Stocks need leadership, but it’s hard to be critical of a stock market that seems to hit new highs on a daily basis and that resists all logical reasons to do otherwise.

Stocks need leadership, but it’s hard to be critical of a stock market that seems to hit new highs on a daily basis and that resists all logical reasons to do otherwise.

That’s especially true if you’ve been convinced for the past 3 months that a correction was coming. If anything, the criticism should be directed a bit more internally.

What’s really difficult is deciding which is less rational. Sticking to failed beliefs despite the facts or the facts themselves.

In hindsight those who have called for a correction have instead stated that the market has been in a constant state of rotation so that correction has indeed come, but sector by sector, rather than in the market as a while.

Whatever. By which I don’t mean in an adolescent “whatever” sense, but rather “whatever it takes to convince others that you haven’t been wrong.”

Sometimes you’re just wrong or terribly out of synchrony with events. Even me.

What is somewhat striking, though, is that this incredible climb since 2009 has really only had a single market leader, but these days Apple (AAPL) can no longer lay claim to that honor. This most recent climb higher since November 2012 has often been referred to as the “least respected rally” ever, probably due to the fact that no one can point a finger at a catalyst other than the Federal Reserve. Besides, very few self-respecting capitalists would want to credit government intervention for all the good that has come their way in recent years, particularly as it was much of the unbridled pursuit of capitalism that left many bereft.

At some point it gets ridiculous as people seriously ask whether it can really be considered a rally of defensive stocks are leading the way higher. As if going higher on the basis of stocks like Proctor & Gamble (PG) was in some way analogous to a wad of hundred dollar bills with lots of white powder over it.

There have been other times when single stocks led entire markets. Hard to believe, but at one time it was Microsoft (MSFT) that led a market forward. In other eras the stocks were different. IBM (IBM), General Motors (GM) and others, but they were able to create confidence and optimism.

What you can say with some certainty is that it’s not going to be Amazon (AMZN), for example, as you could have made greater profit by shorting and covering 100 shares of Amazon as earnings were announced. than Amazon itself generated for the quarter. It won’t be Facebook (FB) either. despite perhaps having found the equivalent of the alchemist’s dream, by discovering a means to monetize mobile platforms.

Sure Visa (V) has had a remarkable run over the past few years but it creates nothing. It only facilitates what can end up being destructive consumer behavior.

As we sit at lofty market levels you do have to wonder what will maintain or better yet, propel us to even greater heights? It’s not likely to be the Federal Reserve and if we’re looking to earnings, we may be in for a disappointment, as the most recent round of reports have been revenue challenged.

I don’t know where that leadership will come from. If I knew, I wouldn’t continue looking for weekly opportunities. Perhaps those espousing the sector theory are on the right track, but for an individual investor married to a buy and hold portfolio that kind of sector rotational leadership won’t be very satisfying, especially if in the wrong sectors or not taking profits when it’s your sector’s turn to shine.

Teamwork is great, but what really inspires is leadership. We are at that point that we have come a long way without clear leadership and have a lot to lose.

So while awaiting someone to step up to the plate, maybe you can identify a potential leader from among this week’s list. As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or “PEE” categories (see details).

ALthough last week marked the high point of earnings season, I was a little dismayed to see that a number of this week’s prospects still have earnings ahead of them.

While I have liked the stock, I haven’t always been a fan of Howard Schultz. Starbucks (SBUX) had an outstanding quarter and its share price responded. Unfortunately, I’ve missed the last 20 or so points. What did catch my interest, however, was the effusive manner in which Schultz described the Starbucks relationship with Green Mountain Coffee Roasters (GMCR). In the past shares of Green Mountain have suffered at the ambivalence of Schultz’s comments about that relationship. This time, however, he was glowing, calling it a “Fantastic relationship with Green Mountain and Brian Kelly (the new CEO)… and will only get stronger.”

Green Mountain reports earnings during the August 2013 option cycle. It is always a volatile trade and fraught with risk. Having in the past been on the long side during a 30% price decline after earnings and having the opportunity to discuss that on Bloomberg, makes it difficult to hide that fact. In considering potential earnings related trades, Green Mountain offers extended weekly options, so there are numerous possibilities with regard to finding a mix of premium and risk. Just be prepared to own shares if you opt to sell put options, which is the route that I would be most likely to pursue.

Deere (DE) has languished a bit lately and hasn’t fared well as it routinely is considered to have the same risk factors as other heavy machinery manufacturers, such as Caterpillar and Joy Global. Whether that’s warranted or not, it is their lot. Deere, lie the others, trades in a fairly narrow range and is approaching the low end of that range. It does report earnings prior to the end of the monthly option cycle, so those purchasing shares and counting on assignment of weekly options should be prepared for the possibility of holding shares through a period of increased risk.

