There it was.

I had no idea, but someone was actually paying attention.

I looked up at the screen and there, high and tight, was my name, my Twitter handle and a Tweet that I had sent out regarding Dunkin Donuts, of recent IPO fame.

I looked up at the screen and there, high and tight, was my name, my Twitter handle and a Tweet that I had sent out regarding Dunkin Donuts, of recent IPO fame.

I won’t repeat it here, because that just cheapens it and we’re still working on an agreement over residuals.

Given how many Tweets I send out per unit of time over the past 3 months, it shouldn’t have been too surprising that one would show up someplace.

I’m more surprised that no one from the Department of Justice has showed up at my doorstep yet, as I worry that they may construe every Tweet as being something resembling truth.

In fact, though, another Tweet was flagged by CNN as being the best business Tweet of the day, along with a handful of other “bests” a month or so ago. Mine was “bestest”.

The difference was that this time my real name was used. I tend to think that will be a problem with my witness protection status, because absolutely everyone watches CNBC.

On Twitter, at least the small number of people that I follow, all blast CNBC. Yet they keep tuning in, as evidenced by the onging Tweeting commentary. It just proves that there really is no thing such as bad publcity.

Or it may prove that there are no good viewing alternatives now that Oprah is gone.

But I’m not letting that notoriety go to my head, although now potential readers of this blog will be required to undergo a screening process to see if they are “blog worthy”. Coincidentally, the independent Board of Directors of Szelhamos Rules had already been mulling over that possibility and now seems a good time to put our new policy into effect. I have to thank Carl Icahn for that, but I’m not turning my back on him quite yet.

The sure cure for self-inflated sense of worth though, was today’s market action.

It’s always humbling to sit on a couple of the days’ biggest losers. In my case that would be Caterpillar and Riverbed Technolgies.

Although their blow was softened somewhat with the outstanding call options I had written, there wasn’t really much good news today. It’s not like there would have been much of a difference if the Titanic sunk in 3500 feet or water or 4000.

But before I get down too much on myself, that need to self-aggrandize takes hold again, and I marvel at the fact that right now I’m sitting on lots of options premiums and nearly every “hostage” stock of mine is near the money. Some of them will expire this Friday, while others will have 3 weeks to go.

Compared to the S&P 500, as good of a comparison index as I can find for myself, which is down 3.0% for the week, my portfolios are down 2.1%.

Notice, I didn’t use the adverb “only” to describe my loss. It’s still pretty bad and as I said earlier, humbling. Now I know exactly how Rupert Murdoch must have felt.

But if today was the Wednesday before the monthly options expiration I’d be feeling pretty good about myself. Instead of feeling like a fool, albeit less of a fool than the Index of Fools, I’d smugly be patting myself on the back for another investing job well done.

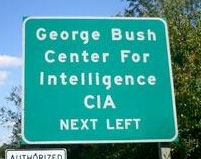

I wonder, in the name of self-denial, just how our elected officials are feeling about themselves. Since the bar is set fairly low on Capitol Hill, it should be fairly easy to outperform that index. I’m not much of a political junkie, but in the wake of any number of pledges that politicians are finding themselves signing, it’s not terribly easy to hedge your positions.

To do so, would make you a loser by most accounts, even though steadfastly holding onto ideological positions is the equivalent of group suicide or nuclear holocaust, where we all lose and don’t even get any Kool-Aid to show for our troubles.

Take Rudy Giuliania for instance. His positions on many issues have evolved, especially in the social arena, demonstrating that a thought process was at work, in a politician no less.To others though, it represented the completely unacceptable.

Selling out.

Imagine actually doing what the electorate wants. That’s novel. I know one guy that will never be elected again.

John Boehner must be spouting Latin, as he intones “Et tu, Cantor?” As he is getting squeezed from all sides he looks about ready to molt right out of his bronzed skin. Lterally and figuratively a shell of a man unless he pulls something miraculous out of his hat. Like his soul.

Not likely.

I think that Boehner is probably one guy who would be happy to let his fame and notoriety take a couple of days off. It’s at times like this that you’d just love to kill bin Laden again.

In the meantime as my suddenly found fame offered me no protection, the market just kept right at it. Losing nearly 200 ponts, its been a rough few days for nearly everyone. Even Apple and Google got slammed today. Up until a couple of days ago the party line was that the market would sell off on the news of a debt ceiling agreement.

