It was interesting listening to the questioning of FOMC Chairman Janet Yellen this week during her mandated two day congressional appearance.

It was interesting listening to the questioning of FOMC Chairman Janet Yellen this week during her mandated two day congressional appearance.

The market went nicely higher on the first day when she was hosted by the more genteel of the two legislative bodies. The apparent re-embrace of her more dovish side was well received by the stock market, even as bond traders had their readings of the tea leaves called into question.

While the good will imparted by suggesting that interest rate increases weren’t around the corner was undone by the Vice-Chair on Friday those bond traders didn’t get vindicated, but the stock market reacted negatively to end a week that reacted only to interest rate concerns.

His candor, or maybe it was his opinion or even interpretation of what really goes on behind the closed doors of the FOMC may be best kept under covers, especially when I’m awaiting the likelihood of assignment of my shares and the clock is ticking toward the end of the trading week in the hope that nothing will get in the way of their appointed rounds.

Candor got in the way.

But that’s just one of the problems with too much openness, particularly when markets aren’t always prepared to rationally deal with unexpected information or even informed opinion. Sometimes the information or the added data is just noise that clutters the pathways to clear thinking.

Yet some people want even more information.

On the second day of Yellen’s testimony she was subjected to the questioning of those who are perennially in re-election mode. Yellen was chided for not being more transparent or open in detailing her private meetings. It seemed odd that such non-subtle accusations or suggestions of undue influence being exerted upon her during such meetings would be hurled at an appointed official by a publicly elected one. That’s particularly true if you believe that an elected official has great responsibility for exercising transparency to their electorate.

Good luck, however, getting one to detail meetings, much less conversations, with lobbyists, PAC representatives and donors. You can bet that every opacifier possible is used to make the obvious less obvious.

But on second thought, do we really need even more information?

I still have a certain fondness for the old days when only an elite few had timely information and you had to go to the library to seek out an updated copy of Value Line in the hopes that someone else hadn’t already torn out the pages you were seeking.

Back then the closest thing to transparency was the thinness of those library copy pages, but back then markets weren’t gyrating wildly on news that was quickly forgotten and supplanted the next day. That kind of news just didn’t exist.

You didn’t have to worry about taking the dog out for a walk and returning to a market that had morphed into something unrecognizable simply because a Federal Reserve Governor had offered an opinion in a speech to businessmen in Fort Worth.

Too much information and too easy access and the rapid flow of information may be a culprit in all of the shifting sands that seem to form at the base of markets and creating instability.

I liked the opaqueness of Greenspan during his tenure at the Federal Reserve. During that time we morphed from investors largely in the dark to investors with unbelievable access to information and rapidly diminishing attention spans. Although to be fair, that opaqueness created its own uncertainty as investors wouldn’t panic over what was said but did panic over what was meant.

If I had ever had a daughter I would probably apply parental logic and suggest that it might be best to “leave something to the imagination.” I may be getting old fashioned, but whether it’s visually transparent or otherwise, I want some things to be hidden so that I need to do some work to uncover what others may not.

As usual, the week’s potential stock selections are classified as being in Traditional, Double Dip Dividend, Momentum or “PEE” categories.

It’s difficult to find much reason to consider a purchase of shares of Chesapeake Energy (NYSE:CHK), but exactly the same could have been said about many companies in the energy sector over the past few months. There’s no doubt that a mixture of good timing, luck and bravery has worked out for some willing to take the considerable risk.

What distinguishes Chesapeake Energy from so many others, however, is that it has long been enveloped in some kind of dysfunction and melodrama, even after severing ties with its founder. Like a ghost coming back to haunt his old house the legacy of Aubrey McClendon continues with accusations that he stole confidential data and used it for the benefit of his new company.

Add that to weak earnings, pessimistic guidance, decreasing capital expenditures and a couple of downgrades and it wasn’t a good week to be Chesapeake Energy or a shareholder.

