Good luck to you if you have staked very much on being able to prove that you can make sense of what we’ve been seeing in the US stock market.

Good luck to you if you have staked very much on being able to prove that you can make sense of what we’ve been seeing in the US stock market.

While it’s always impossible to predict what the coming week will bring, an even more meaningful tip of the hat would go to anyone that has a reasonable explanation of what awaits in the coming week, especially since past weeks haven’t necessarily been simple to understand, even in hindsight.

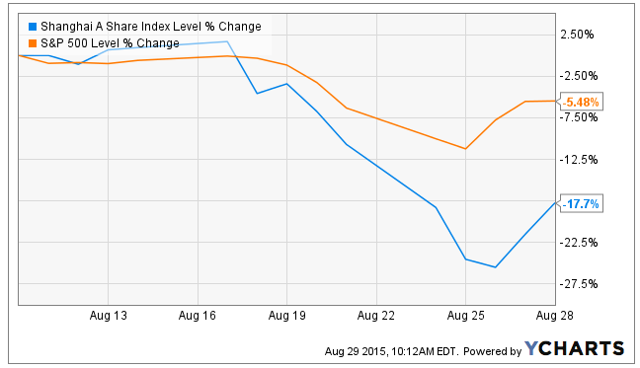

Sure, you can say that it’s all about the confusion over in China and the series of actions taken to try and control the natural laws of physics that describe the behavior of bubbles. You can simply say that confusion and lack of clear policy in the world’s second largest economy has spilled over to our shores at a time when there is little compelling reason for our own markets to make any kind of meaningful move.

That appears to be a reasonable explanation, in a case of the tail wagging the dog, but the correlation over the past week is imperfect and not much better over the past 2 weeks when some real gyrations began occurring in China.

The recovery last week was very impressive both in the US and in China, but in the span of less than 2 months, ever since China began restrictions on stock trading activity, we can point to three separate impressive recoveries in Shanghai. During that time the correlation between distant markets gets even weaker.

Good luck, then, guessing what comes next and whether the tail will still keep wagging the dog, now that the dog realizes that a better than expected GDP may be finally evidencing the long expected energy dividend to help boost consumer participation in economic growth.

Sure, anyone can say that a 10% correction has been long overdue and leave it at that, and be able to hold their head up high in any argument now that we’ve been there and done that.

There has definitely not been a shortage of people coming out of the woodwork claiming to have gone to high cash positions before this recent correction. If they did, that’s really admirable, but it’s hard to find many trumpeting that fact before the correction hit.

What would have given those willing to disengage from the market and go to cash following unsuccessful attempts to break below support levels a signal to do so? Those lower highs and higher lows over the past month may have been the indication, but even those who wholeheartedly believe in technical formations will tell you that acting on the basis of that particular phenomenon has a 50-50 chance of landing you on the right side.

And why did it finally happen now?

The time has been ripe for about 3 years. I’ve been continually wrong in that regard for that long and I certainly can’t hold my head up very high, even if I had gotten it right this time.

Which I didn’t. But being right once doesn’t necessarily atone for all of the previous wrong calls.

No sooner had the chorus of voices come together to say that the character and depth of the decline seen were increasingly arguing against a V-shaped recovery that the market now seems to be attempting that V-shaped recovery.

What tends to make the most sense is simply considering taking a point of view that’s in distinct contrast to what people clamoring for attention attempt to build their reputations upon and are equally prepared to disavow or conveniently forget.

Of course, if you want to add to the confusion, consider how even credible individuals see things very differently when also utilizing a different viewing angle of events.

Tom Lee, former chief US equity strategist for JP Morgan Chase (NYSE:JPM) and founder of Fundstrat Global, who is generally considered bullish, notes that history shows that the vast majority of 10% declines do not become bear markets.

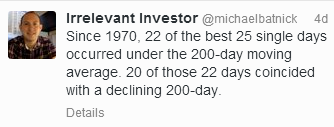

Michael Batnick, who is the director of research at Ritholtz Wealth Management, looked at things not from the perspective of the declines, but rather from the perspective of the advances seen.