Now like most predictions, that one is probably not likely to occur quite as planned. If somehow the dysfunctional and self-absorbed elected officials do pull this one out by the August 2nd date, there’s likely to be a rally.

Some will call it a relief rally. Some will call it the beginning of a new bull run. Some will call it a dead cat bounce and others will refer to it as a bear trap.

And those are just the experts.

That’s the beauty of the markets these days. Just like the sudden sell off that began this afternoon in the absence of any macro or micro-economic news. Nor was there some earth shattering international event, like bin Laden coming back to life.

Some blamed it on technical factors, with the S&P 500 dipping below a “critical support level”.

Now I’d like to think that with my new found fame I’d be far too important to be effected by such intangibles as a line and a curve. But that’s not the case. Even the original JP Morgan would occasionally get the sniffles.

As it turned out, my fame didn’t last much more than about 4 seconds and a handful of re-tweets and direct messages, there was no lasting love or respect.

Even Andy Warhol would have thought me a loser for not lasting the full 15 munutes.

But still, I had those 4 seconds.

Would I have traded it all for a 200 point up day and maybe a debt ceiling agreement?

Probably not.

That’s because today’s plunge will long be forgotten, maybe as early as tomorrow and there will be some other man made and completely preventable crisis coming down the pike for the markets to over-react toward.

But there’ll be at least one person remembering seeing his handiwork and 140 spaced based wit on TV, despite the fact that it wasn’t on COPS. Granted had it been on Tosh.0, the whole world would see that Tweet for all eternity

At least I still have a goal.

Oh, and there’s the doorbell. Just a couple of non-descript guys in black suits and dark glasses.

See you in 10 to 20 years with good behavior.

Anyway, one recurring theme on Futurama is the ability to preserve human heads. Not only preserve them, hell, even Ted Williams could do that, but maintain them as living, thinking and talking entities.

Anyway, one recurring theme on Futurama is the ability to preserve human heads. Not only preserve them, hell, even Ted Williams could do that, but maintain them as living, thinking and talking entities. Did you see the beating that legacy companies such as Boeing, 3M, Illinois Toolworks and AK Steel took in their shares prices today? It surely can’t change by tomorrow. (I can’t really find a good “sarcasm” font, so instead here’s a winking eye instead, as the allusion to cartoon characters just continues.)

Did you see the beating that legacy companies such as Boeing, 3M, Illinois Toolworks and AK Steel took in their shares prices today? It surely can’t change by tomorrow. (I can’t really find a good “sarcasm” font, so instead here’s a winking eye instead, as the allusion to cartoon characters just continues.) I don’t know about you, but among the things that I’m getting tired of is the everpresent appearance of the U.S. Debt Clock.

I don’t know about you, but among the things that I’m getting tired of is the everpresent appearance of the U.S. Debt Clock.

Sometimes the message is pretty simple. There’s not much mistaking the “I Want You” message from a few generations ago. The aim was clear, as was the objective. The only downside to answering the call was death, but even that was pretty clear.

Sometimes the message is pretty simple. There’s not much mistaking the “I Want You” message from a few generations ago. The aim was clear, as was the objective. The only downside to answering the call was death, but even that was pretty clear.

But I had faith it would return to the neighborhood in which we both felt comfortable.

But I had faith it would return to the neighborhood in which we both felt comfortable. Unfortunately, sometimes time seems to fly and it’s only when I see the flies circling about me do I realize what’s been neglected.

Unfortunately, sometimes time seems to fly and it’s only when I see the flies circling about me do I realize what’s been neglected. What really amazed me was the initial reaction of the huckster that tried to “pie” the elder Murdoch. For the first few moments neither the small portion of the Twittersphere that I follow, nor the media seemed to understand exactly what a “foam filled plate” signified.

What really amazed me was the initial reaction of the huckster that tried to “pie” the elder Murdoch. For the first few moments neither the small portion of the Twittersphere that I follow, nor the media seemed to understand exactly what a “foam filled plate” signified.

In a way, this thought is a little bit in keeping with yesterday’s blog “Remember Report Cards”.

In a way, this thought is a little bit in keeping with yesterday’s blog “Remember Report Cards”.