While it’s hard to say that Chesapeake Energy has now hit rock bottom, it’s certainly closer than it was at the beginning of this past week. As a shareholder of much more expensive shares I often like to add additional lower cost lots with the intent of trying to sell calls on those new shares and quickly close out the position to help underwrite paper losses in the older shares. However, I’ve waited a long time before considering doing so with Chesapeake.

Now feels like the right time.

Its elevated option premiums indicate continuing uncertainty over the direction its shares will take, but I believe the risk-reward relationship has now begun to become more favorable as so much bad news has been digested at once.

It also wasn’t a very good week to be Bank of America (NYSE:BAC) as it well under-performed other large money center banks in the wake of concerns regarding its capital models and ability to withstand upcoming stress tests. It’s also never a good sign when your CEO takes a substantial pay cut.

If course, if you were a shareholder, as I am, you didn’t have a very good week, either, but at least you had the company of all of those analysts that had recently upgraded Bank of America, including adding it to the renowned “conviction buy” list.

While I wouldn’t chase Bank of America for its dividend, it does go ex-dividend this week and is offering an atypically high option premium, befitting the perceived risk that continues until the conclusion of periodic stress testing, which will hopefully see the bank perform its calculations more carefully than it did in the previous year’s submission to the Federal Reserve.

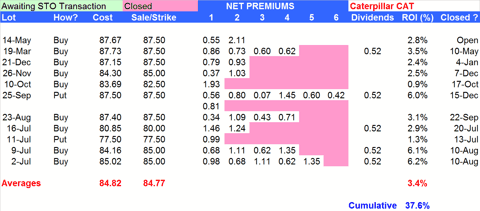

After recently testing its 2 year lows Caterpillar (NYSE:CAT) has bounced back a bit, no doubt removing a little of the grin that may have appeared for those having spent the past 20 months with a substantial short position and only recently seeing the thesis play out, although from a price far higher than when the thesis was originally presented.

While it’s difficult to find any aspect of Caterpillar’s business that looks encouraging as mining and energy face ongoing challenges, the ability to come face to face with those lows and withstand them offers some encouragement if looking to enter into a new position. Although I rarely enter into a position with an idea of an uninterrupted long term relationship, Caterpillar’s dividend and option premiums can make it an attractive candidate for longer term holding, as well.

Baxter International (NYSE:BAX) is a fairly unexciting stock that I’ve been excited about re-purchasing for more than a year. I generally like to consider adding shares as it’s about to go ex-dividend, as it is this week, however, I had been also waiting for its share price to become a bit more reasonable.

Those criteria are in place this week while also offering an attractive option premium. Having worked in hospitals for years Baxter International products are ubiquitous and as long as human health can remain precarious the market will continue to exist for it to dominate.

Las Vegas Sands (NYSE:LVS) has certainly seen its share of ups and downs over the past few months with very much of the downside being predicated on weakness in Macao. While those stories have developed the company saw fit to increase its dividend by 30%. Given the nature of the business that Las Vegas Sands is engaged in, you would think that Sheldon Adelson saw such an action, even if in the face of revenue pressures, as being a low risk proposition.

Since the house always wins, I like that vote of confidence.

Following a very quick retreat from a recent price recovery I think that there is more upside potential in the near term although if the past few months will be any indication that path will be rocky.

This week’s potential earnings related trades were at various times poster children for “down and out” companies whose stocks reflected the company’s failing fortunes in a competitive world. The difference, however is that while Abercrombie and Fitch (NYSE:ANF) still seems to be mired in a downward spiral even after the departure of its CEO, Best Buy (NYSE:BBY) under its own new CEO seems to have broken the chains that were weighing it down and taking it toward retail oblivion.

As with most earnings related trades I consider the sale of puts at a strike price that is below the lower range dictated by the implied move determined by option premiums. Additionally, my preference would be to sell those puts at a time that shares are already heading noticeably lower. However, if that latter condition isn’t met, I may still consider the sale of puts after earnings in the event that shares do go down significantly.