Heading into this past Friday morning, I thought that there was a chance that I would be recommending all three of my “Evil Troika,” of Halliburton (HAL), British Petroleum (BP) and Transocean (RIG). Then came word that Halliburton had admitted destroying evidence in association with the Deepwater disaster, so obviously, in return shares went about 4% higher. WHat else would anyone have expected?

With that eliminated for now, as I prefer shares in the $43-44 range, I also eliminated British Petroleum which announces earnings this week. That was done mostly because I already have two lots of shares. But Transocean, which reports earnings the following week has had some very recent price weakness and is beginning to look like it’s at an appropriate price to add shares, at a time that Halliburton’s good share price fortunes didn’t extend to its evil partners.

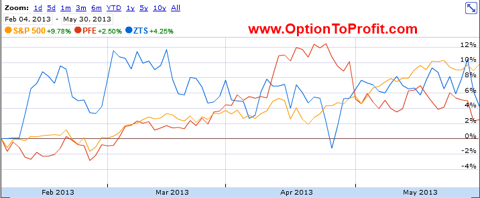

Pfizer (PFE) offers another example of situations I don’t particularly care for. That is the juxtaposition of earnings and ex-dividend date on the same or consecutive days. In the past, it’s precluded me from considering Men’s Warehouse (MW) and just last week Tyco (TYC). However, in this situation, I don’t have some of the concerns about share price being dramatically adversely influenced by earnings. Additionally, with the ex-dividend date coming the day after earnings, the more cautious investor can wait, particularly if anticipating a price drop. Pfizer’s pipeline is deep and its recent spin-off of its Zoetis (ZTS) division will reap benefits in the form of a de-facto massive share buyback.

My JC Penney (JCP) shares were assigned this past week, but as it clings to the $16 level it continues to offer an attractive premium for the perceived risk. In this case, earnings are reported August 16, 2013 and I believe that there will be significant upside surprise. Late on Friday afternoon came news that David Einhorn closed his JC Penney short position and that news sent shares higher, but still not too high to consider for a long position in advance of earnings.

Another consistently on my radar screen, but certainly requiring a great tolerance for risk is Abercrombie and Fitch (ANF). It was relatively stable this past week and it would have been a good time to have purchased shares and covered the position as done the previous week. While I always like to consider doing so, I would like to see some price deterioration prior to purchasing the next round of shares, especially as earning’s release looms in just two weeks.

Sticking to the fashion retail theme, L Brands (LTD) may be a new corporate name, but it retains all of the consistency that has been its hallmark for so long. It’s share price has been going higher of late, diminishing some of the appeal, but any small correction in advance of earnings coming during the current option cycle would put it back on my purchase list, particularly if approaching $52.50, but especially $50. Unfortunately, the path that the market has been taking has made those kind of retracements relatively uncommon.

In advance of earnings I sold Dow Chemical (DOW) puts last week. I was a little surprised that it didn’t go up as much as it’s cousin DuPont (DD), but finishing the week anywhere above $34 would have been a victory. Now, with earnings out of the way, it may simply be time to take ownership of shares. A good dividend, good option premiums and a fairly tight trading range have caused it to consistently be on my radar screen and a frequent purchase decision. It has been a great example of how a stock needn’t move very much in order to derive outsized profits.

MetLife (MET) is another of a long list of companies reporting earnings this week, but the options market isn’t anticipating a substantive move in either direction. Although it is near its 52 week high, which is always a precarious place to be, especially before earnings, while it may not lead entire markets higher, it certainly can follow them.

Finally, it’s Riverbed Technology (RVBD) time again. While I do already own shares and have done so very consistently for years, it soon reports earnings. Shares are currently trading at a near term high, although there is room to the upside. Riverbed Technology has had great leadership and employed a very rational strategy for expansion. For some reason they seem to have a hard time communicating that message, especially when giving their guidance in post-earnings conference calls. I very often expect significant price drops even though they have been very consistent in living up to analyst’s expectations. With shares at a near term high there is certainly room for a drop ahead if they play true to form. I’m very comfortable with ownership in the $15-16 range and may consider selling puts, perhaps even for a forward month.

Traditional Stocks: Deere, Dow Chemical, L Brands, MetLife, Transocean

Momentum Stocks: Abercrombie and Fitch, JC Penney

Double Dip Dividend: Pfizer (ex-div 7/31)

Premiums Enhanced by Earnings: Green Mountain Coffee Roasters (8/7 PM), Riverbed Technology (7/30 PM)

Remember, these are just guidelines for the coming week. Some of the above selections may be sent to Option to Profit subscribers as actionable Trading Alerts, most often coupling a share purchase with call option sales or the sale of covered put contracts. Alerts are sent in adjustment to and consideration of market movements, in an attempt to create a healthy income stream for the week with reduction of trading risk.