an obscene hour in the morning.

Letting my Sugar Momma sleep, I get up and let Laszlo out with the full intention of going back to bed.

That never happens. Just can’t do it.

And so, I wait more than 4 hours waiting for that opening bell with my days’ trading strategies all planned out. I was fully expecting a rebound in Research in Motion and another upward bump in Freeport McMoRan.

Besides, the pre-open numbers indicated only a mild drop. Plenty of reason for sustained optimism.

But for the first time in a very long time, the market acted in an appropriate fashion for the economic news at hand.

The ADP employment numbers and then the ISM (Institute for Supply Management) data were not very good. But instead of moving in the irrational direction, the market actually did what a normal person would have predicted.

Given yesterday’s 128 point climb, today’s numbers gave a good reason to take some profits, but it was really an overdone reaction.

Given that Friday are the official government job numbers, I can’t imagine another such reaction for the release of numbers that should roughly mimic ADP’s numbers. The caveat being whether there are substantive revisions to previous month’s data.

Unfortunately, I’m not very well hedged and today was quite a hit. Normally at this stage of the month I’m fully hedged, but I change gears a bit if the previous month didn’t have many assignments. That usually means that I’m holding positions that are in negative territotry and I expect price rebounds.

In a perfect world, I’d rather make profits from an always upward spiraling stock price, but that’s just not the way of the world. Sometimes stock prices move downward and options premiums offest those paper losses very nicely.

That was the case during the May 2011 options cycle. I chose to not write June call options on a number of positions until they exhibited some price rises.

That was the strategy that I used during the early period of the post 2009 recovery. Back then, I went for capital gains on the stocks and smaller call option premiums.

For the pasy year, however, especially when volatility was high, I was particularly happy with the options premiums that came with near the money strike positions.

So today ened up being a total disappointment.

Rather than rapture, today was definitely a day from Hell.

Trump, Palin, The Dow Jones and Laszlo.

But at least my day tomorrow will have a much better chance of improving.

Don’t think Rep. Anthony Weiner will be able to say the same thing, although I guess we both could be guilty of letting the dog out.