Michael Batnick, who is the director of research at Ritholtz Wealth Management, looked at things not from the perspective of the declines, but rather from the perspective of the advances seen.

His observation is that the vast majority of those declines generally occurred in “not the healthiest markets.”

Not that such data has application to events being seen in China, but it may be worthwhile to make note of the fact that the tremendous upside moves having recently been seen in China have occurred in the context of that market still having dropped 20%.

Perhaps not having quite the same validity as laws of physics, it may make some sense to be wary of the kind of moves higher that bring big smiles to many. If China’s stock market can still wag the United States, even with less than perfect correlation, there’s reason to be circumspect not only of their continued attempts to defy natural market forces, but also of that market’s behavior.

As usual, the week’s potential stock selections are classified as being in the Traditional, Double Dip Dividend, Momentum or “PEE” categories.

While I’m among those happy to have seen the market put 2 consecutive impressive gains together, particularly after the failed attempt to bounce back from a 600+ point loss to begin the week, I don’t think that I’ll be less cautious heading into this week.

I did open 2 new positions last week near the market lows, and despite their performance am still ambivalent about those purchase decisions. For each, I sold longer term contracts than would be my typical choice, in an attempt to lock in some volatility induced premiums and to have sufficient time for price recovery in the event of a short term downturn.

With an unusually large number of personal holdings that are ex-dividend this week, I may be willing to forgo some of the reluctance to commit additional capital in an effort to capture more dividend, especially as option premiums are being enhanced by volatility.

Both Coach (NYSE:COH) and Mosaic (NYSE:MOS) are ex-dividend this week.

For me, both also represent long suffering existing positions that I’ve traded many times over the years, and have been accustomed to their proclivity toward sharp moves higher and lower.

However, what used to be relatively short time frames for those declines have been anything but that for some existing lots, even as having traded other lots at lower prices.

Since their previous ex-dividend dates both have under-performed the S&P 500, although the gap has narrowed in the past month, even as both are within reach of their yearly lows.

On a relative basis I believe that both will out-perform the S&P 500 in the event of the latter’s weakness, but may not be able to keep pace if the market continues to head higher. However, for these trades and unlike having used longer term contracts with trades last week, my eyes would be focused on a weekly option and would even be pleased if shares were assigned early in an effort to capture the dividend.

That’s one of the advantages of having higher volatility. Even early assignment can be as or more profitable than in a low volatility environment and being able to capture both the premium and dividend, when the days of the position being open are considered.

Despite having spent some quality time with Meg Whitman’s husband a few months ago, I had the good sense not to ask him anything a few days before Hewlett Packard (NYSE:HPQ) was scheduled to report earnings.

That would have been wrong and no one with an Ivy League legacy, that I’ve ever heard about, has ever crossed that line between right and wrong.

While most everyone is now focusing on the upcoming split of Hewlett Packard, my focus is dividend centric. As with Coach and Mosaic, the option premium is reflecting greater volatility and is made increasingly attractive, even during an ex-divided event.

However, since Hewlett Packard’s ex-dividend date is on Friday, there is less advantage in the event of an early assignment. That, though, points out another advantage of a higher volatility environment.

That advantage is that it is often better to rollover in the money positions, with or without a dividend in mind, than it is to accept assignment and to seek a new investment opportunity.

In this case, if faced with likely early assignment, I would probably consider rolling over to the next week and at least if still assigned early, then would be able to pocket that additional week’s option premium, which could become the equivalent of having received the dividend.

For those who are exceptionally daring, Joy Global (NYSE:JOY) is also ex-dividend this week and it is another of my long suffering positions.

These days, anything stocks associated with China have additional risk. For years Joy Global was one of a very small number of stocks that I considered owning that had large exposure to the Chinese economy. I gave considerably more credibility to Joy Global’s forecasting of its business in China than to official government reports of economic growth.

