Barely 6 months ago I contended that the intrusion of Carl Icahn into the company spelled the end of an era at Apple (AAPL).

Even before that point Apple had already shown that it was favoringfinancial engineering over the kind of engineering that enabled it to create a cash reserve in excess of $150 billion.

For those who cheered when it looked, from the surface, that Carl Icahn was retreating, having been prevented by Tim Cook from sacrificing corporate ethos for even more financial engineering, cheer no more.

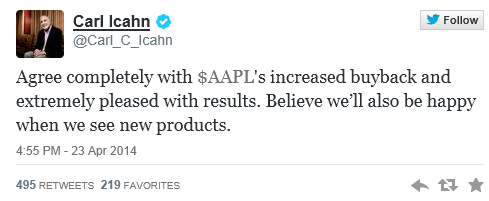

As opposed to the 11th ever Icahn Tweet that told the world that he had amassed a “large position” in Apple, the most recent was (self) – congratulatory.

With Apple’s post-earnings announcement of a 7 for 1 stock split and an 8% increase in the dividend, another nail has been put into a great company that is now evolving into what it had disdained in the past. In the absence of news that would excite investors and consumers alike, Apple has now continued its recent practice of pandering and diverting attention from what may be happening at the core of Apple.

With Apple’s post-earnings announcement of a 7 for 1 stock split and an 8% increase in the dividend, another nail has been put into a great company that is now evolving into what it had disdained in the past. In the absence of news that would excite investors and consumers alike, Apple has now continued its recent practice of pandering and diverting attention from what may be happening at the core of Apple.

It is in danger of becoming Microsoft (MSFT) of old, a company that was disparaged for its lack of product innovation and lack of coherent, forward looking leadership. Add to that a lack of a readily understandable strategy and you have a perfect target for hipsters and investors alike to bash and trash.

During that period, as Microsoft share price simply stayed in place, it routinely increased its dividend, at least doing something to appease shareholders. But while doing so it was roundly criticized for expensive and non-strategic acquisitions, which were deemed to be a waste of shareholder money.

However, I don’t make the comparison to Microsoft in a disparaging way. For those who practiced a covered option strategy, they were likely big fans of Microsoft, as treading in place is a great formula for generating lots of option premiums and is especially nice if there are dividends, as well.

In fact, perhaps if I compared Apple to the new Microsoft that many see as developing under the leadership of Satya Nadella, it might be viewed as being laudatory.

Ironically then, we now have today’s Apple.

The most common complaint heard is regarding its lack of innovation. Samsung may now be somewhat passe in its own right and Google (GOOG) may have a less than concretely defined strategy, but Apple has been widely admired for its innovation within a well developed strategy. The eco-system? While many didn’t understand its meaning in high school science, it was an obviously intuitive concept when it came to the Apple family of products, making so many wonder why no one had really mastered that concept before.

But the lack of new product introduction and expansion of that eco-system is troubling and has called into question Tim Cook’s leadership and vision.

Certainly news that sales of its iPad were well below projections can’t easily be interpreted in a positive light, as Apple also reported that its cash reserve fell this quarter, as more was returned to investors than was retained.

While innovation and leadership are now called into question evoking images of the old Microsoft, one has to also wonder how much shareholder cash Apple has squandered. No, not using the traditional Microsoft strategy of over-paying for poor strategic fitting entities, but rather through appeasement.

By waiting so long to pursue any share buy back strategy Apple has continually paid top dollar for shares, as pressure mounted for some use of its cash reserves. Under out-going CFO Peter Oppenheimer the strategy has been to buy shares when prices are high and there’s little doubt that share buy backs were accelerated to, in part, appease activists past and present.

While doing all of this, Apple has significantly under-performed the S&P 500 since August 2011, which is more than a year before it reached its peak share price. The comparisons get much worse after that date.

So that’s all bad, right?

While the days of Apple reaching $1,000/share (or $142.85 on a post-split basis) may be discussions of long ago, I think the opportunities for traders are as great or better than in recent memory.

Unless one believes that Apple can re-create its explosive share growth from 2009-2012, this is the time to look at Apple much in the way that Microsoft was able to reward some shareholders. Those were the shareholders who could look beyond the demand for share appreciation in return for using shares as a vehicle to create income streams through option premiums and dividends.

Sporting an attractive dividend and always attractive option premiums there is opportunity to capitalize on Apple’s signal that it is bidding farewell to that kind of share appreciation and is looking toward more mundane ways of pacifying those who would make noise. If it can’t be done through a shorter product cycle, through new products or ever increasing sales, it may as well be done by putting the obscenely large cash hoard to work in order to maintain a status quo and keep the activists at bay.�

For the purists, it’s about the products. For a while it was also about being able to continually point at higher and higher stock prices and those great, unrealized gains. However, for those who simply view a stock as a vehicle toward realized profits the end of the era that started with Carl Icahn’s “failed” activism and that has resulted in Tim Cook’s capitulation, is now the time to consider the use of Apple in a covered option strategy.

For much of the decade prior to 2009 Apple was a great covered option trade. That era disappeared with its unidirectional price climb and returned a year ago as shares hit their near term lows.

While Icahn may have driven one nail into the purist’s heart and another into the coffin of the old Apple you knew and loved by re-directing attention from product to price, he has opened up the hearts of those that like lining their pockets with real gains.

I look forward to the more frequent trading of Apple now that we all know that the pretense of returning to the glory days is over.