While the options market is implying a 12.6% move in Abercrombie and Fitch’s share price next week a 1% ROI may be achieved even if selling a put option at a strike 21% below Friday’s close. That sounds like a large drop, but Abercrombie has, over the years, shown that it is capable of such drops.

Best Buy on the other hand isn’t perceived as quite the same earnings risk as Abercrombie and Fitch, although it too has had some significant earnings moves in the recent past.

The options market is implying a 7% move in shares and a 1% ROI could potentially be achieved at a strike 8.1% below Friday’s close. While that’s an acceptable risk-reward proposition, given the share’s recent climb, I would prefer to wait until after earnings before considering a trade.

In this case, if Best Buy shares fall significantly after earnings, approaching the boundary defined by the implied move, I would consider selling puts, rolling over, if necessary to the following week. However, with an upcoming dividend, I would then consider taking assignment prior to the ex-dividend date, if assignment appeared likely.

Finally, I end how I ended the previous week, with the suggestion of the same paired trade that sought to take advantage of the continuing uncertainty and volatility in energy prices.

I put into play the paired trade of United Continental Holdings (NYSE:UAL) and Marathon Oil (NYSE:MRO) last week in the belief that what was good news for one company would be bad news for the other. But more importantly was the additional belief that the news would be frequently shifting due to the premise of continuing volatility and lack of direction in energy prices.

The opening trade of the pair was initiated by first adding shares of Marathon Oil as it opened sharply lower on Monday morning and selling at the money calls.

As expected, UAL itself went sharply higher as it and other airlines have essentially moved opposite

ly to the movements in energy prices over the past few months. However, later that same day, UAL gave up most of its gains, while Marathon Oil moved higher. A UAL share price dropped I bought shares and sold deep in the money calls.

In my ideal scenario the week would have ended with one or both being assigned, which was how it appeared to be going by Thursday’s close, despite United Continental’s price drop unrelated to the price of oil, but rather related to some safety concerns.

Instead, the week ended with both positions being rolled over at premiums in excess of what I usually expect when doing so.

Subsequently, in the final hour of trading, shares of UAL took a precipitous decline and may offer a good entry point for any new positions, again considering the sale of deep in the money calls and then waiting for a decline in Marathon Oil shares before making that purchase and selling near the money calls.

While the Federal Reserve may be data driven it’s hard to say what exactly is driving oil prices back and forth on such a frequent and regular basis. However, as long as those unpredictable ups and downs do occur there is opportunity to exploit the uncertainty and leave the data collection and interpretation to others.

I’m fine with being left in the dark.

Traditional Stocks: Caterpillar, Marathon Oil

Momentum Stocks: Chesapeake Energy, Las Vegas Sands, United Continental Holdings

Double Dip Dividend: Bank of America (3/4), Baxter International (3/9)

Premiums Enhanced by Earnings: Abercrombie and Fitch (3/4 AM), Best Buy (3/4 AM)

Remember, these are just guidelines for the coming week. The above selections may become actionable, most often coupling a share purchase with call option sales or the sale of covered put contracts, in adjustment to and consideration of market movements. The overriding objective is to create a healthy income stream for the week with reduction of trading risk.

Depending upon what kind of outlook you have in life, the word “limbo” can conjure up two very different pictures.

Depending upon what kind of outlook you have in life, the word “limbo” can conjure up two very different pictures.

It was interesting listening to the questioning of FOMC Chairman Janet Yellen this week during her mandated two day congressional appearance.

It was interesting listening to the questioning of FOMC Chairman Janet Yellen this week during her mandated two day congressional appearance. The instant the Employment Situation Report was released and news of the creation of 288,000 new jobs was known, the spin and the interpretations started like wild.

The instant the Employment Situation Report was released and news of the creation of 288,000 new jobs was known, the spin and the interpretations started like wild. Everything is crystal clear now.

Everything is crystal clear now.