The daring part of a position in Joy Global has more to do with just having significant interests in China, but also because it reports earnings the day after going ex-dividend. I generally do stay away from those situations and much prefer to have earnings be release first and then have the stock go ex-dividend the following day.

In this case, one can consider the purchase of shares and the sale of a deep in the money weekly call option in the hopes that someone might consider trying to capture the dividend and then perhaps selling their shares before exposure to earnings risk.

In such an event, the potential ROI can be 1.1% if selling a weekly $22 call option, based upon Friday’s $24.01 close.

However, if not assigned early, the ROI becomes 1.8% and allows for an 8% price cushion in the event of the share’s decline, which is in line with the option market’s expectations.

For those willing to cede the dividend, there is also the possibility of considering a put sale in advance of earnings.

The option market is implying only an 8.1% move next week. However, it may be possible to achieve a 1% return for the sale of a weekly put that is at a strike price 12.5% below Friday’s closing price.

Going from daring to less so, I purchased shares of $24.06 shares General Electric (NYSE:GE) last week and sold longer dated $25 calls in an effort to combine premium, capital gains on shares and an upcoming ex-dividend date.

Despite the shares having climbed during the course of the week and now beyond that strike level, I may be considering adding even more shares, again trying to take advantage of that combination, especially the higher than usual option premium that’s available.

General Electric hasn’t yet announced that ex-dividend date, but it’s reasonable to expect it sometime near September 18th. While my current short call position is for October 2, 2015, for this additional proposed lot, I may consider the sale of a September 18 slightly out of the money option contracts.

In the event that once the ex-dividend date is announced and those shares are in jeopardy of being assigned early, I might consider rolling over the position if volatility allows that to be a logical alternative to assignment.

Finally, as long as Meg Whitman is on my mind, I’m not certain how much longer I can go without owning shares of eBay (NASDAQ:EBAY). While it has traded in a very consistent range and very much paralleling the performance of the S&P 500 over the past month, it is offering an extremely attractive option premium in addition to some opportunity for capital gains on shares.

The real test, of course, begins as it releases its next earnings report which will no longer include PayPal’s (NASDAQ:PYPL) contributions to its bottom line. That is still 6 weeks away and I would consider the purchase of shares and the sale of intermediate term option contracts in order to take advantage of that higher market volatility induced premium.

At least that much makes sense to me.

Traditional Stock: eBay, General Electric

Momentum Stock: none

Double-Dip Dividend: Coach (9/3 $0.34), Hewlett Packard (9/4 $0.18), Joy Global (9/2 $0.20), Mosaic (9/1 $0.28)

Premiums Enhanced by Earnings: Joy Global (9/3 AM)

Remember, these are just guidelines for the coming week. The above selections may become actionable – most often coupling a share purchase with call option sales or the sale of covered put contracts – in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stre

am for the week, with reduction of trading risk.

On a cruise ship you only know the answer to the question of “How low can you go” once you’ve met the physical limits of your body and the limit of your ability to balance yourself.

On a cruise ship you only know the answer to the question of “How low can you go” once you’ve met the physical limits of your body and the limit of your ability to balance yourself.

It’s too bad that life doesn’t come with highly specific indicators that give us direction or at least warn us when our path isn’t the best available.

It’s too bad that life doesn’t come with highly specific indicators that give us direction or at least warn us when our path isn’t the best available. Somewhere along the line most of us have tried the proven strategy of hanging out with people who were uglier or stupider than we perceived ourselves to be, in order to make ourselves look better by comparison.

Somewhere along the line most of us have tried the proven strategy of hanging out with people who were uglier or stupider than we perceived ourselves to be, in order to make ourselves look better by comparison. Last week was like a perfect storm, except that the winds blew from all different directions during the latter half of the week.

Last week was like a perfect storm, except that the winds blew from all different directions during the latter half of the week.

People tend to have very strong feelings about entitlements.

People tend to have very strong feelings about entitlements.